2020-9-3 23:00 |

Following in the flaming hot footsteps of Chainlink, its closest competitor, fellow decentralized oracle solution Band Protocol had an incredible few month rally. The asset shot up to set a new all-time high, rising several hundred percent along the way.

But after such a powerful and rapid rise, an elastic band effect could send the superstar altcoin snapping back toward a lower low, now that a lower high as been set on daily timeframes.

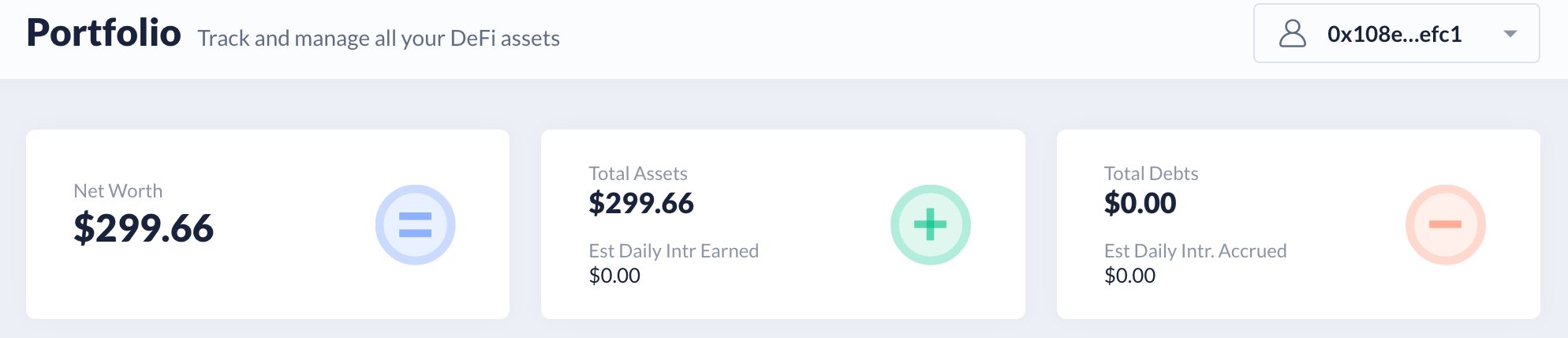

Band Protocol Readies Reversal According To TD Sequential, Lower High May Mark TopFor as hot as the Ethereum-based DeFi tokens have been, they couldn’t hold a candle next to decentralized oracles Chainlink and Band Protocol. These two top crypto market performers easily bested all other altcoins even during the most profitable alt season in years.

These crypto token’s gains made Bitcoin and Ethereum look meager by comparison. Band led the list of top ROI across all Coinbase coins in the month of August alone. Across the board, all tokens listed on the platform gained over 50% during the month.

Related Reading | Chainlink Monthly Finish Flashes Grand Finale Sell Signals

But as soon as the September monthly candle opened, the crypto market turned into a sea of red, starting with a collapse in Bitcoin. The distinct drop in top crypto assets like Bitcoin, Ethereum, and XRP dealt a blow to the rest of the space.

The total crypto market cap is still up over 80% year to date, but gains are at risk of further reduction if sell signals ranging across nearly all crypto assets have anything to say about it.

One of those ominous sell signals has appeared on both USDT and BTC trading pairs against the once-booming altcoin. The TD Sequential indicator has triggered a 9 sell setup on daily timeframes across both pairs. The USDT chart below also shows a clear uptrend that may have ended with the first lower high.

By definition, an uptrend is a series of higher highs and higher lows. An uptrend is only over, once the asset fails to put in a higher high or higher low. This doesn’t necessarily mean a downtrend will follow, but at the very least consolidation could result.

Coinciding with the TD 9 sell setup, the asset has been trading within a rising wedge chart pattern – a bearish reversal pattern.

BANDUSDT Daily TD Sequential 9 Sell Setup And Lower High | Source: TradingView Elastic Effect Could Send Altcoin Cryptocurrency CrashingFurther showing what sort of snapback type impact the cryptocurrency could see in the days ahead, the Bollinger Bands are also giving a tell that a reversal could follow.

Related Reading | Five Signs Bitcoin Dominance Has Bottomed: Are Altcoins Headed To Zero?

According to the technical analysis indicator created by John Bollinger, a close back within the upper BB can cause an elastic-like effect that sends the asset tumbling back down to the lower BB.

BANDUSDT Daily Bollinger Bands | Source: TradingViewThis only happens when the breakout outside of the Bollinger Bands fails to hold. In prior examples, a breakout outside the upper BB led to what’s called “riding the bands.” This trading strategy should be taken only with a close outside either BB, coinciding with at least a 3x rise in normal trading volume. The surge in volume confirms the breakout.

Volume can also be yet another tool to spot reversals in assets. Note how at the local high, a red volume candle marked the peak, and volume has been declining since.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|