2020-8-6 23:00 |

After an incredible 670% rally from bottom to top in Chainlink, the odds are stacked against the crypto asset climbing much further. Could a set of sell signals triggering on the altcoin across multiple timeframes and trading pairs finally point to an end of the asset’s parabolic rise?

Chainlink (LINK) Topping $10 Triggers Sell Duo Of Dangerous Sell SignalsWhen it comes to the crypto market, there are few success stories greater than XRP, Ethereum, or Bitcoin itself. These assets grew from virtually worthless, to the finance titans they are today.

But those stories are old news now, and a new chapter in the crypto market was written by Chainlink’s showstopping performance.

While other assets fell to extreme bear market lows, over the last two years, Chainlink has been on an unstoppable rise to stardom.

Related Reading | How Crypto Company IPOs Could Incite Retail Investor FOMO

The asset recently set a new record high over $10 per token, after climbing a full 670% from the Black Thursday low. From the 2019 low, the altcoin remains up over 3000%. And from the December 2018 low before it, LINKUSD has grown by over 8000%.

Not since the before the crypto bubble popped has the asset class performed this well. But like the bubble itself, such returns aren’t sustainable, and profit-taking can turn into a sharp decline quickly as Bitcoin and altcoins in the past have proven.

With a dangerous set of sell signals stacking on Chainlink, is the beginning of the end near now that the asset has tapped above $10 per token?

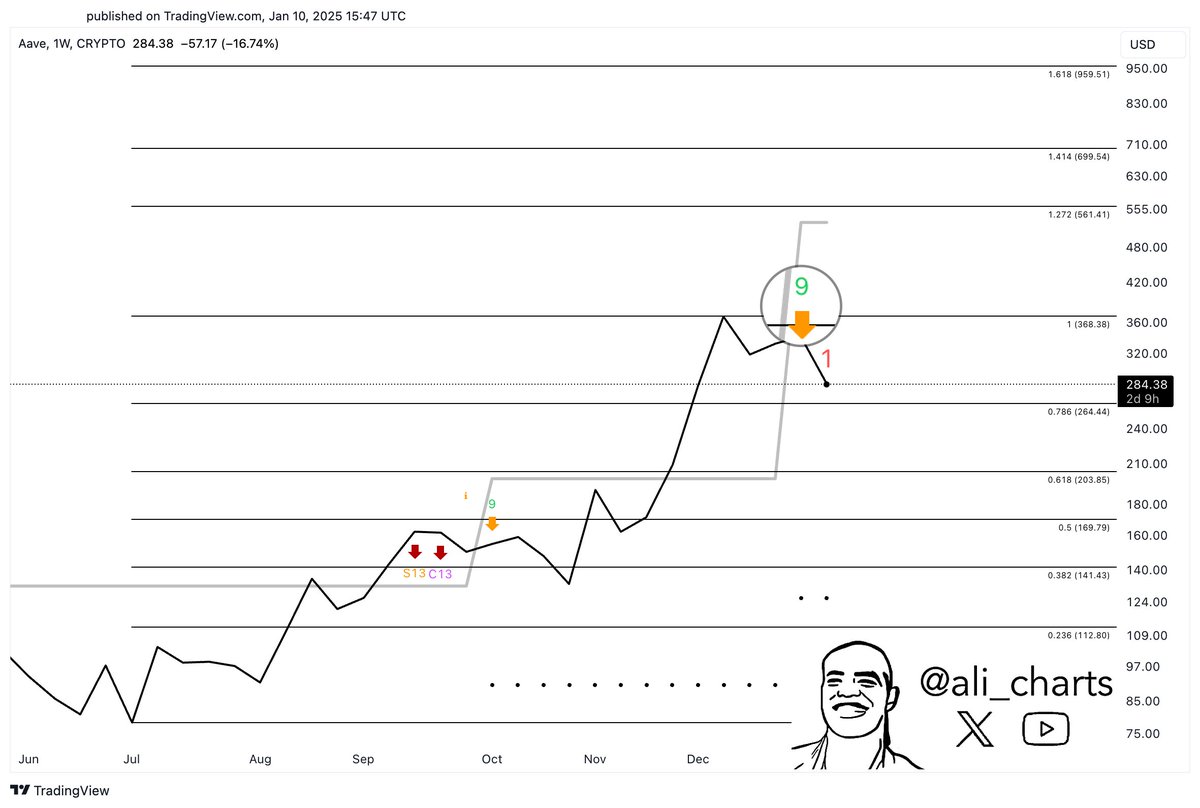

LINKUSDT TD Sequential S-13 | Source: TradingView TD Sequential Reaches 13 on USD and Bitcoin Pairs, Altcoin At Risk Of DropThis week, Chainlink showed the crypto market it had more fuel left in its rockets for another rally higher. The asset has been in full price discovery mode for weeks now and continues to climb.

The latest high above $10, followed by a reversal candle, has triggered a 13 sell signal on the TD Sequential indicator across both LINKUSD and LINKBTC trading pairs.

LINKBTC TD Sequential S-13 | Source: TradingViewAs the chart depicts above, Chainlink had a sharp fall each time the 13 count appeared in the past. On the Bitcoin trading pair, Chainlink set a lower high. The previous high was marked by the same 13 count and setup.

If the same sort of downtrend begins on daily timeframes, it could lead the crypto asset toward a deeper decline due to yet another TD Sequential signal stacking on top of the above two.

Related Reading | Chainlink (LINK) Turns $10 Into A Million In Six Months—But How?

Not only has Chainlink triggered such signals on daily timeframes, on monthly LINKUSD price charts the crypto asset has also triggered a 9 sell setup. After 9 full months of positive momentum, coinciding with a pair of daily timeframe setups, Chainlink’s fall from grace may finally be here.

origin »Bitcoin price in Telegram @btc_price_every_hour

ChainLink (LINK) на Currencies.ru

|

|