2023-9-10 00:21 |

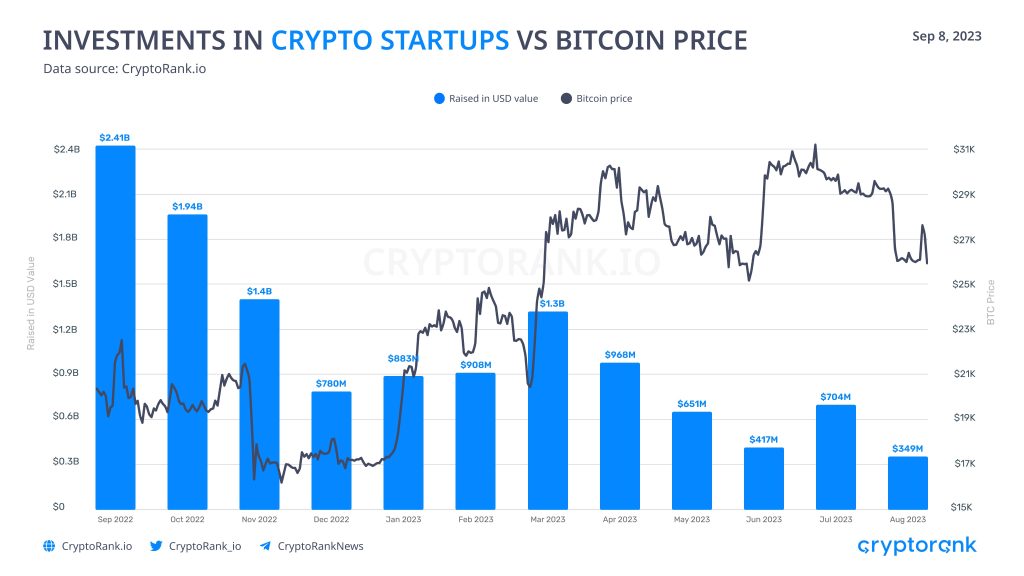

In recent months, the world of cryptocurrency has witnessed a fascinating and somewhat paradoxical trend: while the price of Bitcoin (#BTC) has been on a rollercoaster ride, venture capital (VC) investments in crypto startups have steadily declined, reaching multi-year lows in August. Surprisingly, the correlation between Bitcoin’s performance and VC interest in the crypto space has been anything but straightforward.

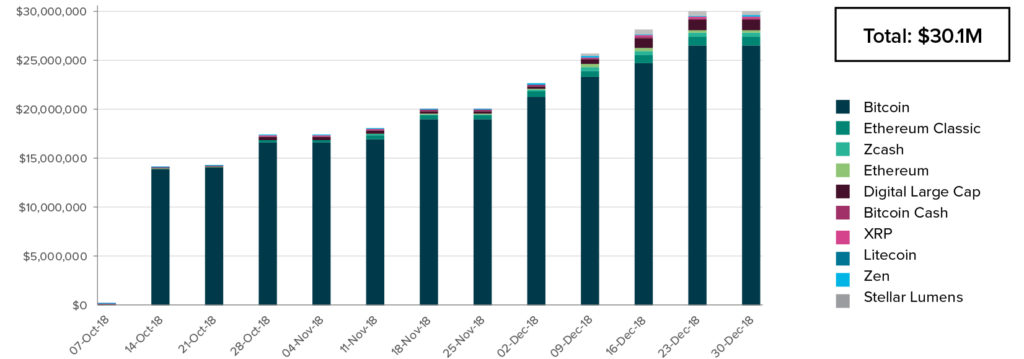

Source: CryptorankHistorically, Bitcoin has been the bellwether for the entire crypto market. When its price surges, it often triggers a rush of interest and investments in the broader cryptocurrency ecosystem. Conversely, a Bitcoin bear market can cast a shadow over the entire industry, leading to a decline in VC funding. However, recent developments have deviated from this traditional pattern.

Growing Maturity Of Cryptocurrency MarketOne possible explanation for this decoupling is the growing maturity of the crypto market. Bitcoin, as the pioneer and most established cryptocurrency, is now seen by many institutional investors as a digital gold and a store of value. Its price fluctuations might not deter them from exploring other opportunities within the crypto space, such as DeFi (Decentralized Finance) projects, NFTs (Non-Fungible Tokens), or blockchain-based platforms.

Another factor at play is regulatory uncertainty. Governments worldwide are increasingly scrutinizing cryptocurrencies, which has made investors, including VCs, more cautious. The evolving regulatory landscape can dampen enthusiasm for early-stage crypto startups.

Lastly, the once tight-knit relationship between Bitcoin’s price and VC investments in crypto has shown signs of loosening. While Bitcoin remains a significant player in the market, VC interest now appears to be influenced by a more diverse set of factors, including the growing maturity of the crypto space and regulatory concerns. This shifting dynamic emphasizes the need for a nuanced understanding of the crypto market, where Bitcoin is just one piece of a much larger puzzle.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: tonktiti//123RF // Image Effects by Colorcinch origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|