2019-5-31 21:06 |

For the past few weeks, Bitcoin has been gaining a good bullish momentum that has now taken effect at the end of the crypto winter. Since the beginning of the year, the top coin has gained by about 130%. At the moment, Bitcoin is trading at almost triple the value it was at the beginning of 2019. So what’s really behind this spike? There are 6 factors.

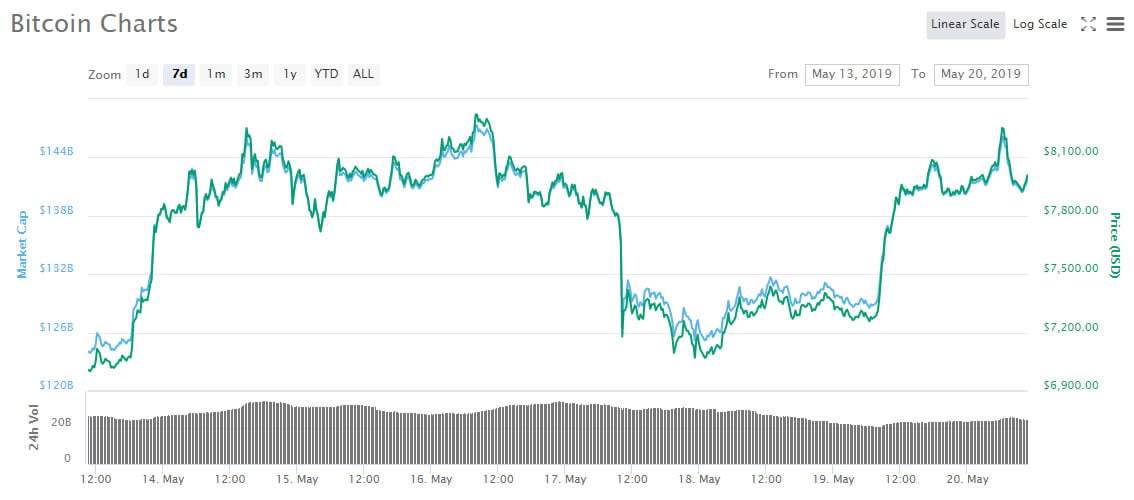

It’s The TechnicalsUnlike other markets like stocks, investors in the Bitcoin market mostly look at the technical analysis on charts and graphs, and this results to speculations that could either push up or bring down the price.

Since Bitcoin’s charts formed the Golden Cross a few months ago, speculations have abounded and caused FOMO, and hence the price increase.

Block HalveningEvery 4 years, the Bitcoin network experiences an automatic block reward reduction whereby the kick-back dished out to miners after facilitating transactions on the network is slashed by half.

Currently, the reward stands at 12.5 BTC, but the next halving expected in May 2020 will bring that down to 6.25 BTC. Bitcoin price has been known to spike about a year before the halvening.

Decreasing SupplyThe total Bitcoin supply is capped at 21 million coins, with about 17.72 of those already mined. When halvening happens, and the number of coins paid out to miners decreases, demand increases and drives up the price. The perceived scarcity due to the anticipated 2020 block halvening has contributed to the current price hike as people rush to accumulate before the supply fades.

Institutions Are InterestedBuying from crypto exchanges has always been a no-go zone for many financial institutions. Now, entities like CBOE Global Markets have come up with a channel through which institutions and other big money entities can buy Bitcoin futures without involving unregulated exchanges. As such, more money is flowing into the Bitcoin market and affect the price.

SEC And ETFsThere has always been a possibility that the SEC will one day approve a Bitcoin ETF. Numerous proposals have been presented, and although none has been approved yet, the SEC seems to be warming up to that idea as applicants come up with better proposals.

The approval of a Bitcoin ETF would lead to a capital inflow into the Bitcoin market and contribute to its growth. The mere fact that it’s possible, especially now that there are pending applications before the SEC, is already affecting Bitcoin’s value.

Bitcoin-related Blockchain ProjectsAs the blockchain technology takes root, developments targeting the Bitcoin market have come up to facilitate ease of trading, storing, and transferring Bitcoins. That’s beside the expansion of the blockchain industry into other important economic sectors. All these developments work to “sell” Bitcoin to the masses and create demand.

The post The Big Q: What’s Driving Bitcoin’s Continuous Spiking? appeared first on ZyCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|