2024-3-5 20:13 |

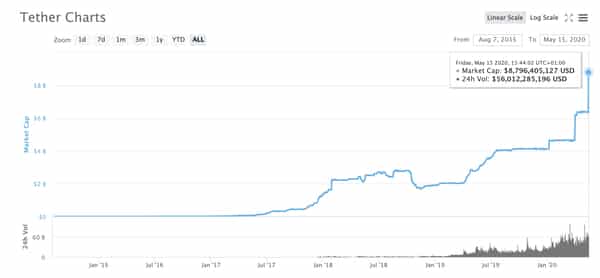

USDT, a stablecoin issued by Tether, hit the $100 billion market value for the first time in its history, according to CoinGecko data, as the rally on crypto markets expanded. origin »

Bitcoin price in Telegram @btc_price_every_hour

USDx stablecoin (USDX) на Currencies.ru

|

|