2018-8-14 08:19 |

On Tuesday, August 13, Bitcoin climbed over $6500 mark showing up a minor recovery in its price. Considering the extreme volatility over the past few weeks, there can be multiple reasons for the price rise like OTC trades or other things. However, the latest price surge has been in synchrony with the issuance of new Tether (USDT) tokens.

The USDT token is a dollar-pegged “stablecoin” that is created by the controversial digital currency startup Tether. On Saturday, August 11, Tether has supposedly issued 50 million USDT tokens which amount to $50 million influx in the cryptocurrency market, according to the data from Omni Explorer.

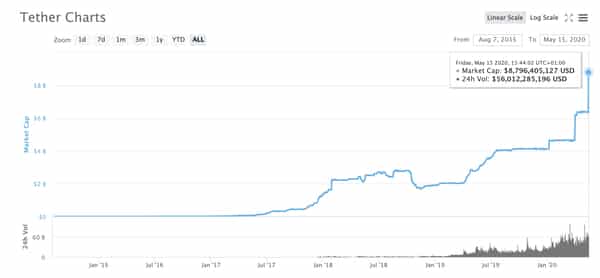

The data on the Tether Rich List shows that these new tokens have been transferred to cryptocurrency exchange Bitfinex. This is for the third consecutive time this month when Tether is said to have issued $50 million in USDT tokens to Bitfinex. Moreover, Tether’s “transparency” page goes to show the company’s circulating marketcap of $2.5 billion. The page data also shows that Tether currently holds $500 million in reserves, meaning that the company has another $500 million worth funds available for distribution.

Last month, a big whale with huge USDT token holding redeemed a block of Tether tokens at the respective dollar price, after which the company’s market cap dipped from $2.7 billion to $2.4 billion suddenly. Currently, Tether’s USDT token is the second most circulated token after Bitcoin in the entire cryptocurrency market.

One of the reasons stablecoins have gained so much popularity among investors is that they prevent the hassle of converting crypto-to-fiat and vice versa. This not only helps investors save conversion fees but also makes their funds available instantly whenever they want to invest in the crypto market.

Tether’s Controversial PastTether has been embroiled in a lot of controversy related to the issuance of the USDT tokens and the Bitcoin price movements. Reports have suggested that the crypto startup has been trying to manipulate the market through its fractional reserve. Moreover, Tether’s association with Bitfinex has also remained in question then. Reports have also suggested that Tether has been issuing tokens to Bitfinex without actually backing them with physical USD. But Bitfinex has denied any such involvement.

As a response to a lot of questioning and in order to review its finances, Tether has recently hired legal firm Free, Sporkin & Sullivan LLP (FSS). This legal firm is found by several former federal judges and a former FBI director. FSS has performed a spot inspection of Tether’s bank accounts recently, and also interviewed employees of the banks who have been holding Tether assets.

FSS found that on the date of the inspection, USDT tokens have been fully backed by the physical USD by the company’s banking partners. Another cryptocurrency exchange Kraken, who is also a major user of the USDT tokens, has also denied any evidence of Tether’s involvement in price manipulation.

However, Tuesday’s rally in Bitcoin was short-lived as the cryptocurrency has slipped further by 5.5%. At the press time, Bitcoin is trading at $6026 with a market cap of $103 billion, according to the data on CoinMarketCap.

The post Bitcoin Showed a Minor Recovery to $6500 as Tether Pumps $50 Million in Crypto Market appeared first on CoinSpeaker.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|