2021-1-15 19:54 |

Bahamas-based Deltec Bank & Trust, which is the banking partner of Tether to hold its reserves, revealed that it has a “large position in bitcoin.”

Chief Investment Officer Hugo Rogers disclosed this during a year-in-review video while explaining its investment portfolio, which also contains gold and other commodities, including the digital asset. Rogers said,

“We bought Bitcoin for our clients at about $9,300, so that worked very well through 2020, and we expect it to continue working well in 2021 as the printing presses continue to run hot.”

This has CT speculating if, by extension, Tether’s dollar-pegged USDT’s reserves, which is backed by cash, cash equivalents, and “other assets and receivables made by loans,” also involves Bitcoin.

After so many years, the question of Tether's backing continues to raise questions among the crypto community despite the companies' several attempts to clarify the situation.

Recently, Tether CTO Paolo Ardoino reiterated that Tether is, in fact, 100% backed and fully regulated.

Tether has also been receiving support from other industry members, with Sam Trabucco, a quantitative crypto trader at Alameda Research, explaining that they do big creations and redemptions with USDT all the time, and it’s a “powerful tool.” Adding,

“The rest of the world is missing out on something for being so distrustful of USDT.”

It's sort of funny hearing people claim that you can't create/redeem USDT for $.

Like, I don't know what to tell you, you can, and we do. https://t.co/8XthTsk1xr

— SBF (@SBF_Alameda) January 12, 2021

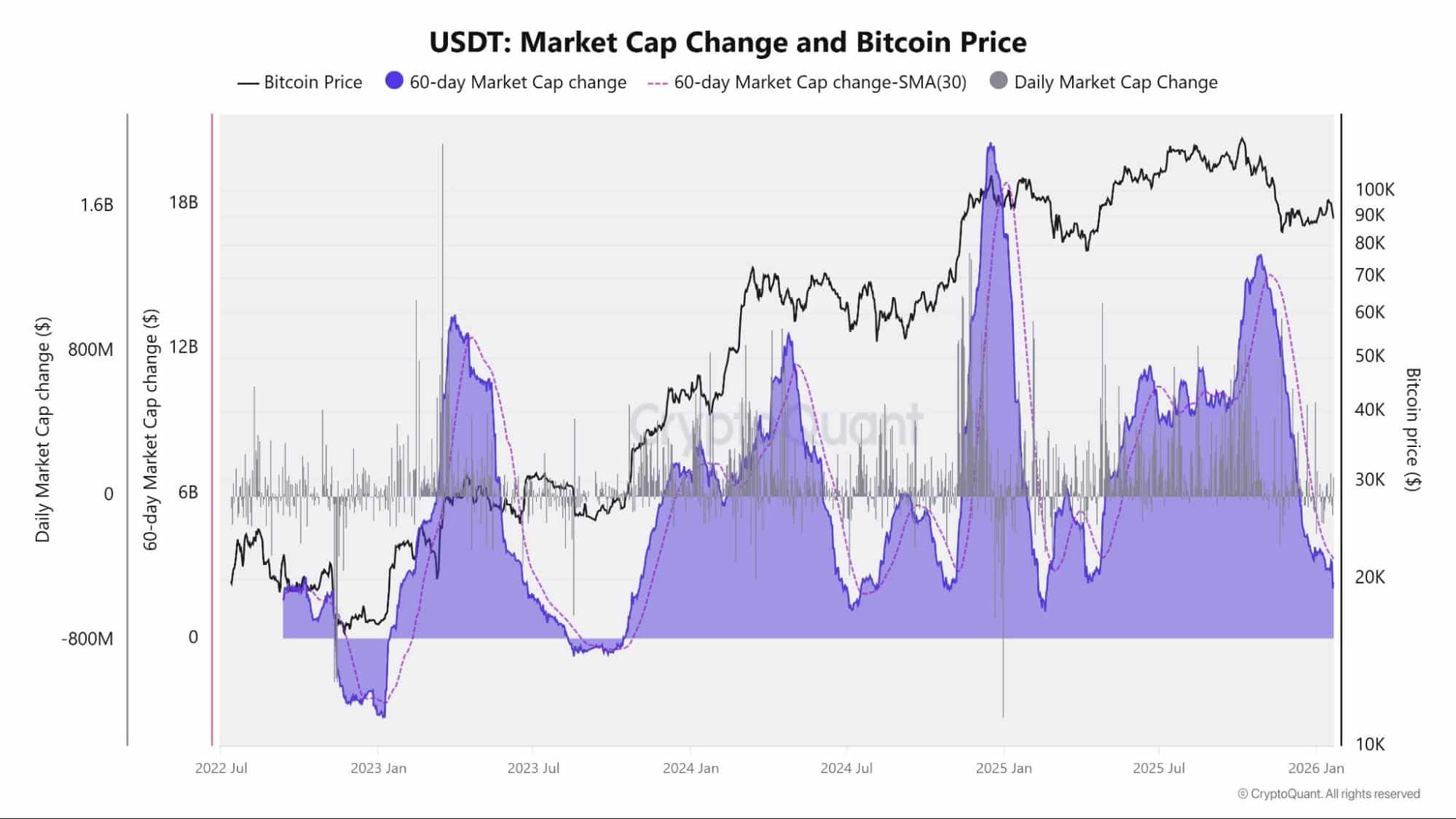

Tether is the dominant stablecoin with a market cap of nearly $25 billion, as per Messari. In less than two weeks of Jan., USDT’s supply grew by more than 4 billion on the back of strong demand in the crypto market.

But another stablecoin, USDC, is catching up fast, resulting in Tether’s share of total stablecoin supply decreasing to about 75%, the lowest share of total supply since Jan. 2019.

Tether is under investigation by the New York Attorney General’s office for co-mingling client funds and losing $850 million without disclosing any of this information to the public.

The post Tether’s Bank ‘Bought Bitcoin’ for its Clients As Part of Its Investment Portfolio first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Intelligent Investment Chain (IIC) на Currencies.ru

|

|