2023-4-24 17:26 |

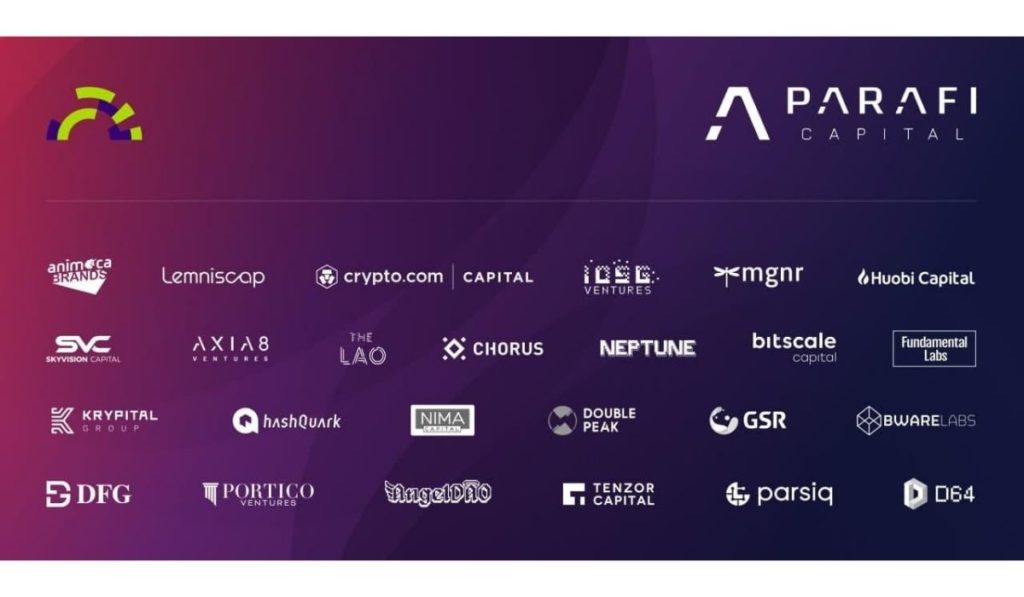

Teahouse Finance raised $5 million in its recent funding round to solve DeFi’s concentrated liquidity problem, according to its recent funding announcement.

The project team recently gave an exclusive interview to CryptoSlate, where they discussed Teahouse Finance’s vision, how it is combatting the concentrated liquidity problem, and what the funding will be spent on.

Concentrated LiquidityIn simple terms, the concentrated liquidity problem emerges as the liquidity providers are allowed to determine a specific price range to provide liquidity to be more intentional and strategic with how they offer liquidity.

This feature was introduced to the DeFi world by the launch of Uniswap V3 in March 2021. Teahouse Finance said it recognized the potential problem with the concentrated liquidity early on and wanted to “be the first to solve the difficult problem.”

The Teahouse Finance team described their mission by stating:

“Initially, we believed that there had to be a mathematical solution to the “concentrated liquidity provision” problem. Yet, to date, no one can claim that they’ve reached the holy grail.

Teahouse has built our own fee simulator, researched and experimented with various algorithms, and has launched several liquidity provision strategy vaults that are performing well, but there is still much room for improvement.”

The Teahouse team believes that DeFi works as a trustless model and, therefore, must provide excellent transparency and convenience.

The Teahouse algorithmsCurrently offering seven DeFi strategy vaults, Teahouse Finance aims to help DeFi users to invest and profit more easily. The platform optimizes existing liquidity provider ranges and categorizes them under modular vaults.

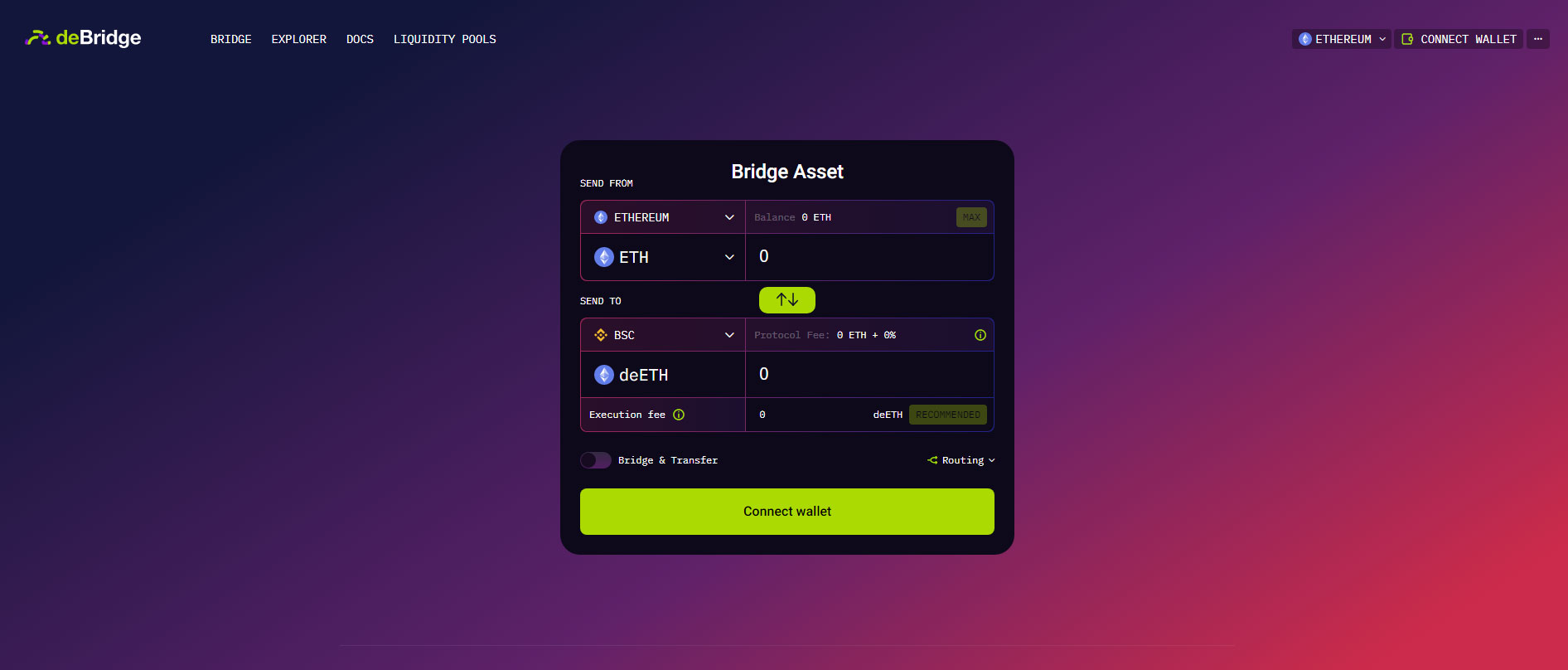

Teahouse uses off-chain algorithms that interact with the main TeaVault on a smart contract basis. The user assets are held on-chain by the TeaVault, which is built on modular vaults called “atomic vaults” that interact with individual DeFi protocols.

The company’s DeFi interaction filters guard all transactions these vaults facilitate, and only the pre-allowed ones are automatically carried out by the smart contracts. The HighTableVault manages these interactions and facilitates the network fees and rewards payments.

Teahouse VaultsThe project team stated that the $5 million would be spent on multiple vault products that are currently being developed.

One of these vaults is an enterprise-level Private Vault that is designed to dedicate smart contracts for each individual investor. It will primarily target organizational users like traditional funds, DAOs, and family offices. One vault will be dedicated to one organization and will only allow the verified representative to interact with it.

Another one that is currently in the development stage is the Permissionless Vault, which the Teahouse team is tailoring in a way to allow the users to enter and exit at any given time without restraints.

The team also noted that they have a number of other projects in the pipeline that they will launch in the near future.

The post Teahouse Finance raises $5M to combat concentrated liquidity appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|