2022-10-3 23:15 |

This article is the core story in Bitcoin Magazine's "The Orange Party Issue”. Click here to subscribe now.

A PDF version of this article is available for download in Spanish and English.

On September 7, 2021, El Salvador became the first country in the history of the world to adopt bitcoin, the world’s new currency.

Remember those words, as they will be engraved in the history of money.

But as of today, in these early times, opinions are stuck in the buckets of it being a bold move, a smart move, a dumb move, or simply a gamble.

Of course, it was none of the above. It was the only obvious move, the only logical one. For those who understand, the real question is not if other countries are going to adopt bitcoin, but when.

We are so early in this paradigm shift, that a logical, common sense move is controversial; it has many people cheering it on, and many, many detractors.

On this occasion, I will not analyze the supporters, but the detractors. They can be separated into three groups:

The ones who genuinely think it was the wrong decision.The ones who think it’s a good decision, but for the wrong reasons.The ones who are afraid of our decision.Now, the interesting part is that the first and second groups exist mostly because of the third.

Why?

Because the most vocal detractors, the ones who are afraid and pressuring us to reverse our decision, are the world’s powerful elites and the people who work for or benefit from them.

They used to own everything, and in a way they still do; the media, the banks, the NGOs, the international organizations, and almost all the governments and corporations in the world.

And with that, of course, they also own the armies, the loans, the money supply, the credit ratings, the narrative, the propaganda, the factories, the food supply; they control international trade and international law. But their most powerful weapon is the control of the “truth”.

And they are willing to fight, lie, smear, destroy, censor, confiscate, print, and do whatever it takes to maintain and increase their control over the “truth”, and everything, and everyone.

Just think about the hundreds, if not thousands, of articles about how El Salvador’s economy was supposedly destroyed because of its “bitcoin gamble”, about how we are inevitably heading to default, that our economy has collapsed, and that our government is bankrupt.

Most of you have surely seen this, right? They’re all over. Every financial publication, every major news organization, every newspaper in the world, all the credit rating agencies, and all the international financial organizations are saying the same thing, as if they were in a choir.

But is any of this true?

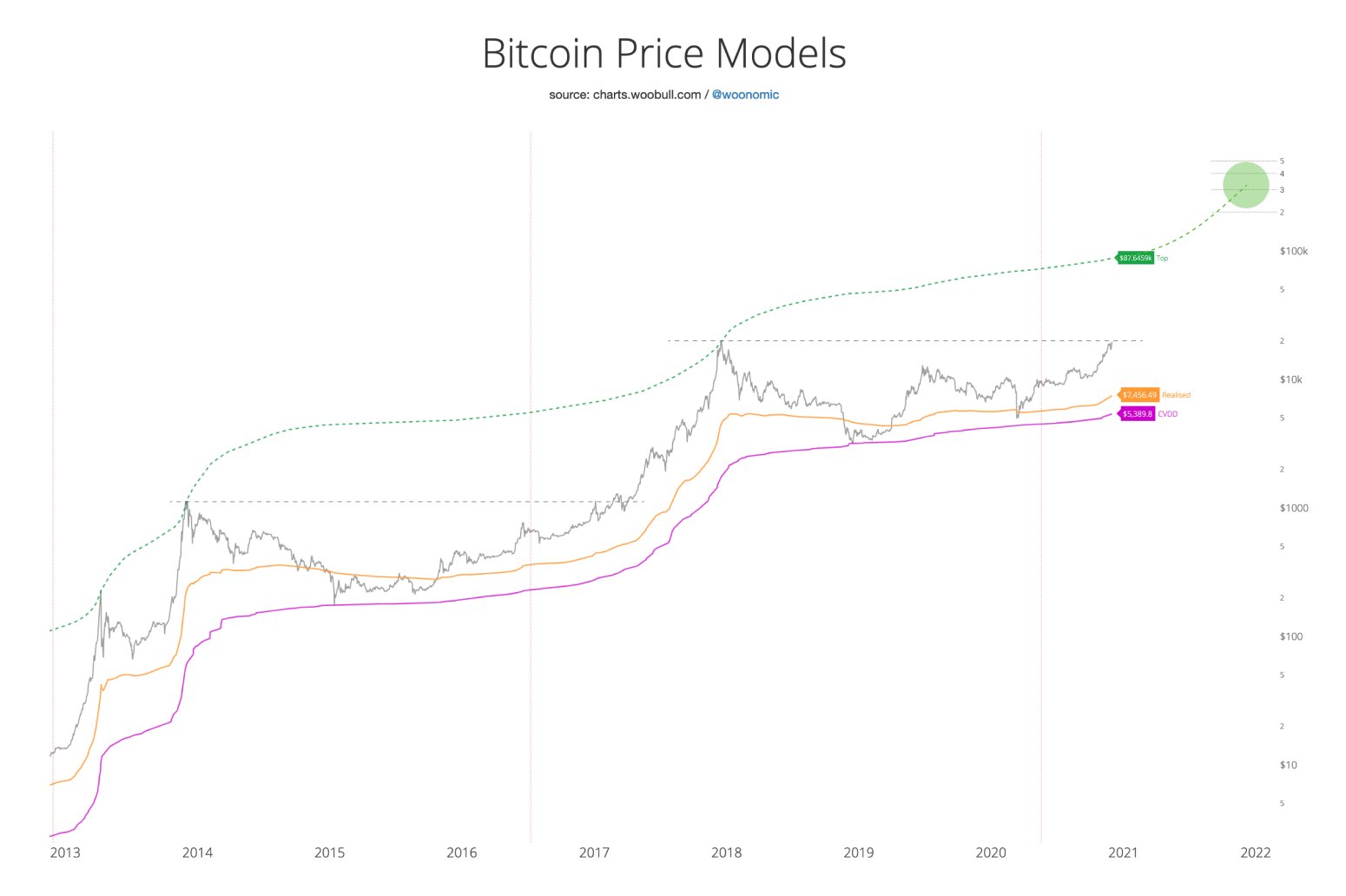

Well, you just need to read their articles and listen to their “experts” saying that all of this happened after El Salvador lost around $50 million because of bitcoin’s plummeting price on exchanges. Since we are not selling any bitcoin, this statement is obviously false. But for the sake of making a more profound analysis, let’s say it was entirely true, which of course it’s not, but bear with me.

Really? A whole country’s economy was destroyed by a $50 million loss?

Yes, El Salvador is a relatively poor country, but in 2021 alone, we produced $28 billion in products and services. Pushing the idea that a $50 million loss — less than 0.2% of our GDP — would destroy or even put our country’s economy in trouble is far more than stupid; it is revealing.

You would think the economic geniuses at Bloomberg, Forbes, Fortune, Financial Times, Deutsche Welle, BBC, Al Jazeera, The Guardian, The New York Times, The Washington Post, etc., would have enough analysts and editors well versed in these topics to tell them not to publish that nonsense. You would think these absurd articles wouldn’t pass those editorial boards, but they do. And sometimes they even get a very large space, like a full-page spread in The New York Times.

So the argument that we have lost $50 million worth of bitcoin is false, because we simply have not sold any bitcoin. And even if we were to accept that argument as true, then it would be ridiculous to conclude that an economy of $28 billion per year will go bankrupt or into default because of a 0.2% “loss” in one year, when in 2021 our economy grew 10.3%, or by $4 billion. This is using the IMF’s own numbers!

And even if you want to accept that absurd argument as true, which would mean you ignore math or basic logic, still, you will have yet to ask yourself why these worldwide media corporations would give so much time and space to such a small country like El Salvador.

Were they talking about El Salvador before? Did they care about what happened in our country? Did they report the $37 billion (with a b) that the previous governments stole from our country’s treasury?

Ask yourself these questions; a few years ago, did you know where El Salvador was located on a map? Did you know the name of the previous president of El Salvador? Did you know about their failed economic policies?

The answer to those questions added to the incredible absurdity of portraying, in hundreds of serious financial publications, that an economy that produces $28 billion a year will go bankrupt for a debatable $50 million loss. That is all the proof one should need to see that they are trying to fool you.

In fact, these are the real numbers, which are public information and can be found and double-checked quite easily:

In 2021, our GDP rose 10.3%, income from tourism rose 52%, employment went up 7%, new businesses up 12%, exports up 17%, energy generation up 19%, energy exports went up 3,291%, and internal revenue went up 37%, all without raising any taxes. And this year, the crime and murder rate have gone down 95%.

These are real numbers, facts that cannot be distorted by narrative. The only number that can be changed with their rhetoric is our bond prices, since they depend mostly on the official narrative and the credit ratings of their agencies; more “truth” than the truth.

They have said over and over again, in more than a hundred self-accredited publications, that we are not able to pay our debts and are heading for default. We were even ranked as the country with the highest risk of default in the world. El Salvador with more risk than Ukraine. Yeah, exactly.

So to counter that narrative, we did exactly the opposite of not paying our debts; we offered to pay in advance. And that is why this month we will be buying all of our 2023 and 2025 bonds, that the holders want to sell of course, at market price.

They have also told you that there are huge anti-Bitcoin protests in El Salvador; they have been anything but huge. Furthermore, why would my government have a 85-90% approval rating according to every poll conducted in the last year, including several polls conducted by the opposition and several by independent international polling firms, if we were handling things so badly?

By the way, what’s your president’s approval rating?

So if you are in group one or two of the detractors, my message to you is this; stop drinking the elites’ Kool-Aid and take a look at the facts. Even better, come ask the people, see the transformations for yourself, walk in the streets, go to the beach or to our volcanoes, breath the fresh air, feel what it really means to be free, see how one of the poorest nations in the continent and the previous murder capital of the world is changing to rapidly become the best place it can be.

And then, ask yourself; why are the world’s most powerful forces against those exact transformations. And why should they even care?

You see it now, right? The reason for all of this is because we’re not simply fighting a local opposition, or the usual roadblocks any small country may face, but the system itself, for the future of mankind.

El Salvador is the epicenter of Bitcoin adoption, and thus, economic freedom, financial sovereignty, censorship resistance, unconfiscatable wealth, and the end of the kingmakers, their printing, devaluating, and reassigning the wealth of the majorities to interests groups, the elites, the oligarchs, and the ones in the shadows behind them, pulling their strings.

If El Salvador succeeds, many countries will follow. If El Salvador somehow fails, which we refuse to, no countries will follow.

They know this very well and that’s why they are fighting us so hard.

Will you play their game?

Or will you become aware of the real game?

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|