2023-7-7 14:26 |

Over the past few years, it has been a fair statement to declare that the majority of cryptocurrencies trade like levered bets on Bitcoin. The world’s largest cryptocurrency rises in value, altcoins rise a little more. Bitcoin falls, altcoins fall a little more. As far as generalisations go, it’s a reasonably fair one.

However, within this overarching pattern, there have been periods where this relationship has deviated from the norm. One of those times is now, when some of the underlying numbers seem to imply that Bitcoin may be decoupling from the rest of the market.

Firstly, the most obvious way to investigate this is to plot the correlation between Bitcoin and the second-largest cryptocurrency, Ethereum. The plot below shows that the normally-uber-high correlation has dipped to its second-weakest mark in the last eighteen months – behind only September 2022, when the Ethereum Merge was executed.

Not only was the Ethereum Merge last September an Ethereum-specific event, but the correlation nearly immediately jumped back up to normal levels. If we dismiss this event, you would need to go all the way back to 2021 to see the correlation between Bitcoin and Ethereum as low as it currently is. Granted, it is still not exactly “weak”, at 0.7 – quite the contrary – but it is notable nonetheless in the context of the historical relationship, where the average has been a near-perfect 0.9 since the start of 2022.

The plot shows that the correlation begins to dip around April. The next graph shows this in a different way – graphing the return since the start of 2022 of Bitcoin and Ethereum. The two assets more or less move in lockstep, but you can see a slight divergence emerge around April of this year.

By the way, the reason I am taking the sample space from the start of 2022 is not strictly for a nice round number. This was when the stock market peaked, and represents a transition into a new paradigm for financial markets. While interest rates only began to be hiked in March 2022, inflation was ramping up, sentiment was dipping and concern was nigh – exacerbated by Russia invading Ukraine in February and triggering an energy crisis. In other words, the pandemic party, aka up-only zero-interest season, was over. It represents a structural break in the macro climate and financial markets at large.

Down went Bitcoin, alongside other risk assets, as the rates kept rising. But, now we ask – are we at another inflection point for Bitcoin? Why is Bitcoin’s relationship with Ethereum weakening?

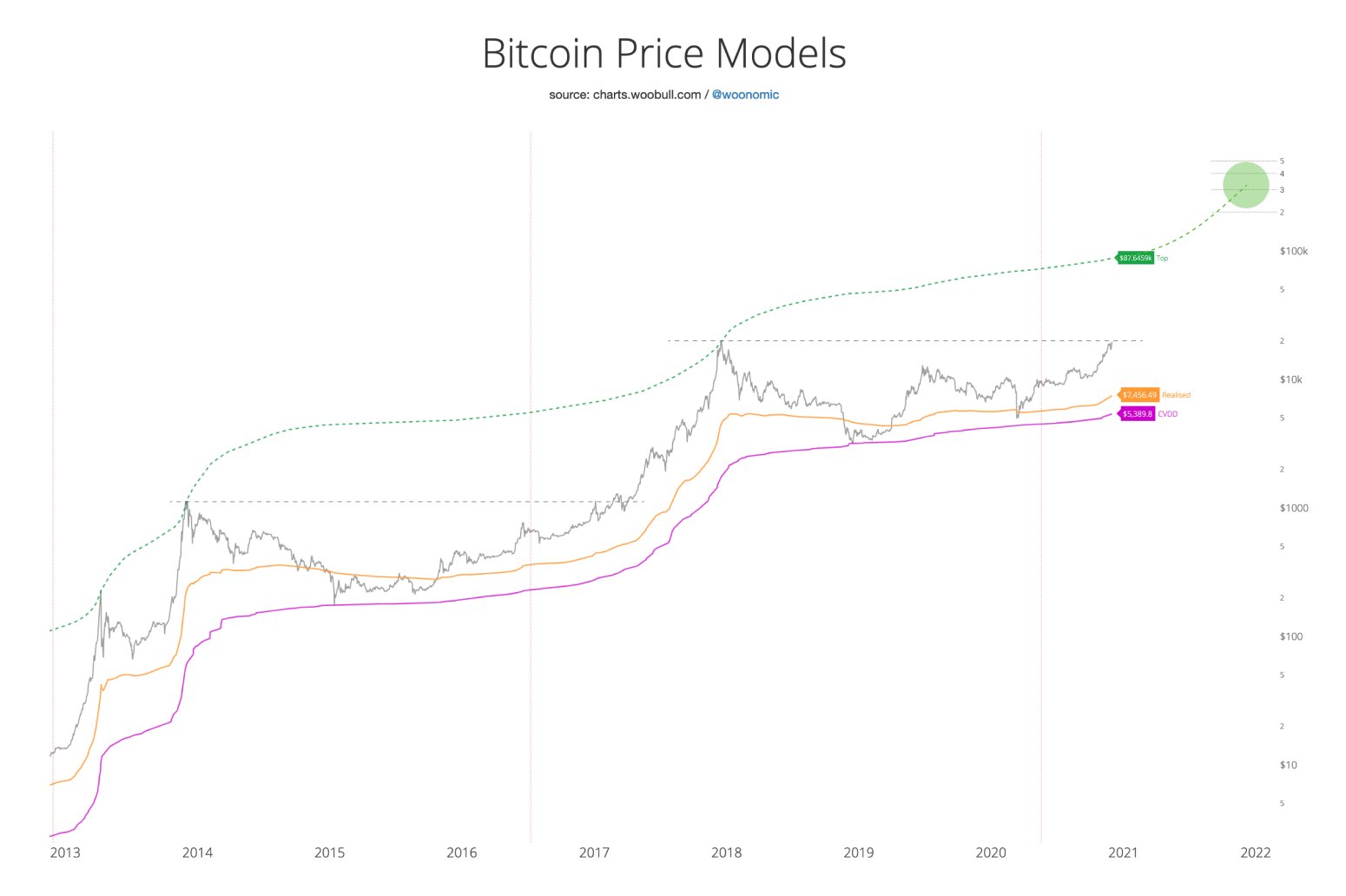

Is Bitcoin carving out its own niche?This weakening of the relationship is really more to do with Bitcoin than Ethereum. In the next chart, we see the much-referenced Bitcoin dominance chart, which plots the market cap of Bitcoin against the market cap of the entire cryptocurrency sector.

The chart shows that it has risen sharply from the start of 2023, jumping from 41% to 51%. That means 51% of the entire crypto market cap is comprised by Bitcoin – the highest mark in two years.

What is interesting is that, traditionally (if we can use that phrase in a sector which is scarcely a decade old), Bitcoin’s dominance falls during times of increasing crypto prices. Generally, Bitcoin jumps higher, before money flows into altcoins with the dominance ratio falling. This time around, that is not happening.

Again, why? The answer may be in regulation, and the fact that the market is increasingly viewing Bitcoin as an asset carving out its own niche. For many cryptoheads (myself included), this has long been a point of discussion. Looking at fundamentals, Bitcoin and Ethereum don’t actually have that much in common, bar the fact that both run on something called a blockchain (and those two blockchains, since the Merge in September 2022, are entirely different beasts).

But my opinion is redundant. However, the the letter of the law isn’t; importantly, it seems like US regulators are beginning to come around to the same point of view. As Coinbase CEO Brian Armstrong lamented after his exchange was slapped with a lawsuit last month:

We kind of got this information from the SEC that, well actually everything other than Bitcoin is a security. And we kind of said to ourselves well, that’s not our understanding of the law

Coinbase CEO Brian ArmstrongCoinbase can complain all they like (and they will have their day in court), but the reality for the market is that this is happening, whether it is fair or not, and it may impact how price action moves in crypto henceforth. The SEC even formally outlined several cryptocurrencies that it formally deemed securities, including Solana, BNB and the native tokens for Cardano and Polygon. Plotting the correlation between Bitcoin and a couple of these assets as an example, the break is clear in June, as the market sells off in response to the securities confirmation.

Of course, this is a stronger selloff and a bigger dip in correlation than what we saw above with Ether. The world’s second-largest crypto seems to be operating in a grey area, perhaps explaining both why the sell-off has not been as large as, say, ADA and SOL, but also why it is failing to keep pace with Bitcoin.

Spot ETF applications paint brighter picture for BitcoinThen there is the case of spot ETF applications, coming in from a handful of the biggest asset managers in the world. These are Bitcoin ETFs – not Ethereum or crypto ETFs. While approval would be a boon for the crypto sector at large, as it could open up doors to similar vehicles for other assets down the road, the many hurdles which Bitcoin has had to evade to even stay in the ETF discussion are numerous. There is still no guarantee these ETFs get approved – certainly, other assets seem a hell of a long way off. Thus, the simultaneous security-driven crackdown from the SEC and the slew of Bitcoin ETF applications is driving a wedge between Bitcoin and other cryptos.

The million dollar question is whether this all regresses to normal once the furore dies down. There is no doubt that the relationship is still strong here and Bitcoin continues to lead the market. But there could also be reason to believe that there has been a structural break and the previous hand-holding relationship will not be quite as tight going forward.

Crypto has had a rough run recently. The scandals of 2022 were plenty – Terra, Celsius, FTX, to name a few – and the capital flight has been astonishing, as (for whatever reason) investors have chosen T-bills paying 5% are preferable to centralised crypto companies paying -100% (with the hope of -90% after many years of bankruptcy court proceedings).

While Bitcoin has also been hurt immensely by the pain of 2022, its first-mover advantage and lack of counterparty risk could help it avoid being tarred by the same tainted brush in the eyes of trad-fi investors. Altcoins are most definitely not in vogue right now, and the non-Bitcoin crypto sector’s reputation has been tarnished immensely in the eyes of institutional capital.

The great Bitcoin decoupling, which would be Bitcoin severing its correlation with risk assets and instead claiming the status of an uncorrelated store of value, appears a long way off yet. But a lesser kind of decoupling, where it separates from other cryptos, perhaps is not as far away as previously thought.

Again, the numbers could immediately reverse back to normal. Perhaps it is just a hint of what may come at some stage down the road. But either way, it is one of the most pivotal and intriguing trends to keep tabs on within the crypto space, even if this episode turns out to just be smoke and mirrors.

The post Is Bitcoin decoupling from rest of crypto market? appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|