2024-7-11 06:32 |

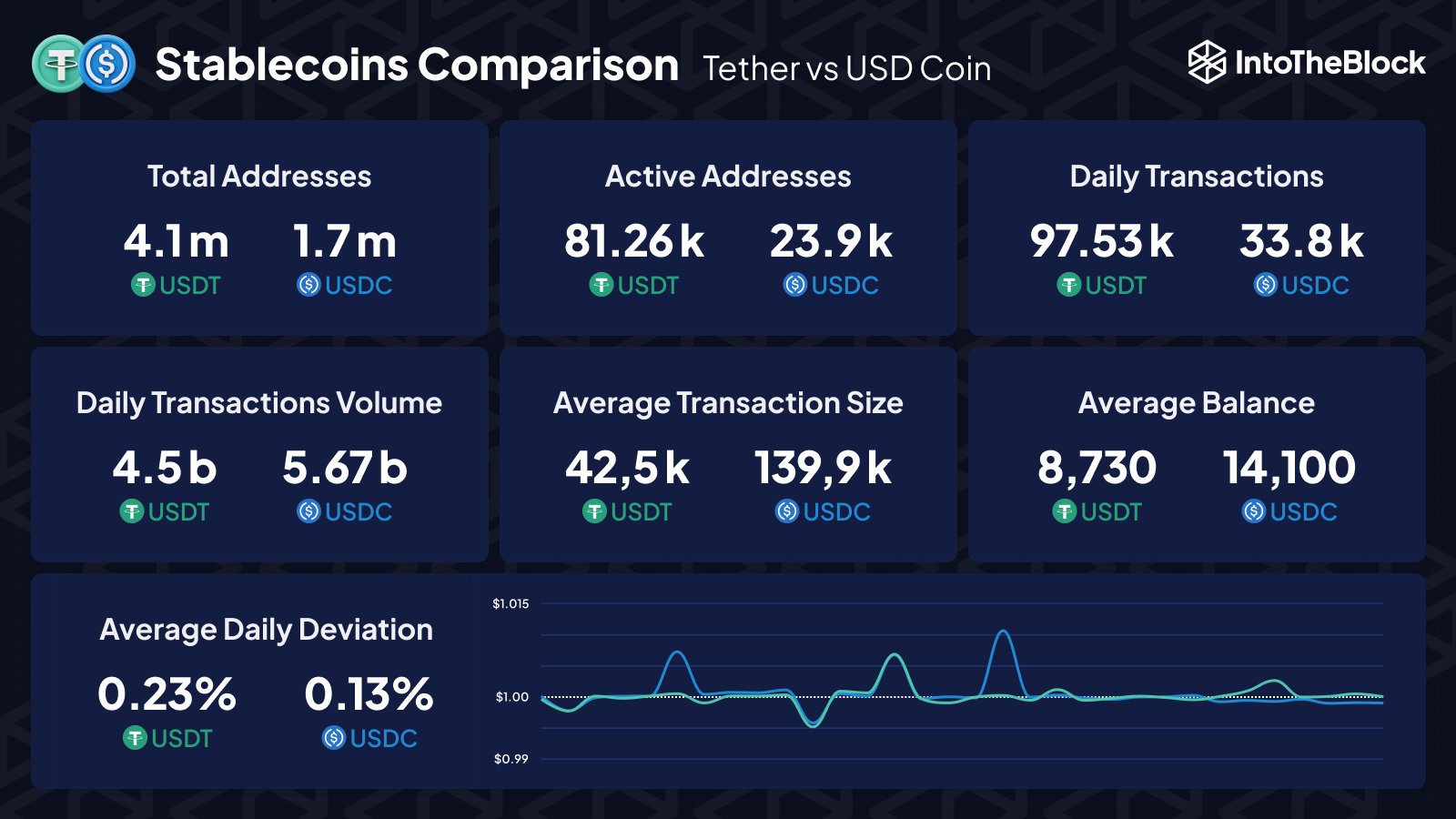

Stablecoins have become a crucial element in the DeFi ecosystem, offering much-needed stability and liquidity. Recent data from @intotheblock underscores their growing influence.

Leading stablecoins such as USDT, USDC, and DAI are witnessing substantial market cap growth, with USDT exceeding the $100 billion mark.

This surge highlights their widespread adoption and vital role in DeFi for lending, borrowing, and trading. They provide users with a stable medium in the often volatile crypto landscape. Transaction volumes for stablecoins are remarkably high, indicating their extensive use across various DeFi sectors. In 2022 alone, the total transaction volume for stablecoins reached an impressive $7 trillion.

https://twitter.com/jayejone/status/1810682118269219006?t=zCDyFg5Ik-w9eQ8hj9T0cA&s=19

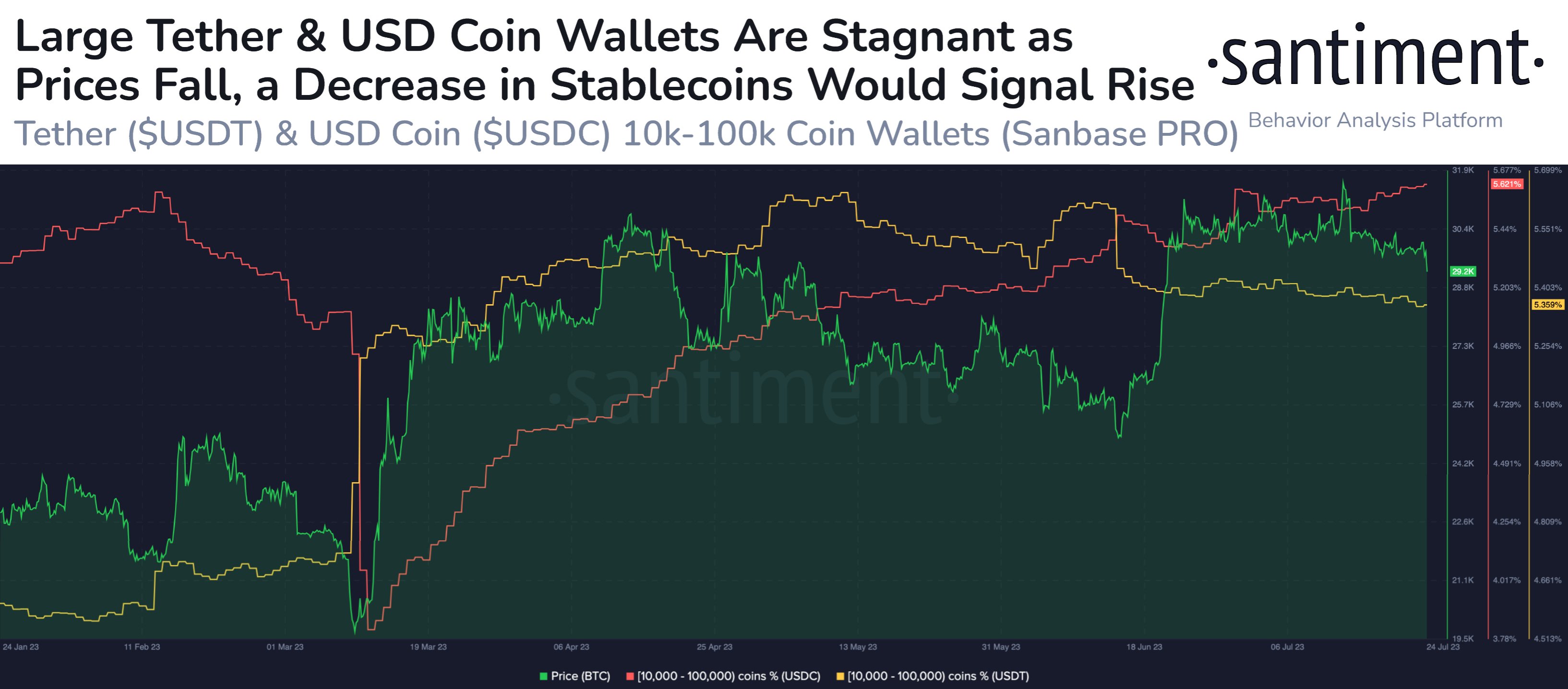

Despite their growth and adoption, stablecoins face challenges, particularly regarding regulation and the necessity to maintain stability. Regulatory scrutiny is increasing, and ensuring these digital assets remain stable is crucial for their continued trust and use.

Looking ahead, the potential for further innovation and integration of stablecoins into the broader DeFi ecosystem is immense. Their ability to offer a stable financial foundation will continue to be pivotal as the cryptocurrency market evolves. Stablecoins are not just a passing trend; they are establishing themselves as a fundamental component of the DeFi infrastructure, supporting its growth and providing stability in a dynamic market.

As the crypto world progresses, the role of stablecoins will likely expand, solidifying their position as an essential piece of the DeFi puzzle. Their contribution to creating a more stable and liquid digital financial environment is undeniable, and their importance will only grow in the coming years.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: chayanity/123RF // Image Effects by Colorcinch origin »Bitcoin price in Telegram @btc_price_every_hour

INS Ecosystem (INS) на Currencies.ru

|

|