2023-9-11 14:00 |

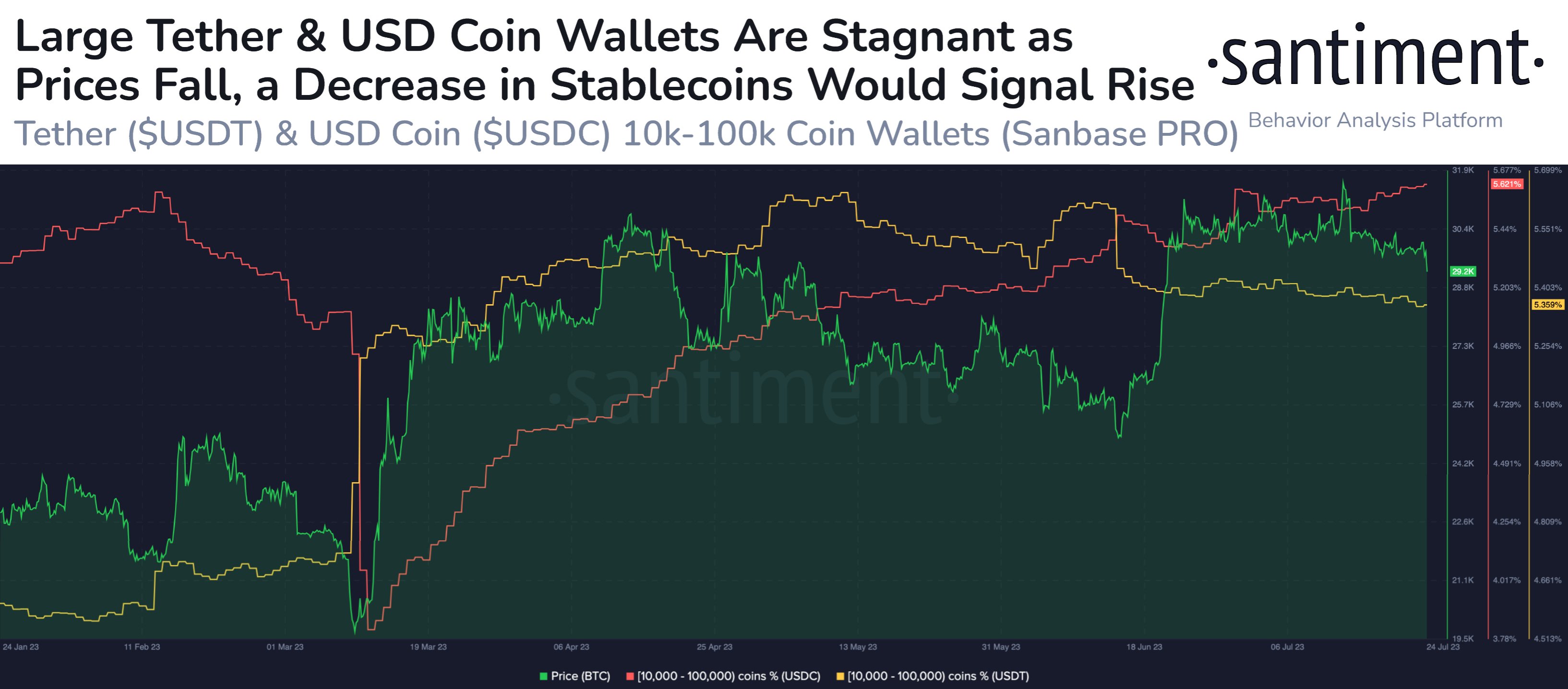

Stablecoins play a pivotal role in providing stability and addressing the notorious price volatility often associated with digital assets. USDT is perhaps the most well-known stablecoin, but it has faced many issues in the past, leading investors to use alternatives.

While USDT is a well-established stablecoin, Tradecurve Markets (TCRV) is an emerging cryptocurrency with unique features and potential. Let’s analyze how the future could look like for stablecoins and projects like Tradecurve Markets, which is in its 5th presale stage.

>>Register For The Tradecurve Markets Presale<<

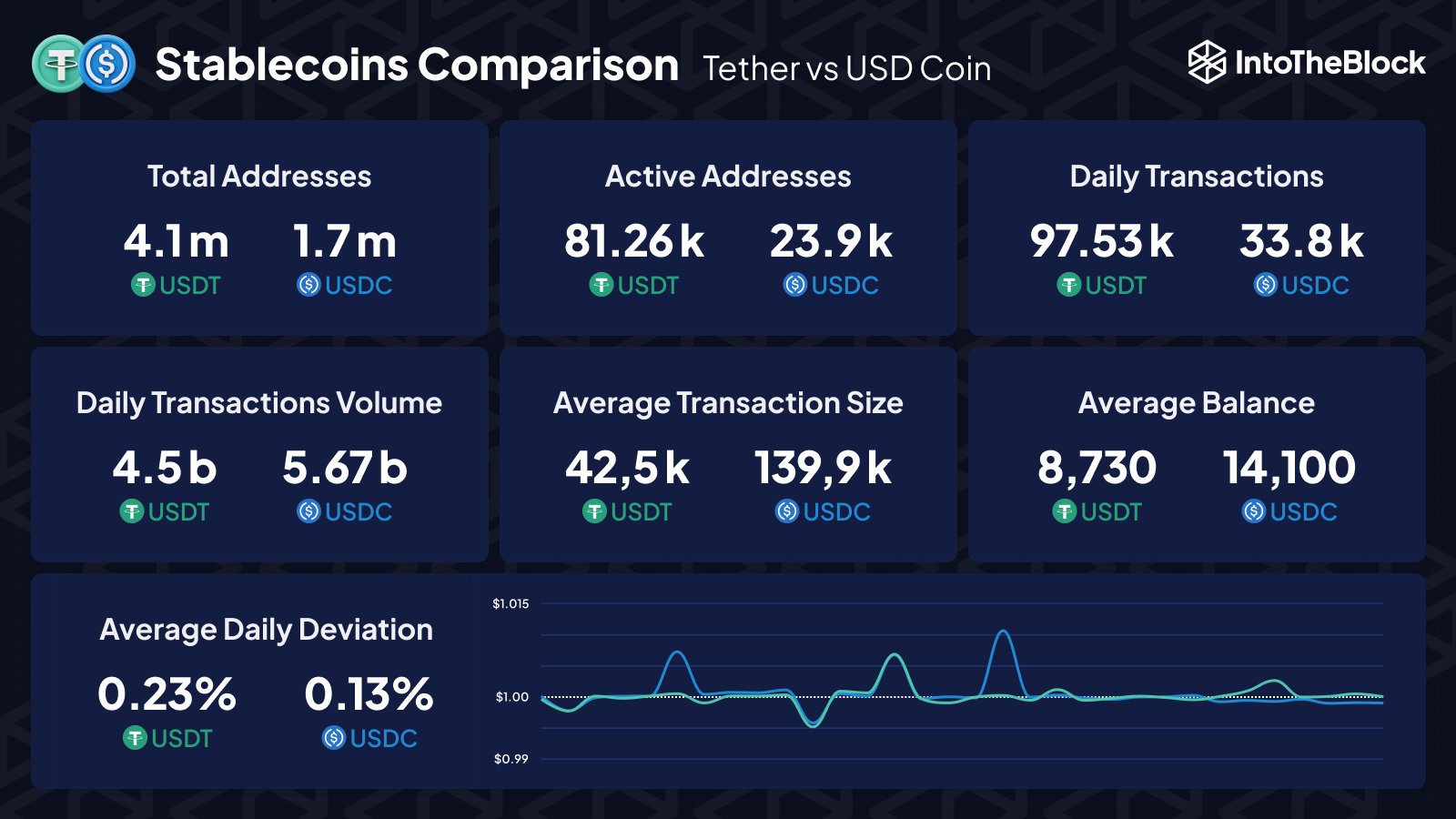

Tether (USDT) – The Pioneer StablecoinTether, commonly known as USDT, holds a prominent position as the first stablecoin in the cryptocurrency market. Launched in 2014, USDT operates on various blockchain platforms, including Ethereum and Tron, with its value pegged to that of the US Dollar. This pegging ensures that one USDT is equivalent to one US Dollar, providing investors with stability and a reliable store of value in the volatile crypto market.

USDT’s widespread adoption and availability on numerous exchanges have solidified its status as a preferred choice for investors seeking to hedge against market fluctuations or facilitate rapid transfers between different cryptocurrencies. Despite facing occasional regulatory scrutiny, USDT continues to maintain its position as the leading stablecoin, boasting a high trading volume and significant liquidity.

Tradecurve Markets – Unlocking the Potential of StablecoinsTradecurve Markets, though not a stablecoin itself, distinguishes itself by offering a hybrid exchange platform that enables users to access various stablecoins along with a broad range of traditional assets. With Tradecurve Markets, investors can seamlessly purchase stablecoins such as USDT, providing them with an additional layer of diversification and stability in their portfolio.

The platform’s user-friendly interface and the elimination of cumbersome Know Your Client (KYC) checks make Tradecurve Markets an attractive option for those seeking a secure and anonymous means to invest in digital assets. Unlike traditional exchanges, which may require multiple accounts to access different assets, Tradecurve Markets consolidates various investment options into one, simplifying the trading process and enhancing overall convenience.

Moreover, Tradecurve Markets provides multiple financial assets to invest in, meaning you won’t need to set up multiple accounts to buy the tokens, stocks, or commodities you need. Instead, you only need to connect a crypto wallet to the platform, and you can buy what you need anonymously. Also, those looking for a hands-off approach can access multiple trading bots powered by AI.

In addition to its wide range of investment options, Tradecurve Markets also offers trading fee discounts, passive income opportunities through liquidity provision, and exclusive VIP benefits to TCRV token holders. These incentives are driving investor interest and fueling the demand for TCRV tokens. Currently in its 5th presale stage, TCRV tokens are available for purchase at $0.025 per token, representing a significant jump of 150% from its initial price. Industry experts and analysts are closely monitoring the development of Tradecurve Markets as it continues to gain community support and traction in the market. The potential for substantial growth and its unique offerings make Tradecurve Markets a promising platform for investors looking to capitalize on the future of stablecoins and digital asset trading.

Disclaimer: This sponsored content is not endorsed by CaptainAltcoin, which takes no responsibility for its accuracy or quality. We advise readers to do their own research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in cryptoassets is high-risk; consider the potential for loss. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post USDT vs Tradecurve Markets: Understanding the Future of Stablecoins appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|