2024-7-15 11:02 |

Ethereum price has staged a strong comeback in the past few days, helped by the strong Bitcoin rebound. The ETH token has risen for four straight days and has moved to its highest point since July 3rd. It has jumped by 20% from its lowest point last week, meaning it has moved into a technical bull market.

Spot Ethereum ETF approvalEthereum price has rallied because of the rising hopes that the Securities and Exchange Commission (SEC) will approve a spot Ether ETF soon. Analysts believe that the approval will happen as soon as this week.

Several companies have applied for these ETFs. Some of the most notable ones are the likes of Invesco, Blackrock, VanEck, Fidelity, Grayscale, and Franklin Templeton.

An ETF approval will be a positive thing for Ethereum because of the potential inflows since Ethereum is the second-biggest crypto in the industry. Spot Bitcoin ETFs have already attracted billions of funds in the past few months.

Yeah, rn it’s all quiet on the Western Front re eth ETFs. Nada from SEC this week. Unclear why they taking such sweet ass time. Every issuer is ready. Docs are ready. It’s like a rain delay in baseball. Gotta just wait. Maybe things will move fast next week. We’ll see… https://t.co/o1ZSdIf1nE

— Eric Balchunas (@EricBalchunas) July 12, 2024The approval will also be positive because of the ongoing Ethereum’s on-chain numbers. Recent data by CryptoQuant shows that the volume of balances in exchanges has crashed to a record low. This performance means that Ethereum is one of the most deflationary tokens in the market.

Ethereum balances in exchanges

Still, as I have written before, Ethereum ETFs will mostly be important for institutional investors who have no time dealing with keys.

Instead, ordinary investors should focus on investing in Ethereum to avoid the 0.25% ETF fees and then generate staking yields. A person who will hold $10,000 worth of Ether will make more money in the long term than one who holds ETFs.

Next potential ETFs to watchIf the SEC approves spot Ethereum ETFs, the focus will now shift to other cryptocurrencies that could be approved.

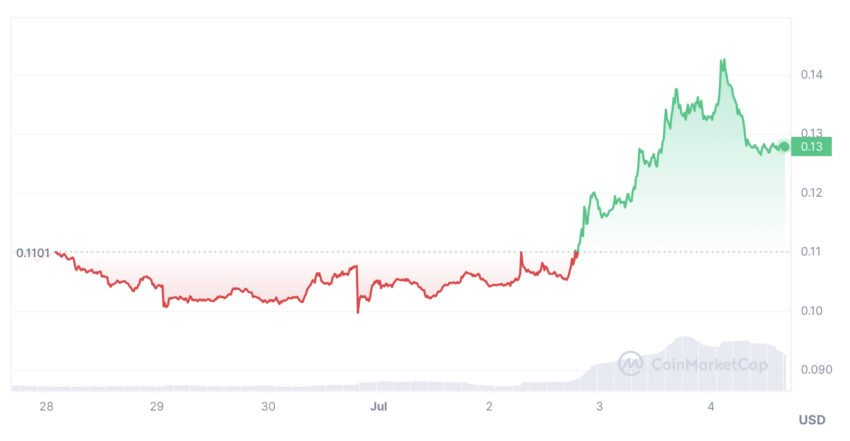

VanEck has already filed for a Solana ETF and other companies are expected to do the same. Solana is a good crypto for an ETF because of its huge market size of over $71.2 billion, making it the 5th biggest crypto in the world.

Solana is also a highly liquid token considering that its daily volume is over $2.5 billion. It is also a highly popular token, especially among developers and traders. Recent data shows that Solana has a DeFi TVL of over $4.6 billion, making it the third-biggest chain after Ethereum and Tron.

Solana is also a major player in the Decentralised Exchange (DEX) industry with its platforms like Raydium, Orca, Jupiter, and Solend having a leading market share.

Spot Chainlink ETFThe other cryptocurrency that could see an ETF is Chainlink (LINK), the biggest oracle network in the blockchain industry. Chainlink is a big cryptocurrency with a market cap of over $8.1 billion. It is also a highly liquid token with a daily volume of over $400 million.

Chainlink is also an important platform in the blockchain industry since it powers the biggest platforms in the industry like AAVE, Spark, Compound, and Venus Core Pool.

The other cryptocurrency to watch will be Justin Sun’s Tron, which has emerged as one of the top tokens in the industry. Tron has become a large cryptocurrency and the second-biggest blockchain for stablecoin transactions. Data by TronScan shows that the network handled over $41 billion in transactions in the past 24 hours, higher than Visa.

Tron is also a highly liquid token with a daily volume of over $35o million. However, it is unclear whether the SEC would approve a spot Tron ETF because of its association with Justin Sun. The SEC sued Sun for securities fraud in 2023.

The other potential spot ETFs to watch will be Avalanche, Dogecoin, Ripple XRP, and Bitcoin Cash.

The post Spot ETF approval is nearing: are Solana, Tron, and Chainlink next? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|