2023-8-25 20:04 |

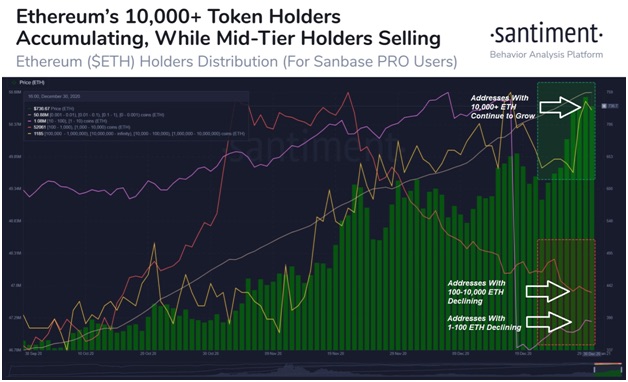

Ethereum continues to consolidate above $1,600 after last week’s dip, and data shows the past few days have witnessed a significant bump in whale activity.

ETH whale activity at highs seen in MayAccording to details shared today by market intelligence platform Santiment, whale activity on the Ethereum network has risen to its highest level in 16 weeks. The data provider indicated in a post on X (formerly Twitter) that there have been more than 23k whale transactions in the past week.

Also notable has been the jump in large addresses with 10-10k ETH, with the cohort seeing an increase of nearly 1,800 wallets over the past two months.

Specifically, Santiment outlines that whales completed 23,073 transactions in the past week, with this including massive $100k+ transactions. The metrics were at their highest since May 4, 2023.

In terms of large wallets growth, whale and shark addresses have been increasing in the past three months. On-chain data shows Ethereum wallets with 10-10,000 ETH have grown back to above 355,000, with 1,788 more wallets added since the beginning of June.

🐳 #Ethereum's network has picked up in large address activity during this drop below $1,650 and its highly volatile price conditions. The amount of wallets holding between 10 and 10,000 $ETH has risen back up to 355K, and $100K+ transactions have surged. https://t.co/X137U93ZYu pic.twitter.com/J9lyMoeBmf

— Santiment (@santimentfeed) August 24, 2023 Ethereum (ETH) price outlookA sharp sell-off on August 17 plunged ETH/USD to lows of $1,540, nearly taking prices to the year-to-date low of $1,438 as ETH volatility dipped below that of Bitcoin.

Before this, the price of Ether oscillated between the $1,900 and $1,800 levels from early May to mid-August. The consolidation followed bulls’ push from $1,438 in March to year-to-date highs of $2,142 in April.

At the time of writing, Ethereum price was poised near $1,650, down 5.3% this past week and over 11% in the past 30 days. The top ranked smart contracts platform, whose market cap currently stands at $198 billion, is thus navigating the latest rough patch in terms of market performance. Ethereum founder Vitalik Buterin’s recent transfer of $1 million worth of ETH to Coinbase did not help bulls’ case.

However, as suggested by the jump in whale activity, large holders are looking at the dips as a buying opportunity. If the market experiences fresh upside momentum, then the psychological level of $2,000 could be the primary short-term target. A retest of lower support is also still on the cards.

The post Ethereum whale activity spikes to 16-week high appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Blue Whale Token (BWX) на Currencies.ru

|

|