2026-1-8 07:00 |

Solana spot exchange-traded funds (ETFs) have witnessed a $220 million spike in trading volume. Here’s what this could mean for the asset.

Solana Spot ETF Volume Has Shot UpIn a new insight post on its website, on-chain analytics firm Santiment has discussed what spikes in the spot ETF trading volume mean for Bitcoin and Solana. Spot ETFs refer to investment vehicles that allow traders to gain indirect exposure to an underlying asset. In the context of cryptocurrencies, they allow investors an off-chain route into digital assets that doesn’t require them to deal with exchanges and wallets; the fund buys and custodies the tokens on their behalf.

The US Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETFs back in January 2024. Ethereum funds got the green light in July of that year, while Solana obtained its approval in October 2025. Thus, while BTC and ETH spot ETFs have been around for some time now, SOL products are relatively new. As the chart shared by Santiment shows, SOL spot ETFs observed a burst of trading volume during the initial launch hype.

Solana spot ETF volume rose to a high of $122 million on October 28th, but excitement was quick to run out as the metric fell to a much lower level soon after. This record wasn’t broken for the rest of the year, but six days into 2026, SOL ETFs finally saw activity surpassing that of the launch period.

From the chart, it’s visible that SOL volume hit $220 million on January 6th, significantly higher than the October 28th spike. The uptick in the cryptocurrency’s investment vehicles has come as its price has enjoyed a rally, and Morgan Stanley has filed for its first Solana and Bitcoin ETFs.

As for what the volume surge could mean for the asset, it’s hard to say from the data of SOL ETFs alone, as they are still quite young. Bitcoin ETFs, on the other hand, have been around for two years now, so some interpretations can be made from their data.

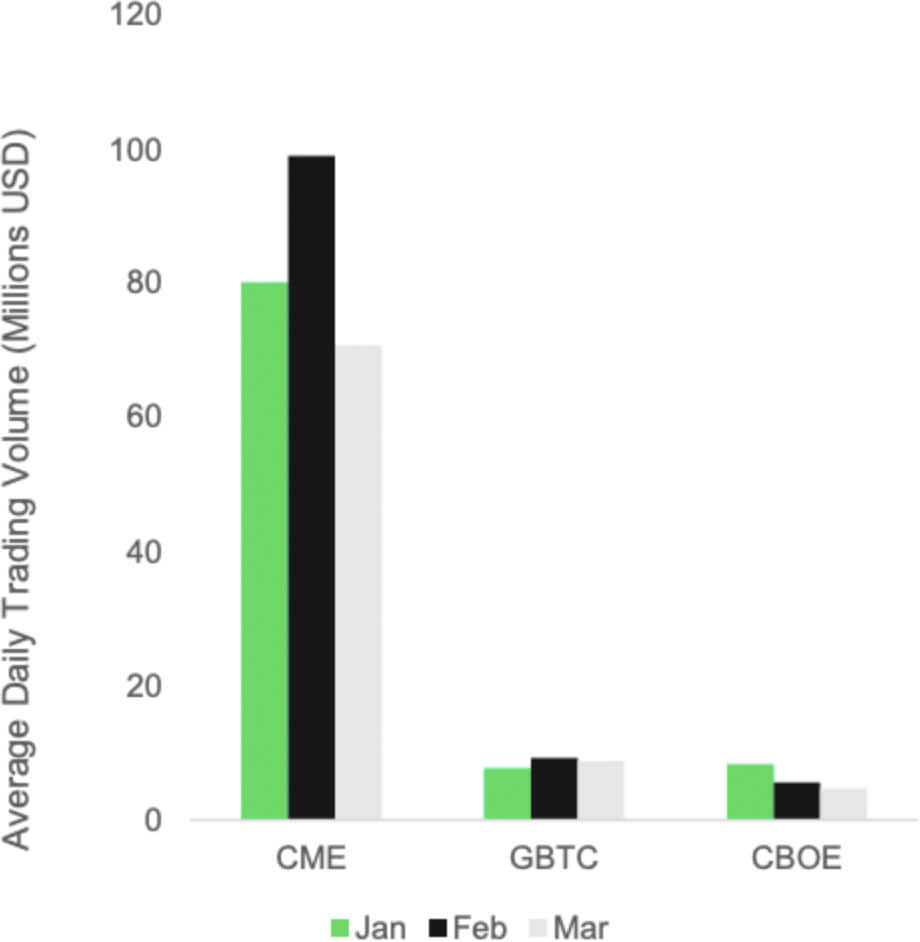

As the analytics firm has highlighted in the chart, Bitcoin has seen two types of surges in the ETF volume: a healthy, sustained rise that supports price moves, and sudden spikes that mark local reversals.

Solana’s latest spike could be of the latter type, but since its spot ETFs still have a small sample size, the pattern with them is yet uncertain. The sharp surge could be an anomaly, or it could just be the start of a new normal (which, if so, would put the spike in the former category).

SOL PriceAt the time of writing, Solana is trading around $138, up more than 9% over the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Volume Network (VOL) на Currencies.ru

|

|