2019-11-29 16:00 |

Cryptocurrency means different things to different people. To early adopters, millennials, techies, geeks, and risk-loving investors, cryptocurrency is the future of money. During bull markets, the incredible performance of cryptocurrencies over traditional assets such as equities, real estate, and gold often makes a solid case for why crypto deserves a place in your portfolio.

However, if you ask traditional financial institutions, regulators, and governments – you’ll hear the usual diatribe about how crypto is highly-risky, speculative, and unregulated. Nonetheless, the recent news that China is getting ready to launch a state-backed cryptocurrency has opened the proverbial Pandora’s box. The world will eventually accept that crypto is here to coexist with fiat (maybe displace fiat) over the long term.

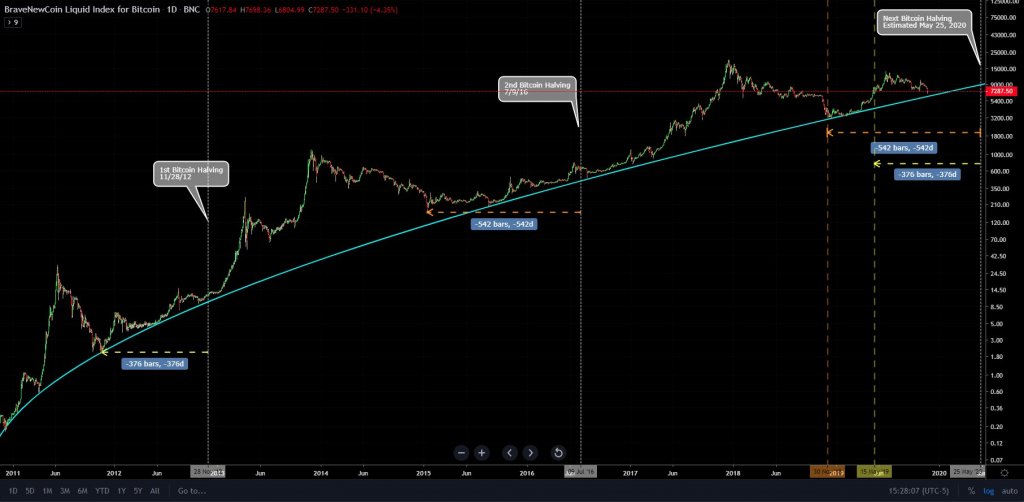

The more interesting point is that the consistent outperformance of cryptocurrency over other legacy Wall Street assets is driving growing interest in the cryptocurrency market. For instance, in the year-to-date period, Bitcoin has recorded more than 140% price gains to septuple the performance of the S&P 500 and Dow Jones Industrial Average in the same period as seen in the chart below.

If crypto is this profitable, why isn’t everybody trading cryptocurrencies?

Bitcoin debuted in 2009 as an application of Blockchain technology. Blockchain itself is built on complex maths, cryptography, and computer science. Traditional finance often advises against investing in things you don’t understand; hence, many people who would love to benefit from the huge potential in cryptocurrencies are not quite sure that they understand how blockchain and cryptocurrencies work.

The worst part is that crypto in its current form looks complex with strings of alphanumeric wallet addresses, network confirmation trees, hash rates, and consensus algorithms. The market also lists more than 4000 different coins, altcoins, tokens, and the 2017 ICO boom has left an exponentially larger number of shitcoins, scamcoins, and deadcoins. Hence, it is often difficult to sift through the information overload to find coins that deserve a place in your portfolio.

Another layer of difficulty that makes it hard for retail investors to get started with crypto is the fact that the whole crypto market is less than 10 years old. There are not many tools to screen coins, build trading strategies, or enough data against which you can backtest your strategies.

The highly volatile nature of cryptocurrencies powered by speculative entry and exits, coupled with manipulative moves by market whales, often makes it difficult for many inexperienced traders to survive in the market.

eToro attempts to simplify crypto trading with CopyTraderHuman beings are social beings, we are wired to look up to others for companionship, guidance, and direction. eToro is leveraging the social predisposition of humans to lower the barriers to cryptocurrency trading, by providing a platform for people who have mastered the cryptocurrency market to share their expertise and experience with other crypto traders and investors.

Last week, eToro announced the launch of its CopyTrader feature for crypto traders and investors in the U.S. CopyTrader is an innovative system that democratizes trading for all types of assets and all traders irrespective of their trading experience and expertise. Through CopyTrader, eToro users can follow other top-performing traders and set up their trading accounts to automatically copy and replicate the trades of these experts proportionally.

By using the CopyTrader feature, new traders can shorten the steep learning curve that often discourages many retail traders from getting involved with cryptocurrencies. New traders can leverage the expertise of experienced traders in developing trading strategies, entering the market, exiting profitable trades and making decisive escapes from losing trades.

The more reassuring part is that traders retain full control of their accounts because CopyTrader is non-intrusive. Hence, you can decide if you want to continue or stop copying the trade of any trader at any time if you are dissatisfied with the performance of their portfolio because of the underlying philosophy of decentralization.

Going forward, more retail traders might be inclined to explore crypto trading because CopyTrader could potentially improve the odds of having profitable trades without any active participation in the market.

Would you trust another trader with the fate of your portfolio?

CopyTrader is an innovative and novel idea, but the question remains if people will trust the performance of their portfolio to the actions of another trader. From a logical standpoint, many people already trust their financial future to other traders through assets such as mutual funds on Wall Street. You’ll even pay the fund manager for their services even though you don’t know exactly what they are doing, and they can’t make any guarantees on the performance of your portfolio.

However, the social trading component of CopyTrader provides access and insights into the trading activities of other traders in a provably transparent manner. Guy Hirsch, US Managing Director of eToro, notes that “CopyTrader can help anyone to build their wealth in a simple and transparent way. Users who want to leverage the crypto asset class can now simply look for an investor with a proven track record and just hit copy to execute the same trades automatically.”

eToro has already signed up several popular crypto influencers such as Nicholas Merten, the host of the DataDash YouTube channel, and #11 Ranked Welterweight UFC fighter Ben Askren. The intentional onboarding of crypto influencers on CopyTrader could foster increased confidence in the platform while accelerating the increased participation of retail investors in the cryptocurrency market.

People who are confident in their crypto trading expertise can also apply to join eToro’s Popular Investor program where they can also make their trading moves and strategies available for the community to copy. In exchange for allowing the community to access and copy your trading strategies, you’ll get a chance to build up a social following, get recognition for your trading expertise, and find ways to monetize your trades.

The post Social Trading Tools Might Be the Key to Simplifying Crypto Trading for Retail Investors appeared first on CoinMarketCap.

origin »Open Trading Network (OTN) на Currencies.ru

|

|