2020-7-2 05:00 |

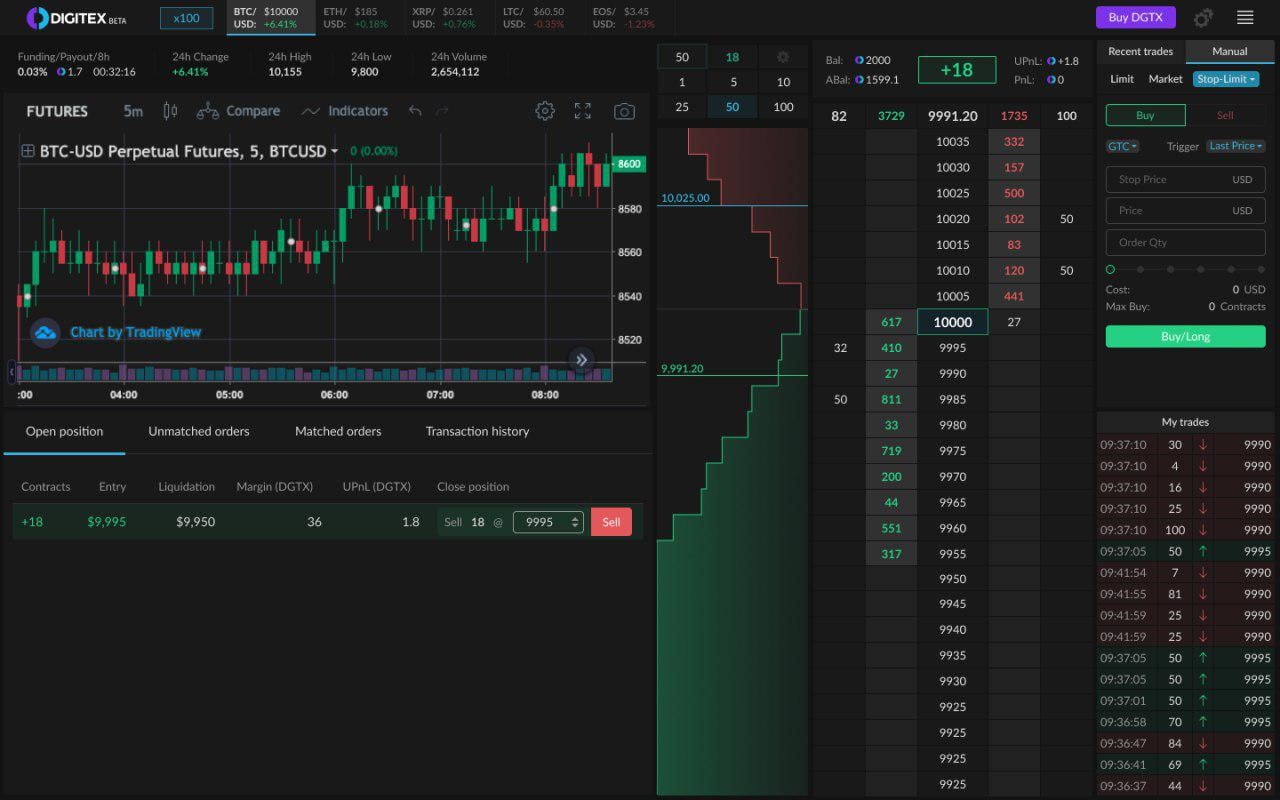

As Bitcoin continues trading sideways within a trading range between $9,000 and $10,000, investors are busy at work speculating as to what could help fuel a further price rise for the benchmark digital asset.

Now, one strategist is noting that the crypto could soon see a massive influx of new capital from retail traders – and particularly those trading on Robinhood.

There have been countless examples of an army of return-hungry retail investors on the popular investment platform who have pumped the stock prices of many small companies – even some that have gone bankrupt.

One strategist is now noting that this retail hoard may soon grow bored with equities and direct their attention to Bitcoin – which is offered on the platform.

He contends that they could soon pile into Bitcoin positions.

Robinhood Traders Gain Increasing Control Over the MarketsArmed with smartphones and relatively small amounts of capital, a collective group of retail investors has been wielding massive influence over the equities market.

Market spectators have been closely watching the dynamics amongst these investors, who have notoriously been behind some bizarre market movements, including the massive parabolic rally seen by Hertz’s stock shortly after it went bankrupt.

To many crypto veterans, this market dynamic is strikingly similar to that seen by altcoins in late-2017, when profits from Bitcoin’s meteoric rise cycled into smaller digital assets, allowing some investors to clock massive profits.

While speaking to Bloomberg about this trend seen amongst Robinhood investors, Benn Eifert – a managing partner at QVR Advisors – explained that this new dynamic stems from social media.

“It’s a social media-like dynamic… Someone points out a stock that’s moving and posts some charts, an influencer says, ‘Ok we’re buying it, buy the calls’ and then many people pile in.”

Strategist: Bitcoin Likely to See Influx of Fresh CapitalMatt Maley, the chief market strategist at Miller Tabak + Co., believes that these retail traders will soon target the crypto markets through the popular app, which offers access to Bitcoin and a few other tokens.

“They’re playing in another sandbox right now, but they’re keeping their eyes on all the other sandboxes because they know that something like Bitcoin can make them a big profit very quickly,” he explained.

Maley further added that this trend could kick off if the benchmark cryptocurrency sets a fresh yearly high.

“Interest in [Bitcoin] is going to pick right back up and all those momentum players are going to say, ‘I’m in.’”

Featured image from Shutterstock. origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|