2024-7-31 18:00 |

Slovenia issued the first sovereign digital bond in the EU, a 30 million-euro ($32.5 million) bond which will be settled through the Bank of France’s tokenized cash system. BNP Paribas coordinated the issuance using the Neobonds platform on the Canton blockchain.

Slovenia Pioneers Digital Finance in EU

Slovenia has made history by becoming the first European Union member to issue a sovereign digital bond. The landmark issuance, valued at 30 million euros ($32.5 million), represents a significant advancement in using blockchain technology for sovereign debt instruments.

The digital bond offers a 3.65% coupon and is set to mature on November 25, 2024. The settlement was completed on-chain through the Bank of France’s tokenized cash system as part of the European Central Bank’s (ECB) money settlement experimentation program.

The Evolution of Digital Bonds

Digital bonds, unlike their traditional counterparts, use blockchain technology to improve the transparency, efficiency, and security of their issuance and trading processes. Over the past few years, the adoption of digital bonds has increased, with notable issuances by several countries.

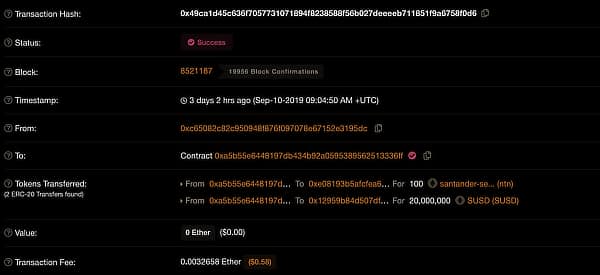

For instance, in 2019, Société Générale issued a $10 million green bond on the Ethereum blockchain. Similarly, in 2021, Germany’s Vonovia issued €20 million ($24.3 million) worth of digital bonds on the Stellar blockchain.

The ECB has been at the forefront of exploring digital finance innovations, conducting various trials and experiments with wholesale central bank digital currency (CBDC) solutions. In May, the ECB completed its first test involving Austria’s central bank, examining the tokenization and simulated delivery-versus-payment settlement of government bonds.

Significance of Slovenia’s Digital Bond Issuance

Slovenia’s issuance of the sovereign digital bond marks a significant milestone in modernising financial markets. The Slovenian government emphasized the importance of these initial transactions and experiments with wholesale tokenized central bank money, viewing them as crucial steps toward greater transparency and efficiency in financial markets.

BNP Paribas was important in this issuance, acting as the global coordinator and sole bookrunner. The bond was issued on Neobonds, BNP Paribas’s private tokenization platform built with Digital Asset’s Daml and using the Canton blockchain. This technology facilitates the efficient management of digital bonds, including recording legal ownership, coupon generation, and support for all lifecycle events.

The Future of Digital Bonds in Financial Markets

Digital bonds have the potential to significantly enhance transparency and efficiency in financial markets. The issuing and settling processes can be made faster, more secure, and less costly by leveraging blockchain technology. These improvements can lead to greater market liquidity and reduced transaction times, benefiting issuers and investors.

Robinson Rouchie, CIO for systematic and quantitative investments at BNP Paribas, highlighted the significance of this development, stating, “The issuance and placement of the first Eurozone sovereign digital bond marks a significant milestone in the financial industry. Our participation underscores our commitment to embracing new technologies and pioneering change within the asset management sector.”

Global finance is poised for significant transformation as more countries and financial institutions explore the potential of digital bonds. Slovenia’s pioneering step should inspire other EU nations to follow suit, accelerating the adoption of blockchain technology in the global debt market and beyond.

The post Slovenia Becomes First European Union Nation to Issue Sovereign Digital Bond appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bond (BOND) на Currencies.ru

|

|