2020-9-2 12:13 |

Coinspeaker

HSBC and Singapore Exchange Issued $300M Digital Bond through DLT

The trio of British multinational investment bank HSBC Holdings Plc (NYSE: HSBC), Singapore Exchange, and Singaporean owned Temasek has successfully deployed Distributed Ledger Technology (DLT) to issue a $300 million digital bond. Renowned as the first of its kind, the DLT based digital bond came after months since it was first mentioned.

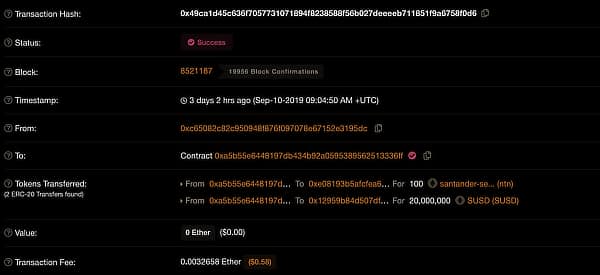

The issued digital bonds were made on the SGX Digital Asset Platform involve a 5.5 year worth of S$400 million (US$294 million) corporate bonds from Olam International Ltd (SGX: 032). The bonds also include a follow-on S$100 million ($74 million) tap of the same issue by Olam International.

Key Takehomes of the Digital Bond IssuanceAccording to the official announcement, SGX utilized DAML, the smart contract language created by Digital Asset, to model the bond and its distributed workflows for issuance and asset servicing over the bond’s lifecycle. Through the SGX smart contracts, the rights and obligations of parties involved in the bond issuance can be adequately captured.

The partner in the collaboration HSBC also deployed its on-chain payments solution which allows for seamless settlement in multiple currencies to facilitate the transfer of proceeds between the issuer, arranger, and investor custodian.

Commenting in the pilot digital bond issuance, Lee Beng Hong, Senior Managing Director, Head of Fixed Income, Currencies and Commodities (FICC), SGX, said:

“We are very excited that this collaboration with HSBC and Temasek has led to the successful completion of the first digital syndicated public corporate bond in Asia. Debt capital markets globally are characterised by deeply engrained legacy systems and processes which can be made faster, more accurate and efficient with this new technology. DLT and smart contracts are rapidly evolving technologies, and our vision is to fully digitalise the end-to-end corporate bond issuance and asset servicing process. We look forward to playing a part in strengthening the fixed income market infrastructure of Singapore, Asia’s fixed income hub for bond issuers”.

With the bond issuance to Olam International, the parties showed how an on-chain solution can fulfill payment needs in DLT-based ecosystems. Expectations are for the innovation to go mainstream, particularly in the Asian markets.

HSBC and Singapore Exchange Issued $300M Digital Bond through DLT

origin »Bitcoin price in Telegram @btc_price_every_hour

Bond (BOND) на Currencies.ru

|

|