2019-1-4 20:25 |

Blockchain technology has managed to make a lot of progress in recent years, with a lot of new use cases being discovered and conceptualized.

However, before it can actually go mainstream and become the next big thing in countless industries that it has a potential to change, it first needs to resolve several legal issues that are still holding it back.

1) The SEC Needs To Define Sufficient DecentralizationThe US SEC has been working hard over the past year to introduce some level of order into the crypto space. They tried to achieve this through regulatory guidance which was explained in various interviews, conferences, and alike. However, there were also numerous personal statements, which were later revealed not to be the stances of the SEC itself.

In other words, even if the SEC official states something, it might only be their personal view on the matter, and not the attitude of the SEC itself. One of the main goals that crypto and blockchain enthusiasts are hoping to see achieved is a successful definition of ‘sufficient decentralization.'

According to the SEC Commissioner William Hinman, Ethereum's network is already sufficiently decentralized. However, it remains uncertain what the definition actually is, as well as whether or not the SEC itself believes it to be true.

2) The Bitcoin ETF DilemmaBitcoin ETFs were something that a large part of the crypto community has been excited about for a long time. Numerous firms already tried to gain the SEC approval — with some of them trying it several times — but the regulator remained firmly against making a positive decision. However, the application submitted by VanEck and SolidX is believed to actually stand a chance of being approved.

This is why many are excited to hear the SEC's decision, and why they were disappointed several times when the SEC announced that the decision would be delayed. Apparently, the reason for postponing the decision includes some key questions and terms that need to be clarified, and then adequately inspected by the regulator.

With the current state of things, the issue is expected to be resolved — one way or the other — on February 27th.

3) Blockchain's Compliance With Privacy RegulationsAnother crucial question revolves around the tensions between the GDPR and blockchain technology, especially when it comes to rights regarding erasure, rectification, and data minimization principles.

It also doesn't help that only a handful of governmental actors are addressing, or even acknowledging these issues.

So far, there were several proposed solutions that might resolve the problems, including zero-knowledge proofs, private key destruction, and alike. However, it still remains to be seen whether or not these solutions are acceptable and practical enough.

4) Cooperation Of International RegulatorsCrypto space and blockchain technology are still new enough to lack proper regulations, which is a problem for countries around the world. Meanwhile, each country is trying to bring its own regulations, which may contain significant differences.

Considering the fact that blockchain projects are becoming more and more geographically decentralized, resistant to censorship, and anonymous, there is a need for a common solution that will meet every country's criteria.

While there were attempts at cooperation in bringing such regulations, any true results are likely still years away from becoming a reality.

5) The Future Of Privacy CoinsPrivacy coins, as many are already aware of, are coins that provide traders with a higher levels of privacy and anonymity. Since there is always a need for anonymity on the internet, quite a few privacy-focused tokens came into existence over the years. And, while individual traders may find them useful, regulators and governments mostly find them to be troublesome and potentially dangerous.

If there is no way to track transactions made with privacy coins, there is no way to determine what are they being used for. This might allow unwanted use cases such as money laundering, funding of terrorist groups, black market payments, and other illegal acts.

Soon enough, regulators found themselves in front of a big issue — what to do with them? One solution would be to ban them and force exchanges to delist them. If they cannot be bought or traded, they might eventually die out. However, this plan is not good enough, as they can be traded on different kinds of markets, decentralized platforms, or even certain websites that are out of regulators' reach.

Another solution might be to allow them on regulated exchanges but only under the regulators' watchful eye. At this point, the solution has yet to be reached, and the fate of privacy coins remains uncertain.

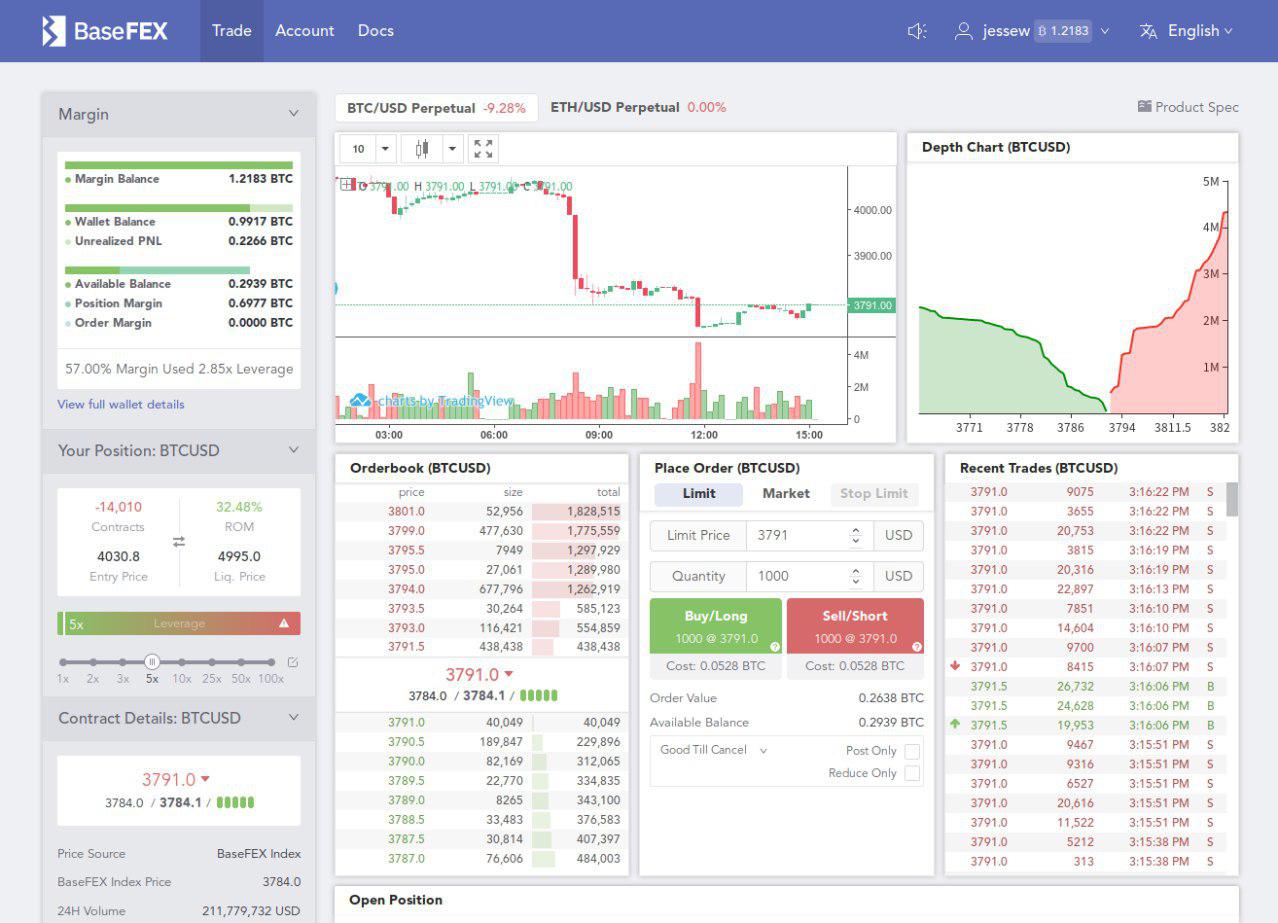

6) Regulating Decentralized ExchangesRegulating centralized exchanges is a difficult task, but it is still much easier than regulating DEXes. After all, how can anyone regulate an exchange platform that has no governmental body that would assume control or be forced to obey certain rules under the threat of being shut down?

One attempt to do this came in 2018 when the SEC introduced guidance on how online platforms should behave, including the obligation to introduce KYC. While some DEXes reluctantly obeyed and were later left alone, others did not, and the SEC came after their creators, accusing them of creating a software that violates the law.

This can only mean that the “true” DEX has yet to be conceptualized, and many are hoping that one such exchange might emerge in the following months.

7) Will Code Developers Be Held Liable For Misuse Of Their Creations?In corporate law, there is a certain rule which allows companies to be considered and treated as separate entities, which allows them not to get blamed if their owners or officials make any violations of law or company's own policy. The same idea used to keep code developers safe from lawsuits or being held accountable if their code is bugged, malicious, or misused.

However, this situation might change soon, as ideas that codes are being created even though it is “reasonable foreseeable” that they might be misused, or used by parties that are not supposed to use them, are starting to appear. Another example of this is prosecuting developers of DEXes that do not follow regulators' orders, as we have already mentioned earlier.

There is still a lack of clarity regarding the term “reasonably foreseeable,” and what it may or should include. However, there is a significant fear in the developers' community that their creations might be used against them, even if they had no malicious intent while creating them.

origin »Bitcoin price in Telegram @btc_price_every_hour

Lottocoin (LOT) на Currencies.ru

|

|