2021-1-27 09:30 |

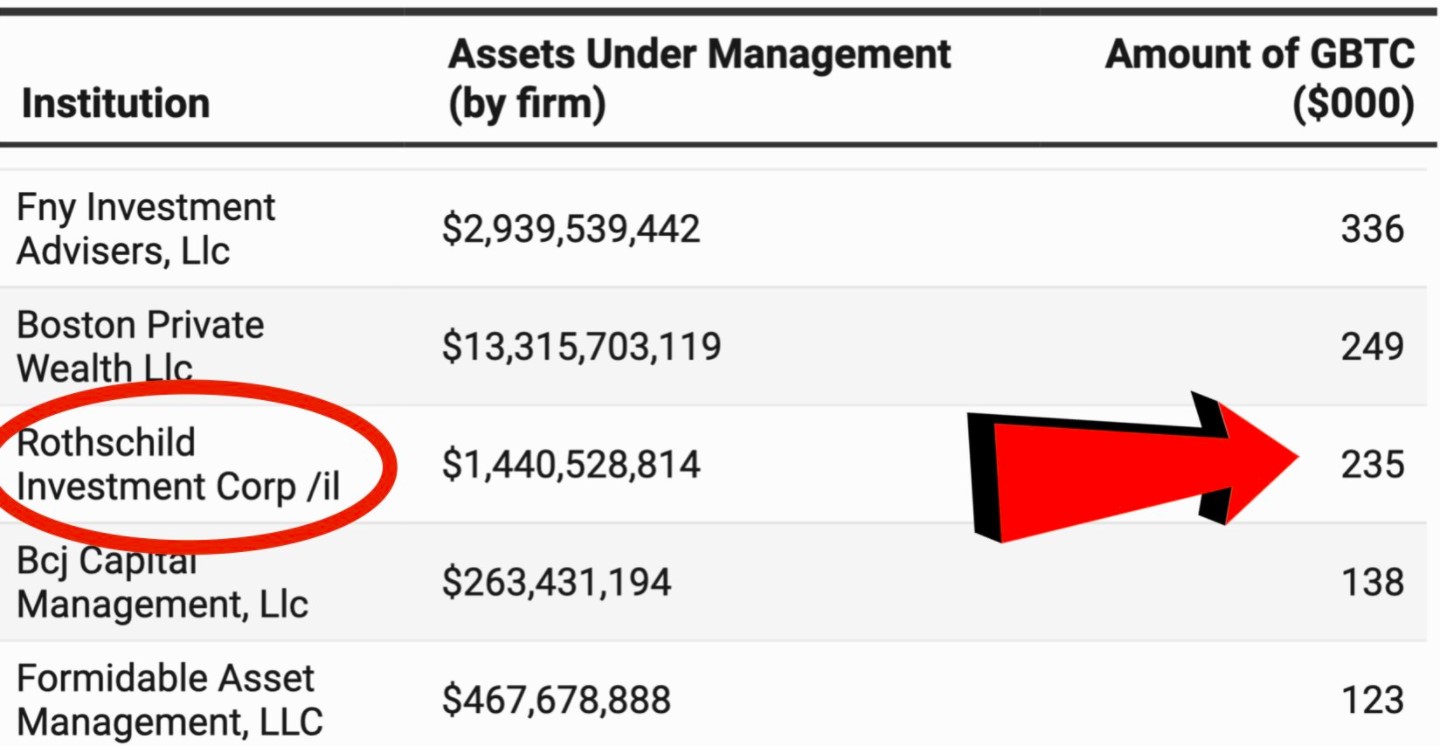

Rothschild Investment has joined the long list of institutions that hold at least $1 million in Bitcoin — particularly through the Grayscale Bitcoin Trust.

Rothschild Investment, a Chicago-based investment bank, has increased its exposure to Bitcoin by at least 24% since October 2020. In its recent filing with the SEC, the firm disclosed that its BTC investment has ballooned to $1 million. Rothschild has been investing in Bitcoin since at least 2017 — primarily through the Grayscale Bitcoin Trust (GBTC).

The Rothschild Investment Corporation reportedly now owns 30,454 shares of GBTC as of Dec. 31, 2020. That figure represents a massive leap over its disclosure of owning 24,500 shares in October. For reference, each GBTC share is trading at $31.50 at the time of publication.

Grayscale Bitcoin Demand Outstrips Mined SupplyOn Jan. 18, 2021, alone, Grayscale reportedly purchased 16,240 BTC — worth around $607 million.

Given that each Bitcoin block takes roughly 10 minutes to mine, an estimated 900 BTC enters circulation each day. Even over two weeks, 12,600 BTC entering the market pales compared to Grayscale’s single-day purchase. This trend of institutions purchasing more Bitcoin than what is being mined every day means that demand has already started to outstrip supply.

Grayscale isn’t the only firm that is aggressively purchasing Bitcoin from the open market either. In December 2020, MicroStrategy announced that it had crossed over $1 billion in BTC purchases that year. The business intelligence company now holds at least 70,784 BTC, with an average acquisition price of approximately $16,035.

MicroStrategy has purchased approximately 314 bitcoins for $10.0 million in cash in accordance with its Treasury Reserve Policy, at an average price of approximately $31,808 per bitcoin. We now hold approximately 70,784 bitcoins.https://t.co/zMJSH29bmC

— Michael Saylor (@michael_saylor) January 22, 2021As MicroStrategy has demonstrated, non-investment companies are now viewing Bitcoin as a suitable hedge too. With the pandemic significantly weakening the US dollar, cryptocurrencies are being viewed as a digital-analog to gold. Even Ivy League colleges appear to agree — with reports suggesting university endowments have been buying Bitcoin over the past year.

According to Coin Corner CEO, Danny Scott, Grayscale bought BTC worth $251 million every week in Q4 2020. The firm’s allocations have been growing at an even greater pace in 2021 though.

A Twitter account dedicated to tracking Grayscale calculated that the investment firm added 35,970 BTC in a single week. At roughly $1.1 billion, that’s an increase of nearly 100 percent over the previous quarter’s weekly average.

.@Grayscale added another ~1,088 #Bitcoin yesterday, which is more than the daily bitcoin mined

Grayscale have added 35,970 bitcoin during the last 7 working days.

Enjoy your weekend. pic.twitter.com/Zwocku1A8Q

Even though Grayscale has been buying larger amounts of Bitcoin every single week, the activity hasn’t affected valuations much. This is primarily because many institutional investors do not disclose the extent of their investments. The widespread use of over-the-counter trading platforms further hides the demand from retail investors.

However, strategists at JP Morgan Chase believe that the cryptocurrency could absolutely see a price rally if demand stays steady. The analysts predicted a breakout above $40,000 if Grayscale continues to accumulate $100 million or more in Bitcoin daily.

Furthermore, the confirmation of a new US Treasury secretary may speed up negotiations for the stimulus deal. An increased risk appetite on both retail and institutional fronts could help Bitcoin soar beyond its current all-time high.

The post Rothschild Investment Now Holds Over $1 Million in BTC through Grayscale Bitcoin Trust appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Intelligent Investment Chain (IIC) на Currencies.ru

|

|