2024-6-4 06:30 |

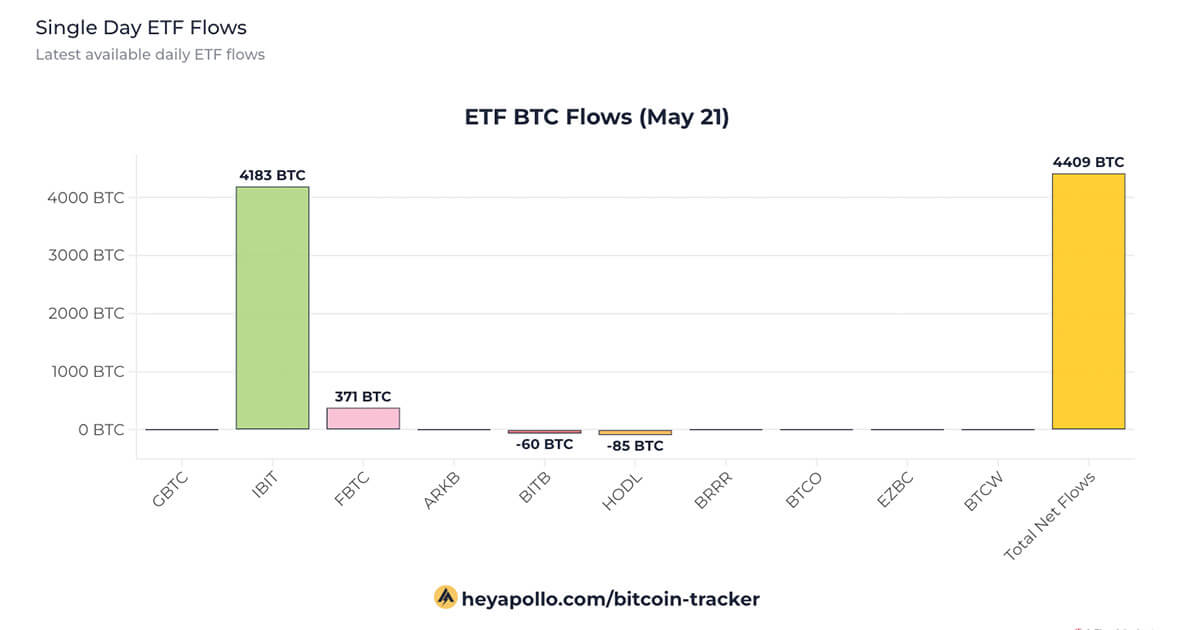

The crypto market is showing signs of a bullish resurgence, with reports of an impressive $2 billion in inflows for May alone.

Alongside this positive trend, Ethereum (ETH) has seen a notable turnaround in investor sentiment as the long-awaited spot exchange-traded funds (ETFs) for the market’s second-largest cryptocurrency received approval from the US regulators last week.

Record-Breaking Month For Crypto ProductsAccording to a recent report from research firm CoinShares, digital asset investment products consistently attracted inflows during the four weeks, amassing a total of $185 million.

May proved to be particularly fruitful, with inflows surpassing $2 billion. This achievement marks the first time on record that year-to-date inflows have exceeded the $15 billion mark, highlighting investors’ growing interest in the crypto market.

Most inflows originated from the United States, with a net inflow of $130 million. However, it is worth noting that ETF issuers experienced outflows amounting to $260 million.

Switzerland also witnessed a significant uptick in investor interest, recording its second-largest weekly inflow this year at $36 million. Meanwhile, Canada witnessed a positive turnaround, with inflows of $25 million, despite experiencing a net outflow of $39 million in May.

Ethereum Rebounds With $200M InflowsPer the report, Bitcoin (BTC) continued to dominate the crypto market, attracting inflows totaling $148 million. Conversely, short-Bitcoin products witnessed another week of outflows, amounting to $3.5 million, suggesting that sentiment among ETF investors remains largely positive for the leading cryptocurrency.

Ethereum, on the other hand, experienced a notable change in investor sentiment following the Securities and Exchange Commission’s (SEC) approval of a spot-based ETF that is expected to launch in July 2024.

CoinShares notes that this approval marked a turning point for Ethereum, which had endured ten weeks of outflows totaling $200 million. Interestingly, the positive news for Ethereum had a ripple effect on Solana (SOL), which received an additional $5.8 million in inflows last week.

While direct investments in crypto assets have been thriving, blockchain equities faced a different scenario. In the past week alone, blockchain equities witnessed outflows of $7.2 million.

The report notes that since the beginning of the year, the sector has suffered outflows totaling $516 million, reflecting a challenging period for blockchain-related stocks.

At the time of writing, Ethereum has seen a 4% price drop in the last week, resulting in a trading price of $3,770. However, the second-largest cryptocurrency on the market still holds gains of 21%, as recorded in the 30 days.

Featured image from DALL-E, chart from TradingView.com

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|