2020-1-17 23:17 |

While the price of the digital asset according to some industry commentators is looking ready for a bullish move, on the regulatory front, there is no knowing if the digital is a security or commodity.

On January 15, Chief District Judge Phyllis Hamilton of the Northern District of California heard Ripple’s motion to dismiss. And now the fate of the Ripple and nearly $10 billion XRP market is in her hands.

Ripple’s Argument: A Threat to Destroy XRP’s Established MarketDuring the hearing, Ripple argued that the continuation of the case,

“would not only threaten to eliminate XRP’s utility as a currency, but it would upend and threaten to destroy the established XRP market more broadly — a market involving over USD 500 billion in trading over the last two years.”

The company further argued that this might wipe out,

“the value held by the alleged thousands of individual XRP holders around the world (many of whom no doubt disagree with Plaintiff’s claim that XRP is a security).”

Ripple added, it,

“would unfairly disrupt the long-settled expectations of other XRP market participants, such as exchanges, market makers, custody providers, and others.”

Ripple’s Strategy: Keep on DelayingThe hearing went for 56 minutes and as is typical, Jake Chervinsky, general counsel at Compound Finance clarifies, “the judge “took the matter under submission,” meaning she will issue a written ruling at some later date. It could be days, weeks, or months.”

Chervinsky who has been providing valuable insight into the legal matters concerning cryptocurrency to the industry further explained that “there is no time limit” to submit the ruling or “the case could settle before a ruling comes down.”

All in all, “the motion can sit on the docket forever” as “there is no time limit for a federal judge to resolve a pending motion to dismiss.”

Even if Ripple wins its motion to dismiss & has the whole class action thrown out, it won't mean much for XRP.

The big & interesting question is if XRP was (or is) a security. Ripple's motion didn't ask that question, so dismissal won't answer it — just defer it to another day.

— Jake Chervinsky (@jchervinsky) January 15, 2020

Ripple Security or Commodity? “Unclear”As for the dispute over the security, plaintiff Bradley Sostack’s counsel, Oleg Elkhunovich said that the council has admitted classifying the digital asset as a security for this motion adding, “Believe it, if this case proceeds that will be one of the key issues that will be hotly disputed.”

The plaintiff sued Ripple back in 2018 claiming that the company violated US securities laws by selling XRP and that the digital asset should be declared a security.

Ripple argued that the complaint exceeds the statute of limitations, a three-year deadline since the first initial public offering of XRP, and as such the case should be dismissed.

Elsewhere, US Commodity Futures and Trading Commission, Heath Tarbert said whether XRP is a security or commodity is still “unclear” and that they are working closely with the SEC on this issue.

Ripple (XRP) Live Price 1 XRP/USD =$0.2312 change ~ 3.10%Coin Market Cap

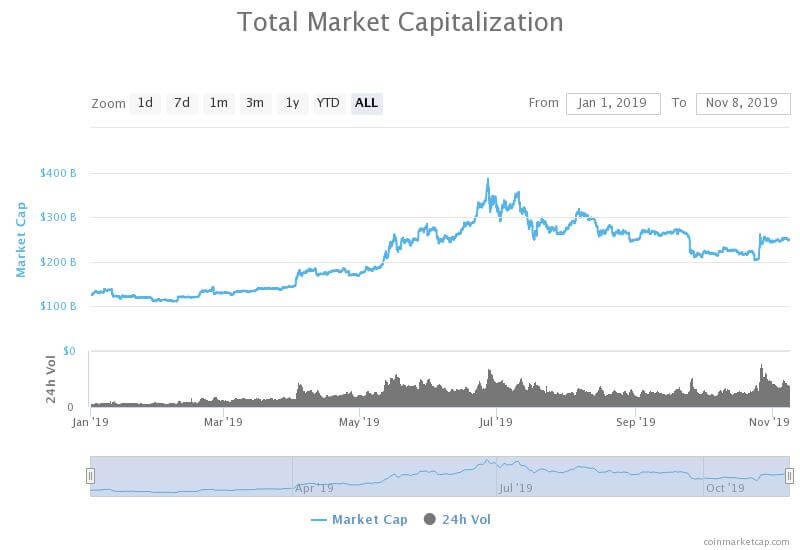

$10.01 Billion24 Hour Volume

$234.02 Million24 Hour VWAP

$024 Hour Change

$0.0072 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~XRP~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|