2023-4-14 11:30 |

San Francisco-based fintech firm Ripple has launched its latest product, Ripple Liquidity Hub. The system aims to help businesses with crypto liquidity needs.

On April 13, Ripple announced the launch of Liquidity Hub, a new service for businesses. The system was launched as a pilot in 2022, and now the fully-fledged public version is live.

“Liquidity Hub is publicly available to provide businesses with a simple, seamless way to manage their modern crypto liquidity needs,” the firm stated.

Additionally, the launch is in preparation for a “multi-asset reality,” noted Ripple. The product will enable enterprise users to access liquidity across a range of assets, including cryptocurrencies, nonfungible tokens (NFTs), and central bank digital currencies (CBDCs).

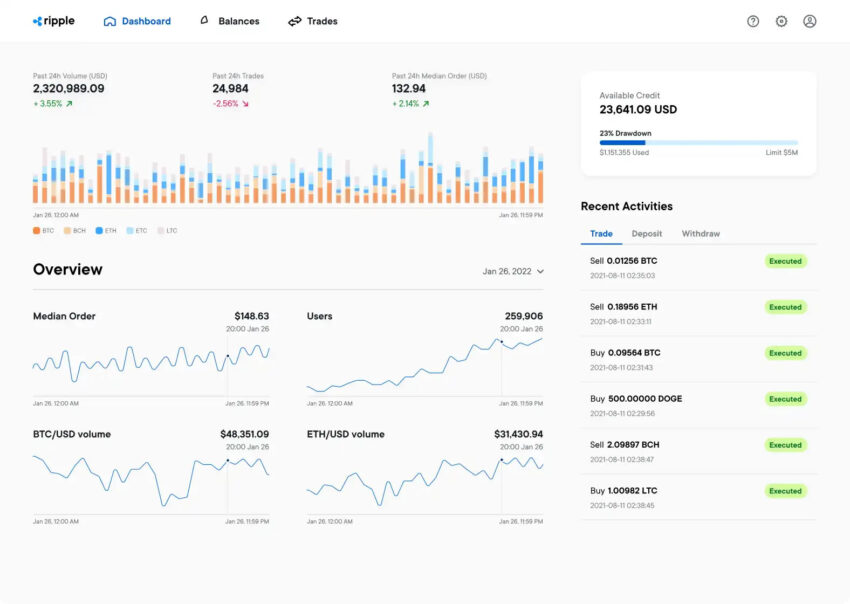

Ripple Crypto Liquidity Hub Dashboard Ripple Sourcing Crypto LiquidityLiquidity Hub will facilitate the movements into and out of these different assets, the firm explained. Additionally, crypto assets can also enhance transparency and facilitate treasury functions, it said before adding:

“These use cases all hinge on interoperability, requiring strong on- and off-ramps between crypto and fiat and deep pools of liquidity between asset pairs—or a crypto asset to bridge lesser pools.”

Ripple Liquidity Hub functions as a standalone solution or an extension of its cross-border payments solution.

Head of Liquidity Products at Ripple, Brad Chase, said that the system “combines ease of use, powerful payment integrations, cost savings, and more into a single, scalable enterprise-grade platform.”

Smart order routing will be leveraged to source crypto assets across several liquidity venues such as exchanges, market makers, and OTC desks. Moreover, it will essentially act as a bridge between crypto liquidity sources and fiat for enterprises.

Ripple lawyers have touted use cases such as these as arguments in the firm’s ongoing battle with the Securities and Exchange Commission (SEC). The financial regulator sued the company in late 2020, accusing it of selling unregistered securities.

Earlier this week, lawyer Jeremy Hogan predicted that Ripple would win the case because it is decentralized.

On April 13, Ripple defendants filed their response to the SEC’s Letter of Supplemental Authority regarding its Motion for Summary Judgment.

XRP Price OutlookRipple’s native XRP token climbed almost 7% on the day. As a result, XRP was changing hands for $0.542 at the time of writing.

Furthermore, the cross-border payment token has gained 44% over the past month.

XRP/USD 1 week – BeInCryptoHowever, XRP remains down 84% from its January 2018 all-time high of $3.40. The next major move is likely to hinge on whether the company is victorious against the SEC.

The post Ripple Launches Liquidity Hub For Business Cross-border Payments appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|