2021-11-11 14:26 |

In a surprising twist of events, Ripple has announced plans to launch a “Liquidity Hub” as it targets to offer enterprises direct exposure to digital assets from the broader crypto market beginning in 2022.

According to a Tuesday release, the San Francisco-based firm said that the hub will “unleash the potential to access deep liquidity within markets, accelerating the shift to crypto”.

Although there are many exchanges supporting liquidity through direct crypto trading services for consumers, the firm disclosed that a true crypto first world liquidity hub for enterprises was still lacking, necessitating the move.

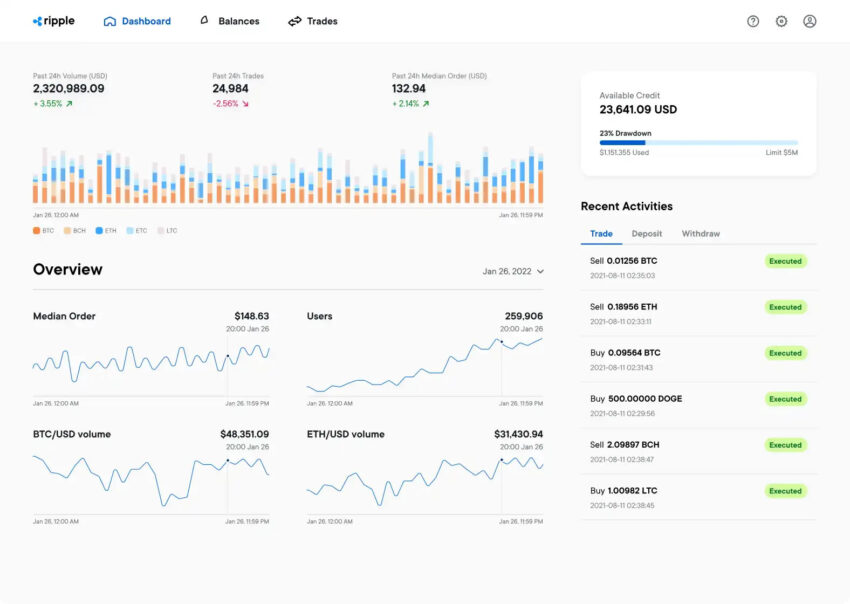

The Ripple Liquidity Hub shall be designed as a turnkey solution, enabling institutions to easily commence their business at the simple push of a button. Accordingly, the hub will anchor its business model on smart order routing, enabling it to source digital assets at the best prices from exchanges, market makers, and OTC desks for its customers.

“If Opportunity Doesn’t Knock, Build A Door”Acting more like an exchange, customers will be able to buy, hold and sell digital assets using the liquidity hub. This comes even as Ripple continues to battle out a protracted legal case with the SEC amid hopes of the U.S. largest crypto exchange, Coinbase relisting XRP.

According to Ripple, the hub aims at doing away with the difficulties associated with enterprises who try a hand in the digital investments businesses including the resource-heavy integrations by offering a streamlined Application Programming Interface(API) which shall handle all the work without unnecessary costs.

In rolling out its first phase, Ripple Liquidity Hub will initially support Bitcoin, Ether, Litecoin, Ethereum Classic, Bitcoin Cash, and XRP as it prepares to add more digital assets to the category. This addition however to be determined by jurisdiction. In addition, Ripple disclosed that it had plans to add more functionalities such as staking and yielding capabilities.

Whereas Ripple has been using a similar crypto sourcing technology to support its On-demand Liquidity(ODL), this is the first time that it will be offering customers direct exposure to other crypto assets through the liquidity hub.

Praising the move, RippleNet GM Asheesh Birla said, “We know full well the need for easy and efficient liquidity management. Crypto and financial institutions are embedded in our DNA. So, it makes perfect sense that as they prepare for a crypto-first world, our customers would want access to the same trusted one-stop-shop for buying, selling, and holding crypto assets that have powered our own extensive work with financial institutions,”.

Ripple will roll out the alpha version of the product in partnership with the first US licensed Bitcoin ATM manufacturer Coinme, as it seeks to make available additional functionalities in the future.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|