2021-2-26 10:07 |

Bitcoin prices dropped Friday, tracking declines in the US indexes after new data indicated a stronger economic recovery and an auction of seven-year bonds met with lukewarm demand from investors.

The flagship cryptocurrency’s upside momentum faltered earlier this week after establishing a record high above $58,000. At first, the move downside appeared like a natural downside correction that follows massive parabolic gains. Nonetheless, the sell-off accelerated in response to the latest macroeconomic updates, showing a positive correlation with tech stocks.

Bitcoin is down 20.78 percent from its record high. Source: BTCUSD on TradingView.com

Investors rushed out of some of the hottest pandemic winners in 2020. Shares of technology companies like Apple, Alphabet, and Netflix fell 2 percent apiece. Meanwhile, Tesla, the US carmaker which holds $1.5 billion worth of bitcoin in its reserves, suffered a share drop of 8 percent.

Dwyfor Evans, the head of macro strategy at Hong Kong-based State Street Global Markets, noted that expectations of the Federal Reserve’s rate hikes in the US prompted investors to de-risk their portfolios. That happened despite reassurances from the central bank’s chairman Jerome Powell that they would keep rates near zero until 2023.

Bond Sell-Off Ripples into Shorter-Dated NotesShorter-dated bonds experienced sell-offs. The five-year yield rose to 0.799 percent on Thursday from its previous session’s close of 0.612 percent, logging its largest one-day surge since December 2010. Meanwhile, the 10-year note yield touched another high at 1.513 percent before closing Thursday at 1.513 percent—still its highest level in a year. Yields move inversely to prices.

The US dollar index, a barometer to track the greenback’s value against top foreign currencies, opened 0.24 percent higher from its previous close on Wednesday. Its dramatic climb served as one of the major catalysts behind Bitcoin’s overnight plunge. The cryptocurrency’s loyal investor base treats it as a hedge against dollar depreciation.

US dollar index climbs higher on investors’ risk-off bets. Source: DXY on TradingView.com

Investors tend to sell Treasurys when they expect faster inflation and growth. That lowers the value of bonds’ fixed payments and can ultimately prompt the Federal Reserve to increase short-term interest rates. Bitcoin, which remains uncorrelated to macroeconomic updates, could become a de-facto cash provider for investors who want to offset losses in traditional markets.

Lower yields served as the main reason behind its supersonic rally throughout 2020 and this year. Mainstream investors treat it as a hedge against global uncertainty. Therefore, it cannot always maintain its correlation with conventional assets, especially as the economic outlook improves from investors’ point-of-view.

Jobs Data vs. BitcoinAt the core of recent sell-offs in bonds, tech shares, and bitcoin remain the US jobs data.

Labor Department data released Thursday showed the number of unemployed claims fell dramatically last week. That raised possibilities that the Fed would end its open-ended bond-buying program and raise benchmark interest rates much sooner than expected, given Mr. Powell’s earlier statements on the jobs market.

These developments hurt Bitcoin in the short-term. Nonetheless, when interest rate rises, it could also increase the cost of borrowing for companies and consumers, making them more likely to stay invested in profitable assets. Meanwhile, a continuous injection of the US dollar liquidity into the market dents their cash reserves’ valuation.

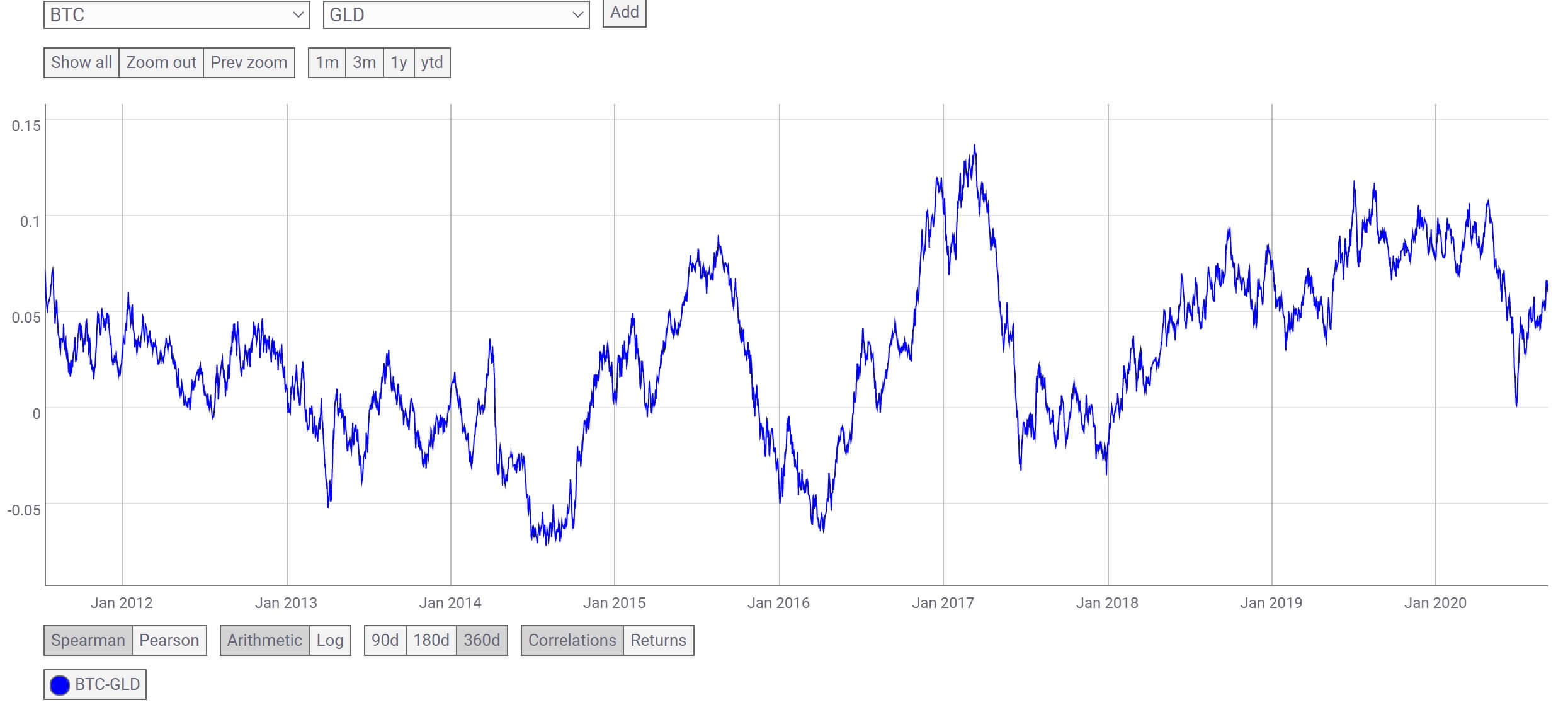

Bitcoin has emerged as an asset that offers hedging capabilities against fiat-linked inflation. Meanwhile, its profits in the previous year has paved way for many investors to treat it as a “digital gold.” Analysts believe the cryptocurrency is off to hitting $100,000 by the end of this year.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|