2025-12-20 23:30 |

Fresh US economic data is sending a clear but nuanced signal to markets. Inflation pressures are easing, but consumers remain under strain.

For Bitcoin and the broader crypto market, that mix points to improving macro conditions, tempered by near-term volatility.

Why Inflation Expectations Matter More Than SentimentUS consumer sentiment edged up to 52.9 in December, slightly higher than November but still nearly 30% lower than a year ago, according to the University of Michigan.

At the same time, inflation expectations continued to fall. Short-term expectations dropped to 4.2%, while long-term expectations eased to 3.2%.

The University of Michigan consumer sentiment index came in worse than expected at 52.9 in December. pic.twitter.com/yQ79MOBt5R

— Yahoo Finance (@YahooFinance) December 19, 2025For markets, those inflation expectations matter more than confidence levels.

Consumer sentiment measures how people feel about their finances and the economy. Inflation expectations measure what they think prices will do next. Central banks care far more about the latter.

Falling short- and long-term inflation expectations suggest households believe price pressures are easing and will stay contained.

That supports the Federal Reserve’s goal of cooling inflation without keeping policy restrictive for too long.

This data follows November’s CPI report, which showed inflation cooling faster than expected. Together, the two reports reinforce the same message: inflation is losing momentum.

Who do you believe:

A. University of Michigan consumer confidence below COVID April 2020 and Lehman September 2008 levels.

B. CPI inflation data, skewed by bogus OER? pic.twitter.com/FFEWj0I7OE

Lower inflation expectations reduce the need for high interest rates. Markets tend to respond by pricing in earlier or deeper rate cuts, even if economic growth remains slow.

For risk assets, including crypto, this matters because:

Lower rates reduce returns on cash and bondsReal yields tend to fall

Financial conditions gradually loosen

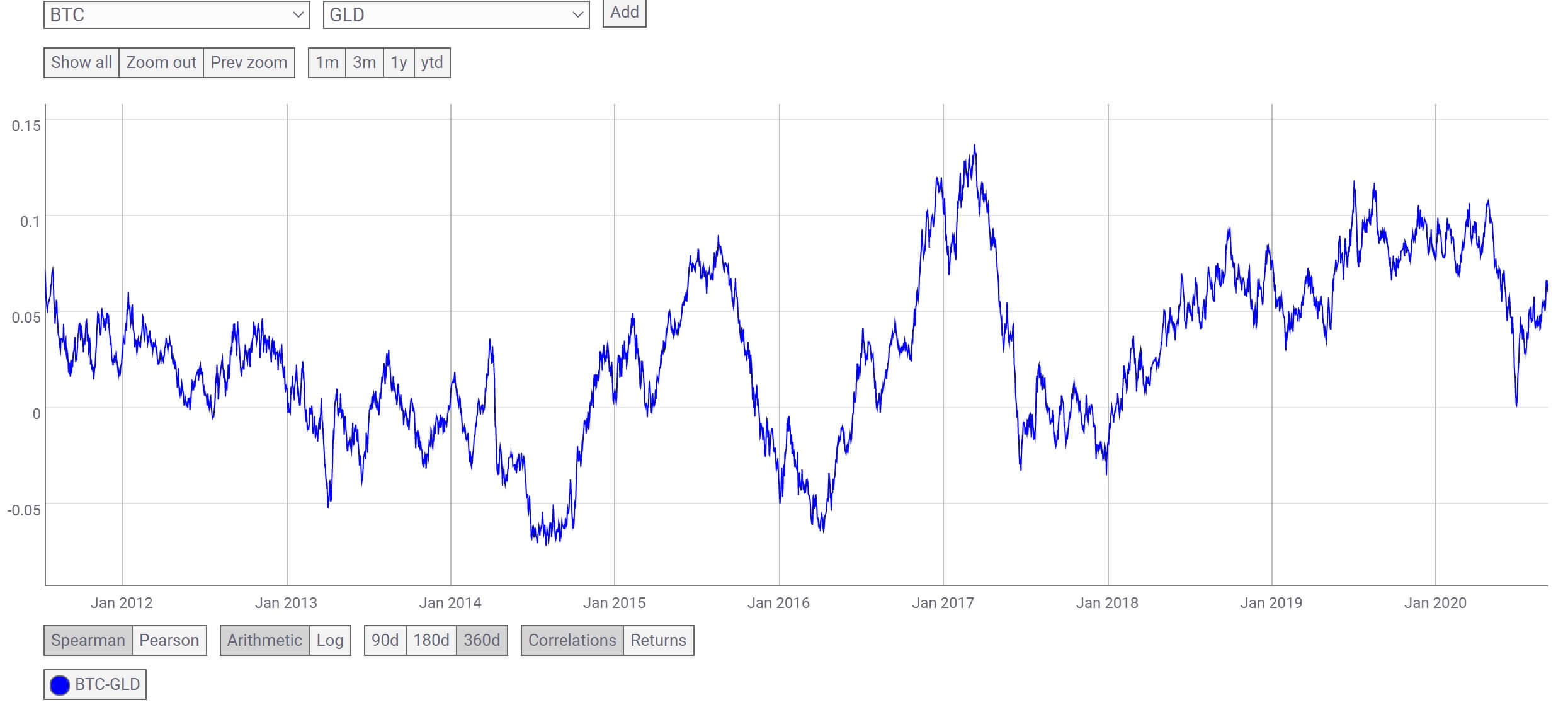

Bitcoin has historically responded more to liquidity conditions than to consumer confidence or economic growth.

Why Weak Confidence Does Not Hurt Crypto as MuchLow consumer confidence reflects cost-of-living pressures, not collapsing demand. People still feel stretched, but they are less worried about prices rising sharply from here.

Crypto markets do not rely on consumer spending in the same way equities do. Instead, they react to:

Interest rate expectationsDollar strength

Global liquidity

That makes falling inflation expectations supportive for Bitcoin, even when confidence remains weak.

Why Volatility Is Likely to ContinueThis environment favors risk assets over time, but not in a straight line.

Weak confidence means growth remains fragile. That keeps markets sensitive to data releases, positioning, and short-term flows. As seen after the CPI report, even bullish macro data can trigger sharp reversals when leverage is high.

For Bitcoin, that typically results in:

Strong reactions to macro newsChoppy price action

Rallies driven by liquidity rather than conviction

Looking Ahead to January 2026

Taken together, the data points to a constructive macro backdrop for crypto heading into early 2026. Inflation pressures are easing, policy constraints are loosening, and liquidity conditions are improving.

At the same time, weak confidence explains why markets remain volatile and prone to sudden selloffs.

The key takeaway is simple: macro conditions are improving for Bitcoin, but price action will continue to be shaped by flows, leverage, and timing rather than optimism alone.

The post Cooling Inflation, Weak Confidence: What the Michigan Consumer Data Means for Bitcoin appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|