2020-3-25 20:15 |

There has been no letup on the punishment that business and finance is getting as the coronavirus continues to wreak havoc across the globe. Analysts have been scouring the charts to gauge Bitcoin’s performance against other assets, and some bullish patterns are emerging.

Bitcoin has spent the weekend consolidating above $6k, however it had started to retreat by the beginning of the new week falling below this level. BTC was given a boost by the Fed announcement late Monday, however, and returned above the $6k support zone.

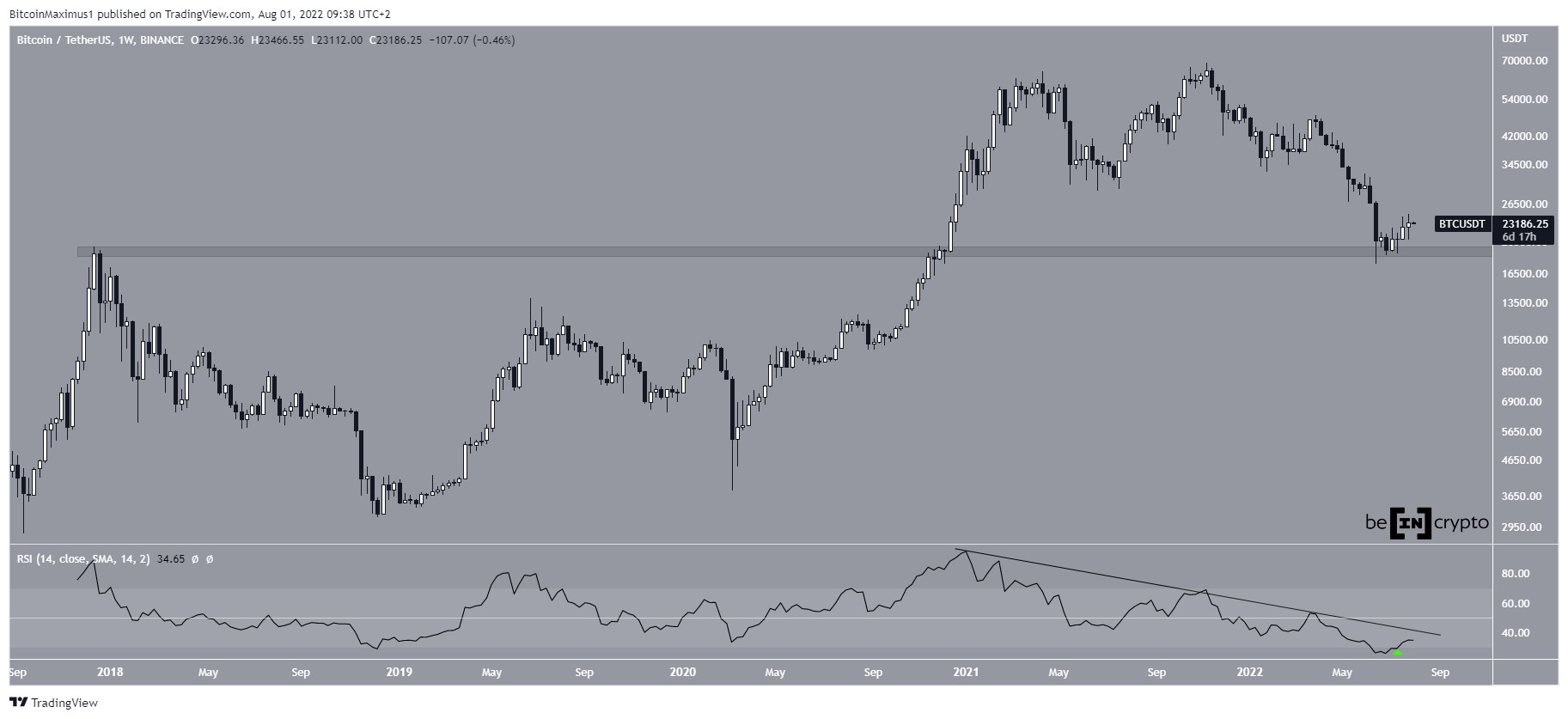

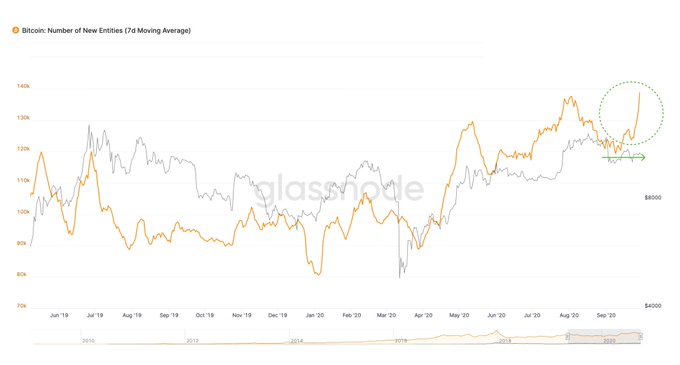

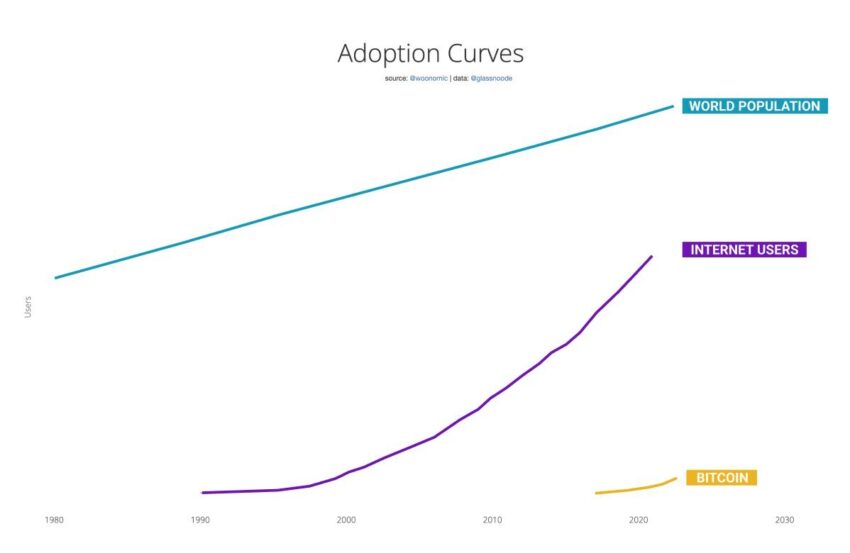

Decoupling EventOn-chain analyst ‘Willy Woo’ has been charting Bitcoin’s correlation with traditional markets and has identified a ‘decoupling event.’ He added that there will not be a V-shaped drop but a prolonged period of accumulation before any recovery.

The next key event is confirmation of BTC decoupling from traditional markets. Here's a bunch of charts, many are bullish. I will note that I don't expect a V-shaped bottom, I think there will be time, an accumulation range before moving up.

— Willy Woo (@woonomic) March 19, 2020

The first chart showed that both gold and BTC were decoupling from the S&P 500, which is still in free-fall. Since its peak in early March, gold has plunged 12% to a three month low, proving that there are no safe havens at all in this crisis.

Silver has fared even worse, dumping almost 38% over the past month as industry comes to a halt, hampering demand. Stock markets have dumped over 30% in less than a month and oil prices have tumbled a whopping 57% over the same period. [MarketWatch]

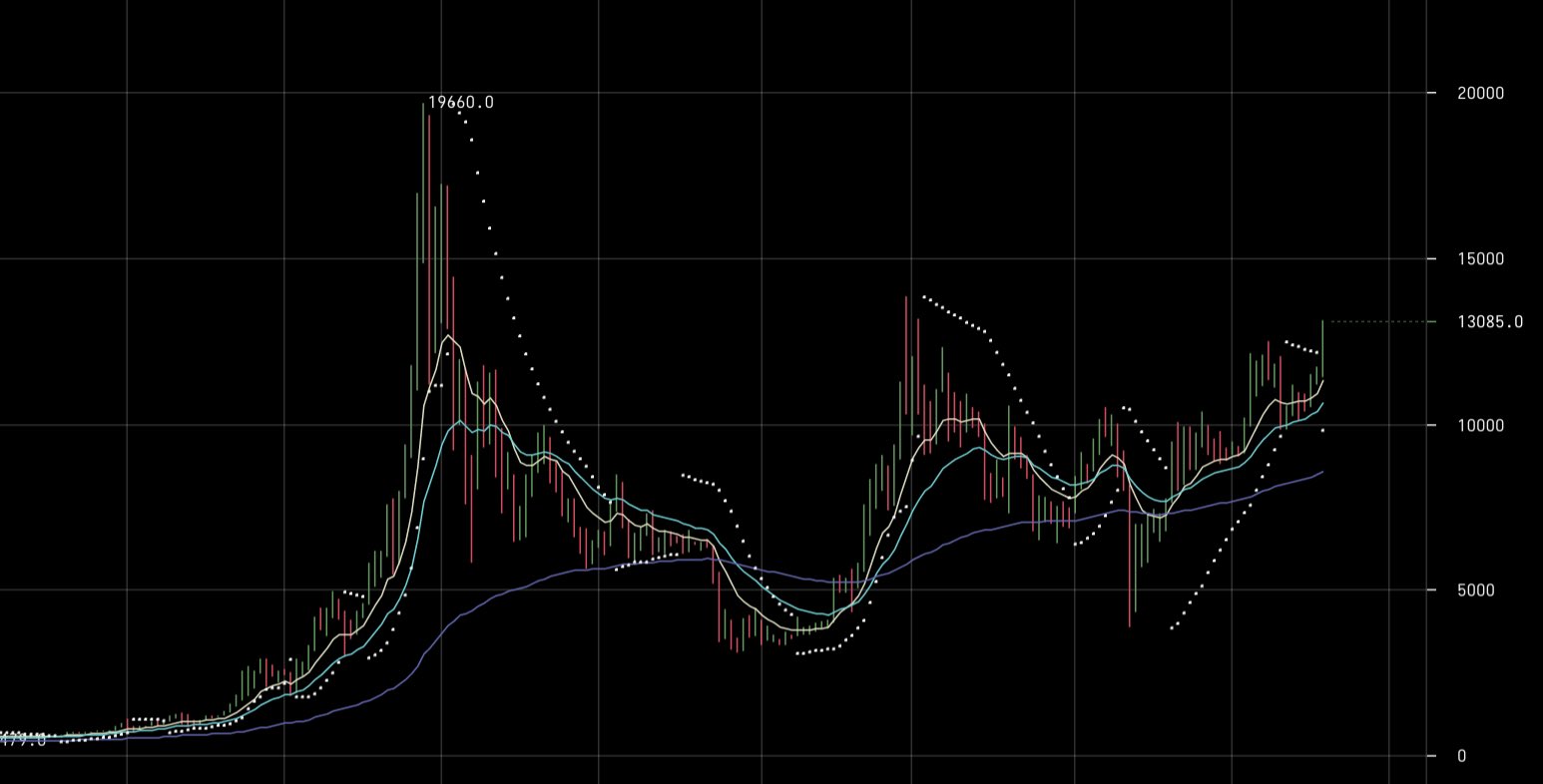

According to the analyst, gold and Bitcoin could be entering an accumulation phase. The next chart showed that the Bitcoin Miners Energy Ratio has made a strong rebound with lots of energy being pumped into the network, which is bullish.

Bitcoin Network HealthThe expansion of the difficulty ribbon after a period in compression also depicts strong network strength while the Bitcoin spent output price ratio, which is the on-chain net position of investors, is recovering.

The time period at the moment is still very short term, and the impact of the coronavirus outbreak is likely to last for the rest of this year.

With jobs being cut and businesses closing down, there will be less capital for investment into high-risk assets such as Bitcoin. Accumulation from institutions, however, is still possible, and this may drive any recovery post-halving.

Massive fiscal stimulus measures by central banks around the world are also bullish for finite assets such as Bitcoin as fiat is devalued further. Printing more money has never been a viable solution to economic woes caused by an epic debt bubble.

Bitcoin may have more pain ahead in the short term, but things still look good for those in it for the long run.

The post 2 Reasons Why Bitcoin May Still Be Considered Bullish appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|