2023-12-7 13:45 |

Traders remain intensely bullish on the price of Bitcoin ($BTC), causing the market to surge by an enormous 20% this week as it breaks $40,000 and reaches $44,000.

The bullish momentum is primarily attributed to the imminent Bitcoin spot ETF approval by the SEC, which Bloomberg analysts predict has a 90% chance of occurring before January 10th, 2024.

Meanwhile, a newly emerging ETF-derivative project is turning heads as it surges toward the $3 million milestone.

Bitcoin ETF Token ($BTCETF) is gaining momentum as it provides direct exposure to the monumental Bitcoin ETF approval event.

Traders Continue to Remain Strongly Bullish Ahead of SEC Bitcoin ETF ApprovalTraders are still bullish ahead of the imminent SEC Bitcoin spot ETF approval.

At the time of writing, there are just 34 days until the deadline for the SEC to approve the series of ETF proposals on the table, and Bloomberg analysts are predicting a 90% chance that one will be approved.

The SEC has been in discussions with many ETF applicants for months, including Grayscale, which recently updated its filing for its Bitcoin spot ETF.

The discussions have created a wave of optimism in the market as participants believe it hints at a possible approval.

Furthermore, with Binance becoming compliant with US financial regulators, many traders expect the SEC to lean further toward approval.

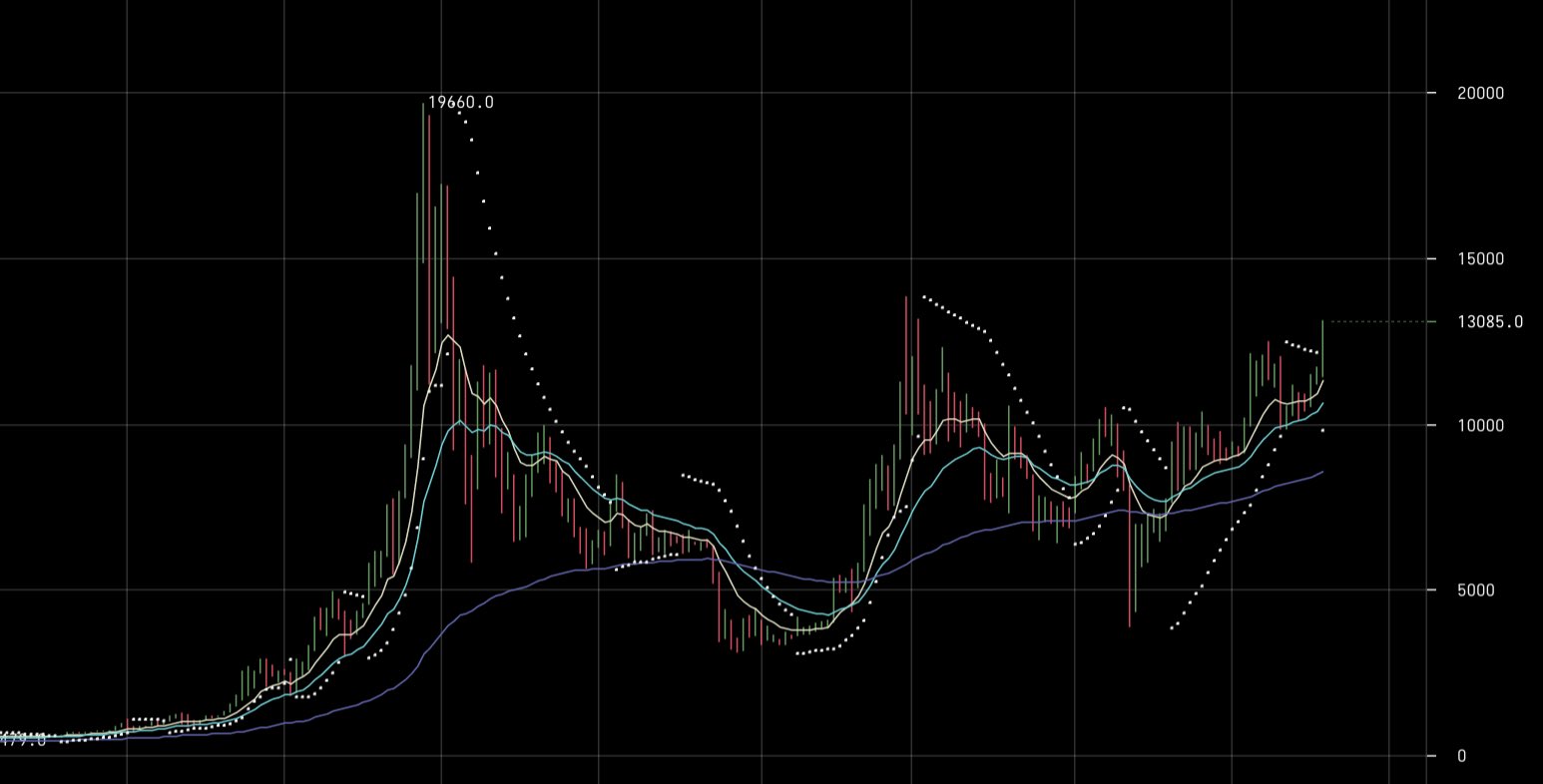

Where is the Resistance on the Way Toward $50,000?The market recently pushed higher above a short-term ascending price channel, allowing it to break resistance at $40,000 and reach as high as $44,000 today.

It is currently battling resistance at a 1.414 Fib Extension level. However, with the current momentum in the market, this resistance is likely to break in the coming hours;

Looking ahead, the first resistance above $44,000 lies at $44,750 – provided by the February 2022 support.

This is followed by added resistance at $46,740 (1.618 Fib Extension), $48,290 (2022 highs), and $50,000.

On the other side, the first support lies at $42,000 (Jan 2021 highs).

This is followed by support at $40,000, $37,200, $36,000, and $35,200.

What Other Tokens Are Traders Turning Their Attention To?As the SEC approval narrative drives markets higher, traders are looking for alternative vehicles besides Bitcoin to gain exposure to the event.

As a result, Bitcoin ETF ($BTCETF) token continues to turn heads as it provides direct exposure to the SEC approval event.

Bitcoin ETF token is an intuitive DeFi project with real-world predetermined milestones that link its supply to ETF approval.

Bitcoin ETF Token Surges Toward $3 Million as Investors Hunt for Direct ETF ExposureInvestors are rushing to the Bitcoin ETF ($BTCETF) token as it provides direct exposure to the SEC ETF approval event, allowing investors to profit from the event.

As a result, the presale has raised a whopping $3 million, demonstrating the building momentum behind the project.

Traders are particularly excited about the project’s future potential as its supply is directly linked to real-world milestones related to the Bitcoin spot ETF approval.

As a result, the token supply will shrink the closer the ETF gets to being approved, meaning the project’s success is directly linked to the arrival of the ETF on US financial markets.

The following chart breaks down all the predetermined milestones;

The audited smart contracts will burn 5% of the $BTCETF supply each time a milestone is reached, with a total of 25% of the supply set to be burnt.

Investors believe there will be a sudden surge in price each time a milestone is hit as the community celebrates individual achievements.

Furthermore, there’s also a short-term sales tax and a staking mechanism to incentivize long-term holding in the project.

Experts believe these mechanisms will create a supply shock on the open market, forcing newcomers to pay higher prices for $BTCETF following the presale.

$BTCETF can currently be purchased for $0.0064.

However, it’s important to note that there’s a rising pricing strategy, so those getting positioned earlier benefit from the lower entry prices.

Overall, as the momentum behind the Bitcoin Spot ETF approval grows, so does the hype behind the $BTCETF token.

This is one of the only projects available that provide direct exposure to the monumental approval event, allowing you to prepare your wallet to profit once the SEC approves the ETF.

Visit the Bitcoin ETF Presale

Disclaimer: We advise readers to do their own research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in cryptoassets is high-risk; consider the potential for loss. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Traders Bullish on Bitcoin as Imminent BTC ETF Approval Forces Steady Rise; Could This ETF-Derivative Project Also Pump? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|