2021-6-7 16:48 |

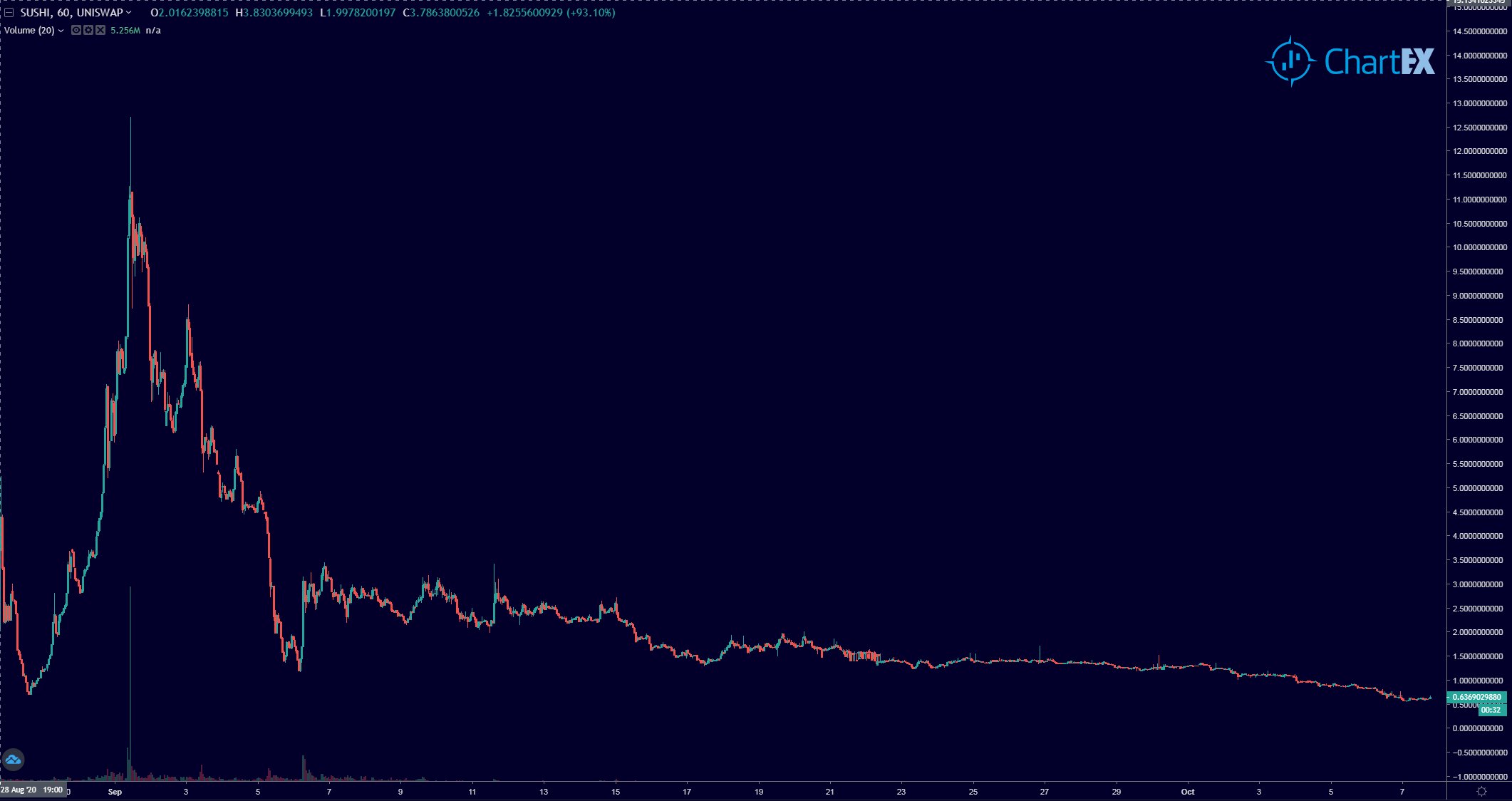

Just like the rest of the cryptocurrency market, the decentralized finance (DeFi) sector is weathering the woes of the deep correction it experienced last month.

The prices of the majority of DeFi tokens are primarily still down 40% to 75% from their all-time highs.

The total market cap of the sector is currently sitting at around $90 billion, down from May’s high of $145 billion, as per CoinGecko.

With prices of coins lower, leverage going down considerably, resulting in funding rates going negative and the highest being 0.01% as per Viewbase, the yield in the market has been on a downtrend.

CME Bitcoin futures basis has been compressing since April. Back in May, it was 5% annualized in the three months bucket. “The 3m basis trade was ~40% at the April peak ex-CME. Now single digit, sub 10%,” noted Degen Spartan. “Pretty much all rates since April have trended lower.”

One potential reason for the same could be more and more people using this arbitrage opportunity.

“As the futures basis inevitably compresses, we should see actors looking at other opportunities for yield enhancement, for instance leveraging options,” stated data provider Skew, which was recently acquired by Coinbase.

This has the interest rate in the DeFi market also falling substantially. As DegenSpartan further noted back in October, after DeFi summer ended, yields dropped much like the prices and continued lower in the following month as well. At the time, daily APY across different strategies went between 1.25% to 7.60%.

Stablecoin supply rates on Compound since early April have gone down from 6.8% to 2.8%; for DAI, it went from 8.57% to a mere 2.09% for USDC, and for USDT, it is now at 2.45% from 9.6% high two months back.

The demand for stablecoins was extremely high up until April, when the market was rallying hard, and people were borrowing them to go long aggressively. Now that the market is down, demand for borrowing stablecoin has gone down too, and so has the supply APY.

Also, the supply of stablecoins has risen by 41.5 billion in just the last two months, currently exceeding $105 billion in total supply. Not to mention, the regulatory crackdown from China is keeping things uncertain and users away from DeFi.

January 2021 CPI 1.5%

April 2021 CPI 4.7%

0.8% month on month

9.6% Annualized

Yield reached as low as 4% – 6%

We need capital exposed to multiple yield bearing sources to outperform the coming markets.@fcmartinelli @josephdelong we need to combine Bento and Balancer v2

— Andre Cronje (@AndreCronjeTech) June 7, 2021

Not just DeFi, even centralized lending solutions have cut down their interest rates dramatically. As we reported, BlockFi has reduced its rates twice in just the first four months of this year. BlockFi attributed the slashing to market conditions which show low demand to borrow the crypto assets.

Interestingly, despite the low activity on DeFi, notional loan volumes have been rising. As we reported, liquidity on Aave has already risen to its elevated levels. Outstanding debt on Aave is also already at almost its ATH at $5.7 billion, the same as DAI’s $4.81 billion. However, Compound has a long way to go at just $5.33 billion as its ATH was at $9 billion.

Interestingly, the top three projects in the DeFi sector are all lending protocols, with Aave dominating the space, accounting for 14.65% share, followed by Maker and Compound, as per DeFi Pulse.

The total value locked (TVL) in the sector is trending upwards, nearing $70 billion but still down from an $89 billion high on May 12.

The post Rates Fall Off a Cliff Suggesting Risk-Off Appetite, But Lending Protocols Leading DeFi first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|