2022-11-8 19:45 |

The Quant (QNT) price has possibly completed the correction that began on Oct. 17. If so, the next upward movement will take it towards $270.

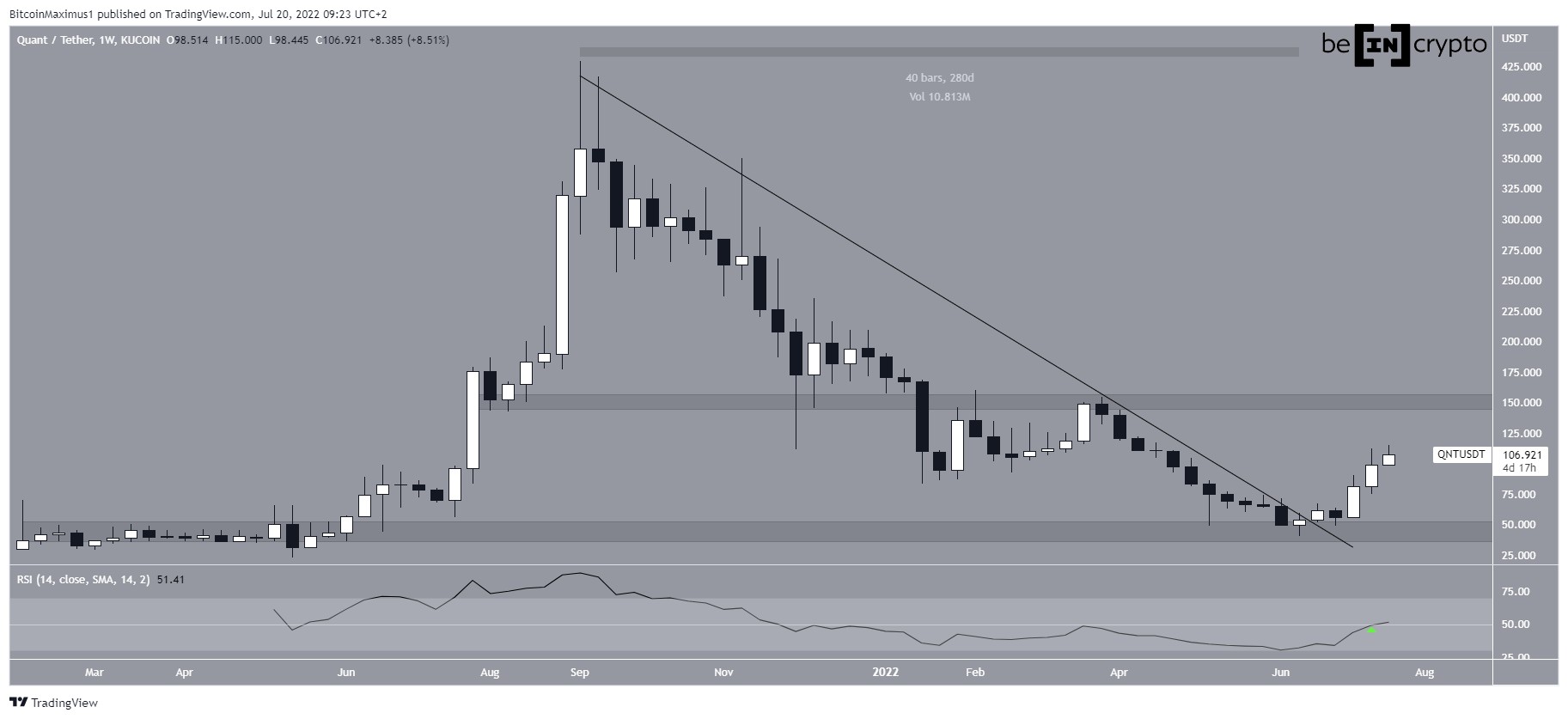

The technical analysis from the daily time frame shows that the QNT price began an upward movement on June 13. The increased led to a high of $228 on Oct. 17.

While the price action is not following any patterns, QNT broke out from the $150 area on Oct. 13 (green icon). It is now in the process of validating it as support. The $150 area is also very close to the 0.382 Fib retracement support level.

Furthermore, the daily RSI has reached its long-term bullish divergence trend line (green line). As a result, the current level is ideal for the initiation of a bounce. Therefore, the daily time frame gives a bullish Quant price prediction.

QNT/USDT Chart By TradingView QNT Price Prediction: Pullback is CompleteThe wave count for QNT is bullish, supporting an upward movement towards $270. Currently, the QNT price is completing a fourth wave pullback.

The current level is ideal for the completion of the correction.

Firstly, the QNT price is right in the middle of the channel (red circle) connecting the high of waves one and two. Secondly, the $151.20 bottom was reached in exactly half the time (white lines) it took for wave three to complete.

As a result, it is possible that the Quant price will now begin wave five. The most likely target for the future price is between $269-$275. The target is found using the 0.618 length of waves one and three (red) and the 1.61 external Fib retracement of wave four (black).

A decrease below the wave one high of $133 (red line) would invalidate this particular wave count and bullish Quant price prediction.

QNT/USDT Chart By TradingViewFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

The post Quant (QNT) Price Prediction: Bull Run Right Around the Corner? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Quant (QNT) на Currencies.ru

|

|