2022-11-21 18:00 |

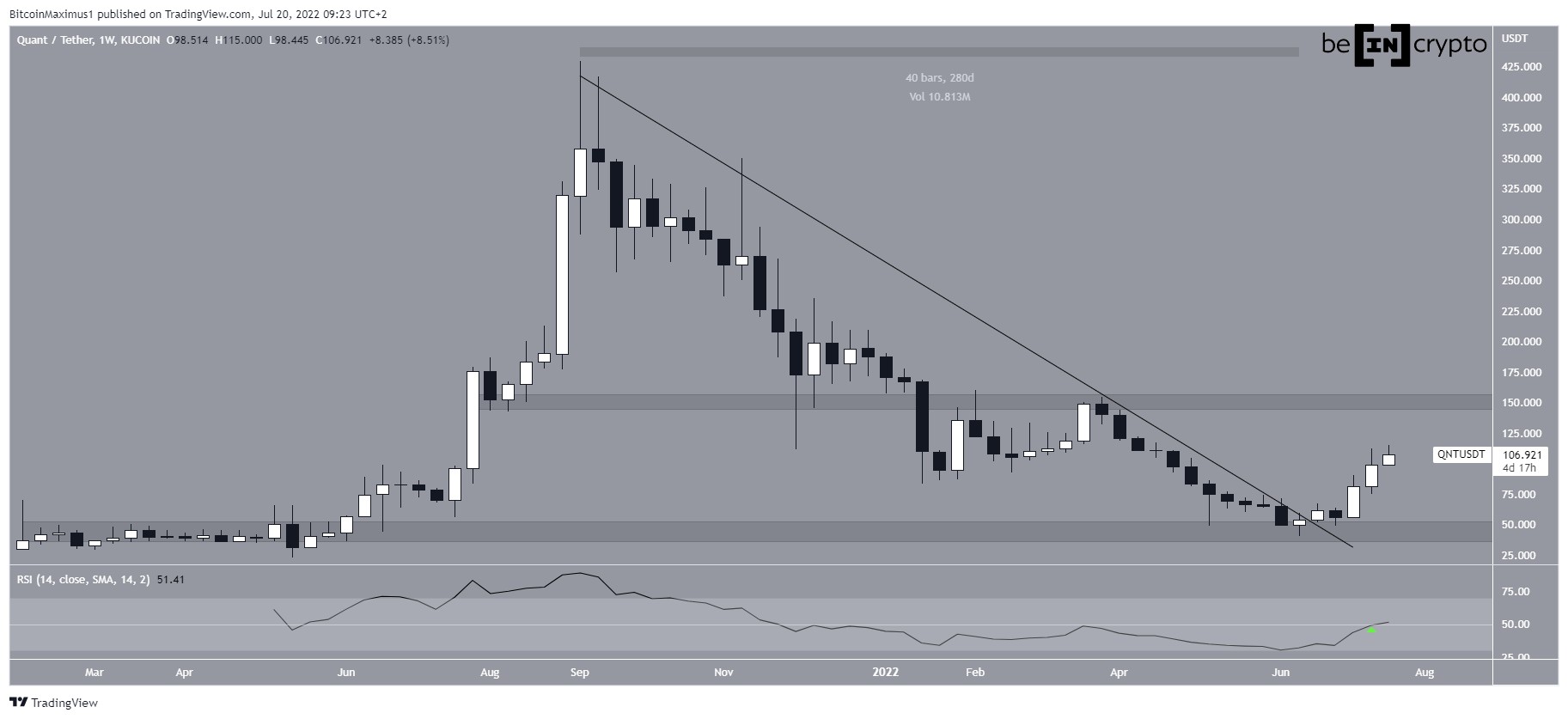

The Quant (QNT) price broke down from an ascending and horizontal support level. The trend is considered bearish until these levels are reclaimed.

The technical analysis for the daily time frame shows that the QNT price has broken down from an ascending support line. This is a bearish sign for the future price.

After breaking down, QNT validated the line and the $130 area as resistance (red icon). Over the past 24 hours, the QNT price has unsuccessfully tried to reclaim the 0.618 Fib retracement support level at $113.

If the drop resumes, the next closest support area would be at $82.

QNT/USDT Chart By TradingView Quant Price Prediction: Outline For Future MovementThere are two potential wave counts for the direction of the future movement.

The bullish count suggests the increase after July 15 is a new bullish impulse. Afterward, the QNT price completed wave A of an A-B-C corrective structure. So, it will complete wave B towards $160-$170 before falling again.

QNT/USDT Chart By TradingViewThe bearish count suggests that the QNT price has instead begun a bearish impulse. In this count, the preceding increase was corrective, and the price will now fall to new lows.

However, even this count suggests that an increase toward $161 will occur before the resumption of the long-term decrease. This is also supported by the bullish divergence in the daily RSI (green line).

QNT/USDT Chart By TradingViewTherefore, a relief rally is supported by both counts and the RSI. Once the QNT price reaches resistance, the reaction will likely determine the correct one.

The bearish count would be more likely if the QNT price fails to reach $161. However, if it increases to $177, the bullish count would become more likely. Due to the daily breakdown, the bearish Quant price prediction remains more likely.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

The post Quant (QNT) Price Has Not Finished Dumping – at Least Not According to This Count appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Quant (QNT) на Currencies.ru

|

|