2024-12-6 01:00 |

John Deaton, the attorney representing over 75,000 XRP holders in the Ripple vs. SEC lawsuit, has voiced strong opinions regarding President-elect Donald Trump’s nomination of Paul Atkins as the new Chair of the US Securities and Exchange Commission (SEC). Deaton took to X to outline four critical actions he believes Atkins must undertake immediately upon assuming office.

If Paul Atkins doesn’t fire, or at least demote, certain individuals and completely dismantle – that is, do away with – the crypto unit, he’s not the right pick. Period!” Deaton declared.

Pro-XRP Lawyer Deaton’s Four Must-Do Actions For AtkinsFirst, Deaton insists that those responsible for the mismanagement of the Debt Box case should be removed from their positions to restore credibility and accountability within the SEC. “Fire all individuals involved in the Debt Box fiasco,” he writes.

Second, the lawyer urges Atkins to “fire and/or demote individuals currently appointed by Gensler in leadership roles.” Deaton emphasizes that Atkins should not retain personnel selected by “a bad faith regulator like Gary Gensler,” advocating for a new team that aligns with Atkins’ vision and, by extension, “Donald Trump’s vision of the Crypto Capital of the World.”

Third, Deaton calls for Atkins to “make clear that DeFi and self-custody do NOT fall within the SEC’s jurisdiction,” aiming to limit regulatory overreach and foster innovation in decentralized finance.

Fourth, he believes that the specialized crypto unit within the SEC is unnecessary and should be dissolved. “Have a general fraud unit that goes after all types of fraud cases,” Deaton suggests, promoting a more integrated approach to enforcement.

Deaton’s post came as a response to John Reed Stark, President of John Reed Stark Consulting LLC and former Chief of the SEC’s Office of Internet Enforcement. Stark highlighted that outgoing SEC Chair Gary Gensler has been “quietly working behind the scenes to lead the SEC from the grave.” He noted that Gensler recently promoted three prominent crypto-enforcement lawyers to senior executive positions within the SEC, specifically in the Trial Unit and the Crypto Unit.

“Interestingly, the SEC has not publicly announced these promotions and seems to be keeping them quiet (which is unprecedented). But these well-deserved promotions are a done deal,” Stark revealed. He warned that Atkins should prepare for significant challenges: “Get ready for World War III on day one, Chair Atkins, because these three crypto-enforcement lawyers, who are now in charge, are some of the best in the business and will not roll over easily.”

Stark concluded with a caution to the crypto industry: “Fail not at your peril, Big Crypto, because the SEC has not quite given up yet.”

Notably, the appointment of Paul Atkins, a former SEC commissioner known for his favorable stance towards the crypto industry, has been met with optimism by many in the digital asset space. His nomination signals a potential shift away from the enforcement approach. As reported earlier, Trump announced on Wednesday that he will nominate former SEC commissioner Paul Atkins to be chairman of the agency.

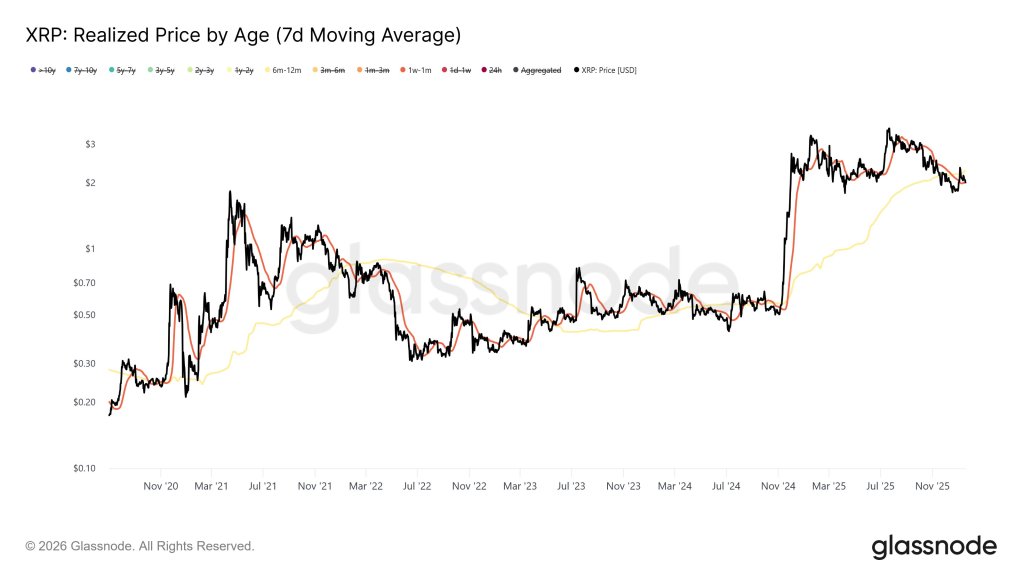

At press time, XRP traded at $2.37.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|