2020-7-9 05:48 |

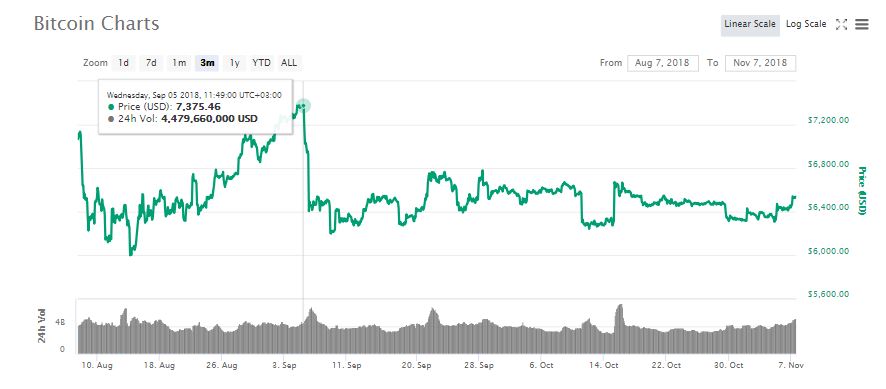

The Chairman of Commodity Futures Trading Commission (CFTC), Heath Tarbert, has said that they are waiting for SEC clearance on more digital assets to scale up crypto futures trading in the U.S market. At the moment, only Bitcoin and Ether have been cleared as commodities, hence the upcoming derivative instruments based on these two leading cryptocurrencies.

Speaking in an interview on July 7 with his predecessor, Jim Newsome, the current CFTC Chair noted that they could only proceed with the blessings of the SEC, which acts as a big brother.

“The determination of whether a digital asset is a security is the sole province of the SEC … If they determine that it's not security, then we can start taking it under our purview,” said Tarbert.

He went on to note that once there is more clarity on whether it is an asset is a security, more futures listings based on digital assets will start to pop up within the U.S market.

“Once you start seeing more clarity on whether something is or is not a security, you will start seeing more futures listed on digital assets.”

Tarbert has since advocated for an expansion of the commodity list, arising from crypto assets to cover more crypto futures in the derivative market. However, this remains an open question, given a skeptical approach by the SEC towards accommodating digital assets in the financial ecosystem.

U.S Ahead in Tech but Lacks in RegulationWhen asked whether the U.S is at the forefront in blockchain and crypto tech, Tarbert said that he is convinced of a technological lead but not sure if the current regulatory frameworks are on par with peer competition

“I don't think I can say that we're a leader from a regulatory standpoint. I do think we're a leader from a technological standpoint.”

He was also keen to highlight the criticality in making laws for digital assets. This is because such instruments are easily transferrable; hence crossing borders is a matter of a few clicks.

While this is the case, there seems to be no coordinated approach towards regulating cryptocurrencies despite their global nature. Tarbert, therefore, emphasized that a cooperative effort would yield better fruits for the growing industry.

“Regulators and governors care about borders, but technology doesn't. So really, for this field to reach its full potential, we need international cooperation.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|