2018-11-7 14:24 |

From the onset of this article, I would like to let the reader know that I am not a Technical Analysis expert. Any further opinion in this piece is based purely on fundamentals and observations. Therefore, looking at the performance of BTC since the expiration of last month’s CME Bitcoin Futures contracts on the 26th of October, we can easily tell that it has a price momentum of moving past the $6,600 level experienced by some traders only a few hours ago.

Effect of BTC FuturesTraditionally, whenever Bitcoin futures contracts offered by either CME or CBOE expire, we experience a decline in value of not only BTC, but the entire spectrum of cryptocurrencies. However, something unique happened in the month of October. Bitcoin managed to maintain levels above $6,400 leading up to the expiring Futures contracts on the 26th.

Many savvy traders had anticipated that BTC would show some excitement soon after the expiration, and probably go up in value by a few hundred dollars.

Pending SEC Decision on 9 Bitcoin ETFsBut the price of Bitcoin had one more hurdle to overcome. It still does. This hurdle is in the form of a pending announcement from the SEC regarding 9 Bitcoin ETF applications that were reviewed after being rejected. November 5th was the deadline for the submission of any public statements in relation to the ETF proposals by Direxion (5), GraniteShares (2) and ProShares (2). This in turn means that the Commission can announce their decision at any time after the 5th of November.

US Mid Term Elections FactorAlso to note is that the citizens of the United States, are in the midst of a highly contested mid-term election. This election has managed to excite the voter base of Democrats, Republicans and Independents. This in turn means that a decision by the SEC, might come after the dust has settled from the elections. It is assumed that they too, were voting for their politicians of choice and took some time off from work.

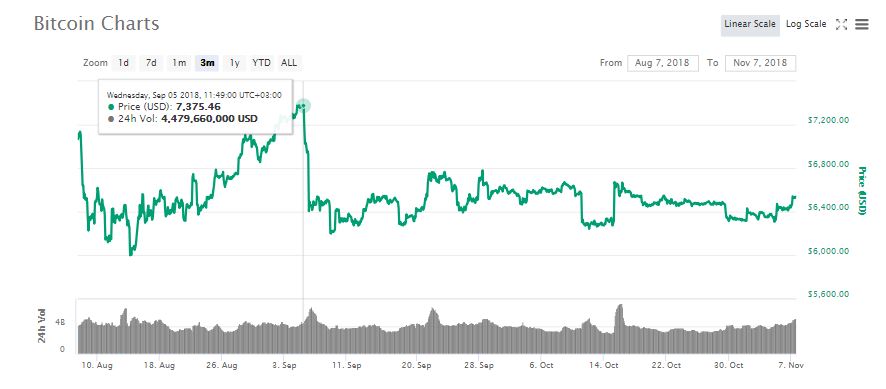

$7,200 Bitcoin PriceWith regards to the $7,200 value provided in the title, it is not a random number. This value has been attained by looking at the value of Bitcoin right before the fake news that Goldman Sachs had shelved plans of opening a Bitcoin and Crypto trading desk. The fake news broke around the 5th of September when BTC was trading comfortably at around $7,300. Since then, the crypto market is yet to recover from this event.

In conclusion, an SEC announcement is therefore what can catalyze a full recovery by BTC to levels seen before the Goldman Sachs fake news. This is given the fact that many traders have accepted that the SEC announcement is probably a rejection.

However, hey simply do not know what the market reaction will be from such an announcement. They do not want to risk their funds just yet. Once the announcement is made, the market reaction will be known and traders can get back to business as usual as they anticipate the launch of Bakkt on the 12th of December.

What are your thoughts on the current price action of BTC? Do you think it can go higher? Please let us know in the comment section below.

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.

The post Why An SEC Announcement Is What Stands Between Bitcoin (BTC) and a $7,200 Price Value appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|