2020-5-7 21:57 |

In these distressing times, there’s no knowing what’s going to happen, but Dan Morehead, CEO of Pantera Capital, “strongly” believes it's almost inevitable that this will be “positive for cryptocurrency prices.”

This is because as Quantitative Easing approaches “infinity,” it has to have an impact on things whose quantity can’t be eased.

Founded in 2013, Pantera Capital was the first investment firm in the US to launch a digital currency, with a minimum investment of $100,000.

It’s just getting startedThe government policy to increase the quantity of paper money has them, in turn, using that money to buy things like stocks and real estate that have fixed quantities. And it has already started bearing fruit as S&P 500 jumped over 17% in April which wouldn't have been possible without trillions of new dollars, said Morehead.

This flood of new money according to him will float all boats, inflate the price of other fixed-quantity assets like gold, bitcoin, and other cryptos as well.

As we saw, Bitcoin ended April with 34% gains and is currently up over 23% YTD.

Pantera Capital’s principal argument for bitcoin in a portfolio is that it has had a 209% 9-year compound annual growth rate with zero long-term correlation to stocks, bonds, oil, or any other asset class.

But it is only the beginning for cryptos because for starters this recession won't’ be V-shaped, said Morehead.

Looking back at the 2008 recession when the US real GDP fell by 4.3% and didn’t recover until three years, this recession is likely to resemble an L as well.

He further noted how most American families’ finances have been seriously damaged, small businesses are permanently closing and the economy has to recover in steps.

And the coronavirus that is both psychological shock and a physical constraint on economic activity will be difficult to counter-act with the standard economic policy tools.

Impact on cryptoDuring the last quarter, the Fed cut down the rates to zero percent which has been named “the lost decade” by Japan which invented Zero Interest Rate Policy (ZIRP) about 25 years ago.

When it comes to fiscal policy, it has been very “inefficient.” As per JP Morgan’s forecast, the US deficit is 19.5% of GDP, larger than the deficit during the Great Depression.

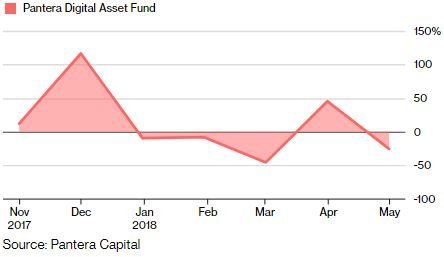

Meanwhile, as Pantera Capital had predicted in March, cryptos outperformed ventures, which are being bought at a discount of 20 to 36%.

Bitcoin’s correlation that reached its all-time high last month has begun to trade independently and is further expected to “drop off now.”

In the crypto market as well, bitcoin’s dominance climbed up to 66.40% from 64.60% in mid-march which is also expected to continue to gain but not as much.

But with the markets no longer range-bound, “long-biased strategies are now best,” projects Pantera Capital.

Post-Bitcoin Halving RallyThe government policies have also been bullish for the traditional haven asset. But Bitcoin still outperformed this safe-haven asset which is up only 13% YTD.

Interestingly, Bitcoin is preparing for this block reward halving in about five days. It is 100% QE proof with its fixed and known money supply and goes through halvings every four years which cuts the reward in half.

Although the past doesn’t predict the future — halvings have coincided with increases in price due to a perceived and/or real scarcity of supply.

According to Pantera Capital, it’s reasonable that the cut down in bitcoin’s new supply, ceteris paribus, “the price should rise.”

Historically, bitcoin has bottomed 459 days before the halving only to climb leading into it and then exploding to the upside afterward.

This time, the market took 514 days before the halving and if history were to repeat itself, bitcoin would peak in August 2021.

But each halving’s impact on price is tapering off. The second halving decreased supply only one-third as much as the first one had exactly one-third the price impact.

If this relationship holds, there would be 40% as much price impulse, as the reduction is only 40% as much as in 2016, meaning “bitcoin would peak at $115,212 /BTC.”

A ludicrous number today but back when Pantera Bitcoin Fund was first launched at $65 per BTC, their $5,000 prediction was just as ludicrous.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,239.1044 change ~ 3.37%Coin Market Cap

$169.68 Billion24 Hour Volume

$10.92 Billion24 Hour VWAP

$9.15 K24 Hour Change

$311.3187 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Ceocoin (CEO) на Currencies.ru

|

|