2018-10-28 04:02 |

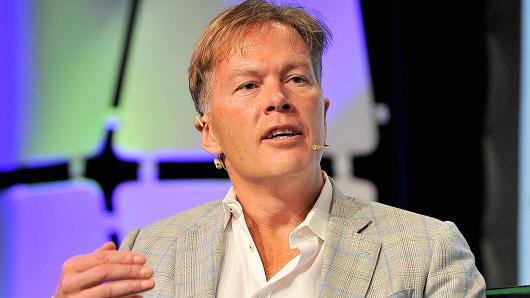

The CEO of Pantera Capital, Dan Morehead, discussed the current state of the Bitcoin (BTC) market and other patterns in the cryptocurrency industry. In a discussion with CryptoTrader Ran NeuNer, Morehead mentioned that this October seems very different from the last, where Bitcoin started to rise in value and to overcome the $19,000 barrier.

Morehead mentioned that the world of Bitcoin and other cryptocurrencies is a concept that has spanned decades, but one of the most important factors now is to look to the future.

He added that investors should venture in the market with a multi-year approach and to not expect immediate gains. NeuNer asked Morehead whether the current doubt on the cryptocurrency market is due to the number of people losing money in the space.

Interestingly enough, Morehead was confident that the market patterns occurring now are not new, but have been seen before, but to varying degrees of changes. He also pointed out that the Bitcoin market was more “manic than other industries.” In his words,

The people in the Bitcoin space as well as the overall cryptocurrency space need to realize the concept of buying low and selling high. We have calculated the percentage of inflows and spikes and have realized that the investors just need to observe the market calmly and not experience FUD.

Morehead continued that the market is a buy one, get two sale because of the price drop. His position was met with amusement. Morehead seems to believe that investor sentiment is controlled by the FOMO devil that forges a lot of people to get into the industry when the prices are too high.

He also discussed the benefits of utility tokens, stating that they are “one of the most powerful financial tools ever.” He also expressed option that Bitcoin has many utilities and the value of cryptocurrency depends on the use cases investors find in it. He was also hopeful that in the next couple of years, people involved in the space will grow to 500 million.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|