2021-8-3 16:48 |

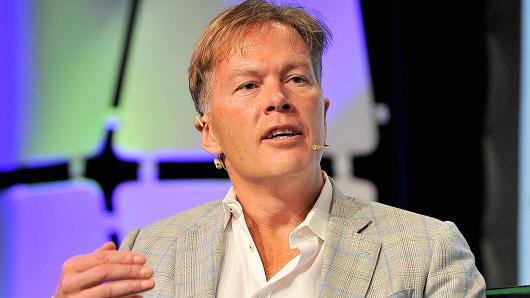

Bitcoin is certainly poised for more pumps and dumps soon, but could close the year between $80,000 and $90,000 and then spiral its way above $120,000 a year later. This is according to a recent prediction by Dan Morehead, the CEO at Pantera Capital in yesterday’s interview with Reuters.

According to Morehead, Bitcoin will recover from its recent 40% decline since the April all-time high of $64,895. This is despite Ethereum becoming a huge competitor for BTC given the platform’s popularity with DeFi projects.

BTCUSD Chart by TradingViewThe prediction by Panthera CEO comes even as the cryptocurrency dipped below $40,000 to stall a now week-long short pump that, however, seems not yet over. The price is now down 3.14% up in the last seven days. However, the price is most likely to retract to a lower value of $36,000 before progressing with the pump, according to a GlobalBlock trader.

There is no doubt that Bitcoin will gather more value naturally as time goes given that it will become scarcer. For that reason, companies like MicroStrategy and Andreessen Horowitz have announced 10-year plans regarding cryptocurrency. According to the Panthera CEO, among other things that will propel this recovery is the obvious increased mainstream adoption by institutional investors. He says this could push the value to $700,000 in the next decade.

Currently, a good number of analysts also expect BTC price to continue pumping for at least in the medium short term given that the accumulation trend is still strong among institutional investors. In fact, last week, data from Glassnode revealed there was a massive outflow of Bitcoin from cryptocurrency exchanges as accumulation seems a sure trend. The amount held decreased by 70,328 BTC. Most of these large volumes tend to find their way to institutional investors’ hands. The crypto exchanges are now holding the lowest number of Bitcoins since November 2020 when Bitcoin registered a massive pump to a historic $20,000 valuation. The decrease in exchange volume may signify a crucial return of demand that could push the price higher.

“This week we have seen an extremely large volume of coins flow out of exchanges, comparable to the peak outflows seen in November 2020. The rate hit over 100k BTC per month in outflows this week,” wrote Glassnode analysts in their latest on-chain review.

Bitcoin is never short of positive outlooks. Billionaire Tim Draper has also tagged a price of $250,000 on Bitcoin by end of 2022. He believes the price tag will be attained given that Bitcoin’s supply will become increasingly limited as time goes.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ceocoin (CEO) íà Currencies.ru

|

|