2021-9-9 23:59 |

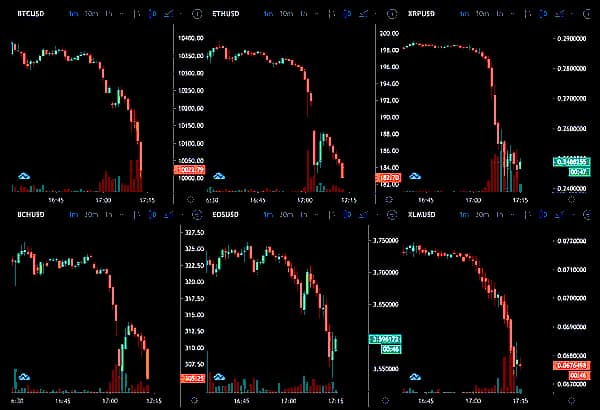

The Bitcoin sell-off that recently caused the price of the big bull to slump saw Bitcoin lose over $4 billion in open interest. On-chain analytics platform Glassnode has branded the event as “the most significant leverage flush out since the sell-off in mid-May.”

Bitcoin loses stamina; did the dreaded September bear storm surface?Although analysts are tracing the selloff triggers back to two fundamental factors, the event still, unfortunately, reinforces the sentiments shared by analysts about September typically being a bearish month for Bitcoin.

After Bitcoin teased $50,000 a few times last month and this September, the bulls managed to break out to $50,000. What followed was an upsurge to $52,800 shortly after. Technical analysts were already calling $54,000 as a crucial price point for the asset, adding that $60,000 could be attainable once the resistance is broken.

However, on Tuesday, the market took a hit and Bitcoin lost over 10% of its value in a space of 24 hours as prices settled at $43,900.

Market players are currently analyzing the state of events as they are torn between bullish and bearish sentiments.

On-chain data indicates strong hands are still not giving into selling pressureThe cause of the selloff, as many proponents have pointed out, could be the result of market manipulation ahead of El Salvador’s recent Bitcoin legalization move, or the heightened profit-taking trend that investors adopted ever since Bitcoin began its recovery in July, and secured 50% in gains since then.

Whichever the case may be, on-chain data is still highlighting a more bullish turn for the market in the long term. This week’s on-chain analysis from Glassnode affirms that Bitcoin bulls are still in control of the market. Holders’ conviction to not sell is still very high, as coins being spent at the moment are highly liquid and old coins. Additionally, the volume of revived supply older than 1yr has dropped below 5k BTC per day, which means that investors who own coins older than 1yr are spending less. Conclusively, data mirrors down a string and optimistic market for Bitcoin at this time.

“As renewed optimism follows positive price action, on-chain transaction volumes are showing continued growth in dominance by large, institutional sized capital. We are also seeing declines in volume spent by long-term investors, A preference to HODL, and the accumulation of young coins. Miners have also started spending coins this week as hash-rate recovers over 42% since the July lows.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|