2020-11-26 13:45 |

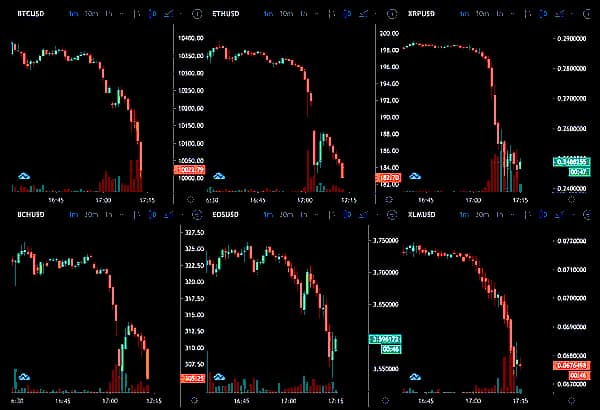

The price of the number one cryptocurrency today plunged over $3,000 within hours. After nearly hitting $19,500, bitcoin saw a sharp sell-off to $16,315. This is the worst single-day decline since “Black Thursday” and represents a fall of 11.32% over 24 hours. Other cryptocurrencies posted similar drops with ethereum down 15.79% and XRP down 24.50% on the day.

Bitcoin’s sudden retracement comes after a stellar rally over the past few weeks as the cryptocurrency knocked on the door of its December 2017 all-time high. Let’s explore three key reasons why the king of cryptos hit a roadblock as the U.S gets ready for Thanksgiving.

#1: Rumors Of Tighter Regulations By The Trump AdministrationBitcoin plummeted right after, Brian Armstrong, the CEO of Coinbase crypto exchange expressed his concerns about the outgoing US Treasury Secretary Steven Mnuchin “rushing out” draconian rules on non-custodial cryptocurrency wallets.

Non-custodial crypto wallets are one of the basic tenets of cryptocurrencies in that they allow users to use the new technology to access financial services without relying on a third-party financial institution.

According to Armstrong, the proposed rule will “require financial institutions like Coinbase to verify the recipient/owner of the self-hosted wallet, collecting identifying information on that party, before a withdrawal could be sent to that self-hosted wallet.”

Last week we heard rumors that the U.S. Treasury and Secretary Mnuchin were planning to rush out some new regulation regarding self-hosted crypto wallets before the end of his term. I'm concerned that this would have unintended side effects, and wanted to share those concerns.

— Brian Armstrong (@brian_armstrong) November 25, 2020Armstrong noted that such a crypto regulation “would be a terrible legacy and have long-standing negative impacts for the U.S.”

#2: BTC Whales Rush To ExchangesBitcoin has been one of the best-performing assets in 2020. Besides going through an impressive uptrend, the pioneer cryptocurrency has also seen rising interest among institutional and retail investors.

As bitcoin climbed past $19,000, it seems that whales made significant deposits to exchanges so as to take some profits. The whale deposits into exchanges coincided with the sharp drop in bitcoin prices, as observed by CryptoQuant CEO Kim Young Ju.

He said:

“All Exchanges Inflow Mean increased a few hours ago. It indicates that whales, relatively speaking, deposited $BTC to exchanges.”

Nonetheless, he believes the bulls will win and bitcoin could even breach $20,000 in a few days’ time.

#3: The Recent Rally Was Due For A PullbackMany pundits had predicted that the recent gains were due for a correction. Additionally, several metrics were hinting at an imminent tumble. Among them is the social perception which has been going berserk.

Santiment’s data shows that the number of BTC mentions on multiple social media platforms recently crossed the $1.2 billion mark. “Regardless, the crowd is still quite positive currently, and we consider this to be confidently bearish territory based on history,” Santiment said.

In other words, bitcoin tends to pull back when social volumes are high.

It is worth mentioning that some analysts are not expecting a drop below $16,000 during this bloodbath and this is actually a necessary consolidation before the cryptocurrency breaks $20,000.

This sell off was expected. Shouldn’t drop below $16,000 and so you can expect some healthy sideways trading for the coming weeks. $20k requires a lot of consolidation to get enough momentum to maintain a break above. https://t.co/9DuMyZTl27

— Vinny Lingham (@VinnyLingham) November 26, 2020 origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|