2023-10-9 12:22 |

The global crypto market currently has a capitalization of just over $1.08 trillion. It’s a fairly simple figure that’s based on the accumulated value of all digital tokens, but it doesn’t even begin to describe the value of the technological concepts that crypto has given birth to.

The value of innovation in areas such as decentralized finance (DeFi), stablecoins, non-fungible tokens (NFTs) and real-world assets (RWAs) is much harder to quantify, but it’s clear enough that they promise to deliver many tangible benefits to people’s lives.

DeFi, for instance, promises to create a new, more equitable and accessible financial system that will benefit everyone equally, rather than the so-called elite who manipulate the traditional financial system to amass even greater wealth at the expense of the rest of us. NFTs are wonderfully innovative things that can enable digital asset ownership and new business models, while RWAs, which use NFTs, promise to increase liquidity in traditionally illiquid asset classes, and make them available to even the smallest of investors.

A Nascent WorldThese wonderful crypto innovations are still nascent and are yet to live up to their promises. While crypto has been around since 2009 when Bitcoin was first engineered by Satoshi Nakamoto, the above concepts are much newer.

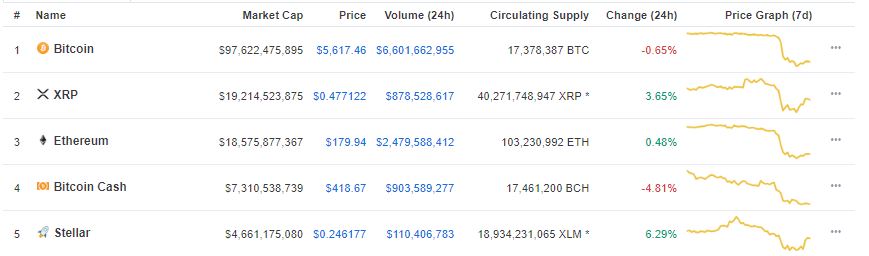

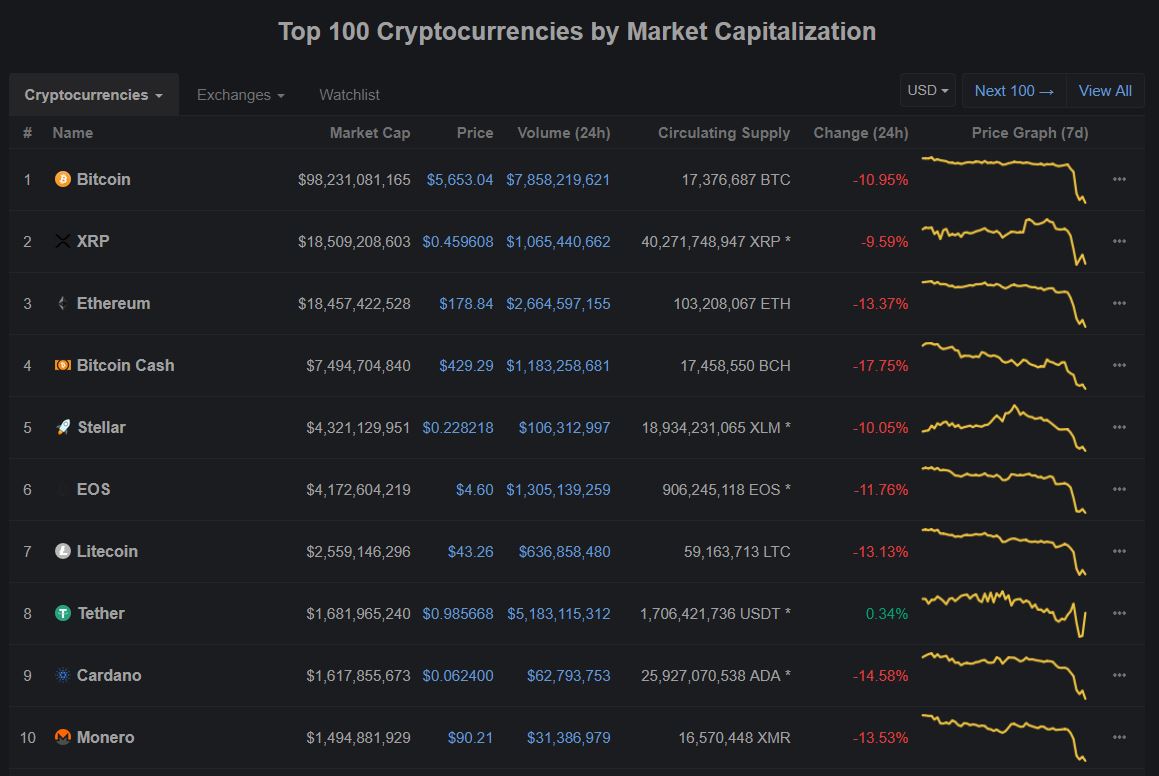

The newness of the crypto economy is plain to see by the growing pains it has experienced. In the last decade there have been numerous ups and downs characterized by incredible bull runs and unparalleled excitement, followed by soul-crushing bear markets that brought agony to thousands of investors across the world.

Crypto’s path to maturity mirrors the one taken by traditional finance, in many ways. Today’s banking institutions and the numerous regulations and compliance rules that bring oversight to the industry took decades to establish themselves and achieve the level of trust that consumers afford today. Crypto, on the other hand, is still taking its first baby steps, with even the best known decentralized protocols barely more than a few years old.

Just as the 2008 financial crisis helped to clean up the traditional financial world, it’s true that the ongoing market forces disrupting crypto today – which present themselves in the shape of hacks, scams and bankruptcies – serve a useful purpose. They are helping to weed out the industry’s insecurities and fragile actors, and remove excesses, paving the way for a more robust ecosystem.

The innovations we’ve seen in blockchain and crypto have already resulted in substantial growth, and yet they have a long way to go before they become mainstream. The distinctive features of the crypto economy, namely self-sovereignty, decentralization and transparency, are not yet fully understood. Yet, they continue to discover new market opportunities, helping crypto to overcome its constant setbacks.

For instance, concepts such as peer-to-peer transactions and tokenization can provide obvious benefits to the world, and they can only be implemented within the world of crypto. Technological innovation typically goes through cycles, and just as the Dot.Com crash failed to kill the internet, the disasters that befall crypto will not stop it from fulfilling its destiny.

Ongoing EvolutionKey to the success of the crypto industry is the ongoing research and experimentation being undertaken by its main participants, and it’s down to them to see it through.

Already we can see the game-changing benefits crypto will bring to the world. Crypto-based lending protocols can utilize RWAs, enabling anyone to borrow funds by using their existing, real-world assets as collateral. Crypto also brings new passive income opportunities with its unique concepts around loans via liquidity pools and staking to verify transactions. Blockchain gaming leverages NFTs to enable players to earn rewards for their progress in video games, while others, such as artists, can use the technology to ensure they’ll always receive royalties from any future sale of their work.

For now, the crypto industry stands at a crucible moment. It’s facing major challenges around security, confidence and trust as a result of the never-ending hacks and the collapse of major exchange platforms like FTX. It’s down to those who participate in the crypto industry to overcome these challenges and reassure the world that the benefits outweigh the negatives.

To build a more prosperous future, crypto platforms have a moral and pragmatic duty to contribute to the ongoing research of the crypto industry. Thankfully, the industry is acutely aware of this responsibility, and representatives from the biggest exchange platforms to the smallest DeFi protocols are all contributing towards it.

Binance Research is a fantastic example of a crypto organization fulfilling this duty. With its research arm, Binance strives to provide in-depth information and studies on hundreds of different cryptocurrencies and their purpose, while its affiliated educational arm provides lessons to everyone from beginners to crypto experts. The main goal is to increase transparency and the accuracy of information in the crypto industry, and it’s doing an excellent job of achieving that.

In the area of DeFi, the leading decentralized exchange Uniswap is leading the way with its advanced research into concepts around the competitiveness of liquidity pools, and the ways DeFi can improve the foreign exchange markets.

A similar effort is being made by Kunji Finance, which is a unique protocol that aims to bring hedge fund-like asset management to the masses. Its research department has a wide area of focus, studying the potential dangers of the recent Curve Finance exploit to participants in that platform and providing regular analysis on the dynamics of crypto price movements.

Just as important is the role of more focused research organizations, such as Messari. Its research plays a pivotal role in helping businesses, institutional investors, crypto builders and compliance teams to understand the latest technology innovations, and the opportunities and risks that reside within the wider crypto economy.

Everyone Must ContributeAs the crypto economy evolves, we’ll see yet more innovative products and services emerge to disrupt the existing financial markets. At the same time, many of the leading players have shown an awareness of the importance of research, helping the industry to better understand the dynamics at play and implement superior risk mitigation strategies to protect users and investors.

The ongoing crypto community research is critical to the industry’s growth. If Crypto wants to fulfill its great aspiration of creating a fairer and more inclusive world that serves billions of users, everyone involved needs to pull their weight. This is well understood, and as the crypto economy continues to grow, so too will the combined efforts of the community to understand exactly how it can fit into the modern world.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|