2022-8-24 22:10 |

Bitcoin trades around $21,500, about 2.5% up in the past 24 hours. Staying below the realized price of $21,700 or if bulls fail to hold above in case of a breakout will result in further accumulation. BTC fell to lows of $20,700 after a swift rejection above $25,000 last week.

Bitcoin has moved above $21,500 on Tuesday, seeing some upside after hitting intraday lows of $20,700 on Monday.

However, despite the uptick, the cryptocurrency remains vulnerable to a downside flip with BTC/USD currently snuggled below the Realized Price.

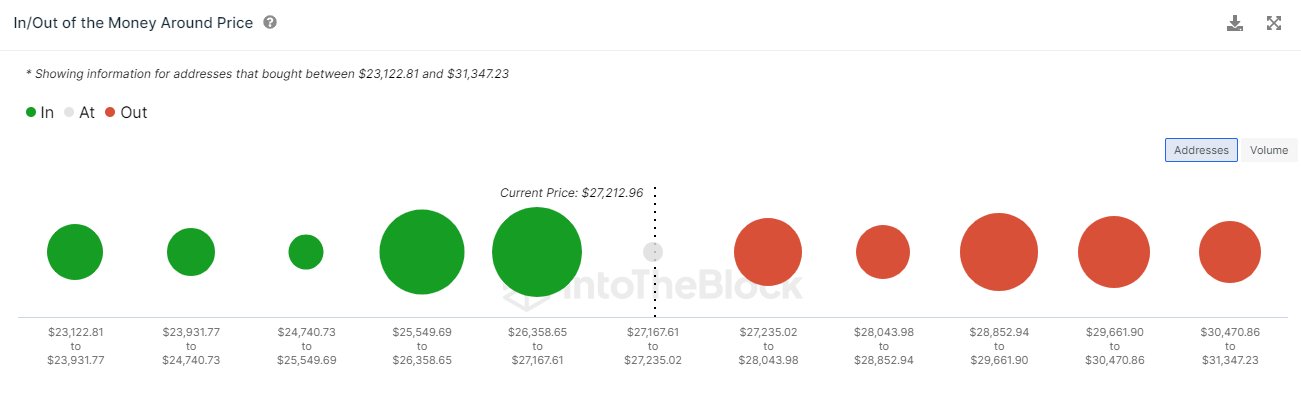

Glassnode alerts data showed more Bitcoin wallets were in profit is at new lows, owing to BTC price selling off this past few days.

📉 #Bitcoin $BTC Number of Addresses in Profit (7d MA) just reached a 1-month low of 24,957,895.655

View metric:https://t.co/qLnvDYVzPt pic.twitter.com/1jUHpvYZl0

— glassnode alerts (@glassnodealerts) August 23, 2022

So while BTC price could scrap some upward moves and see a break above the $22k level and bring some relief likely to push prices even higher, buyers might struggle to push past key resistance in the $25k region.

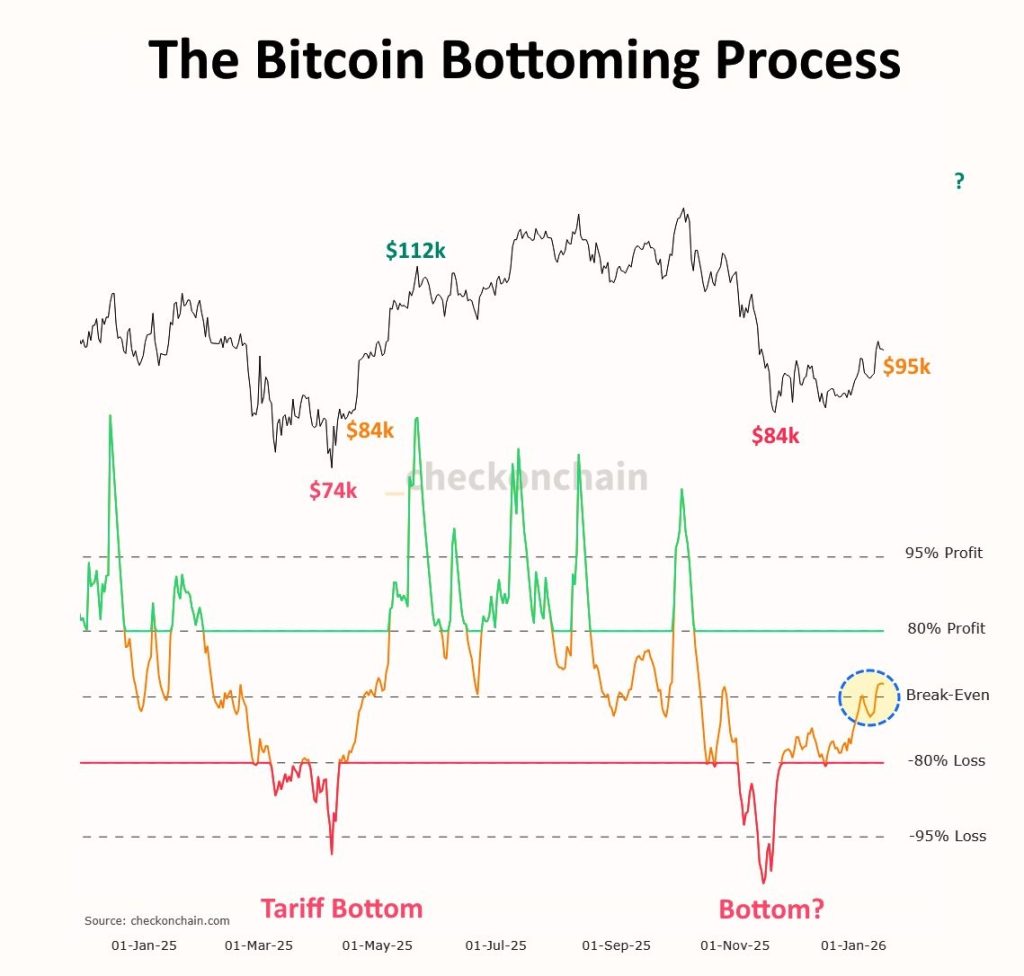

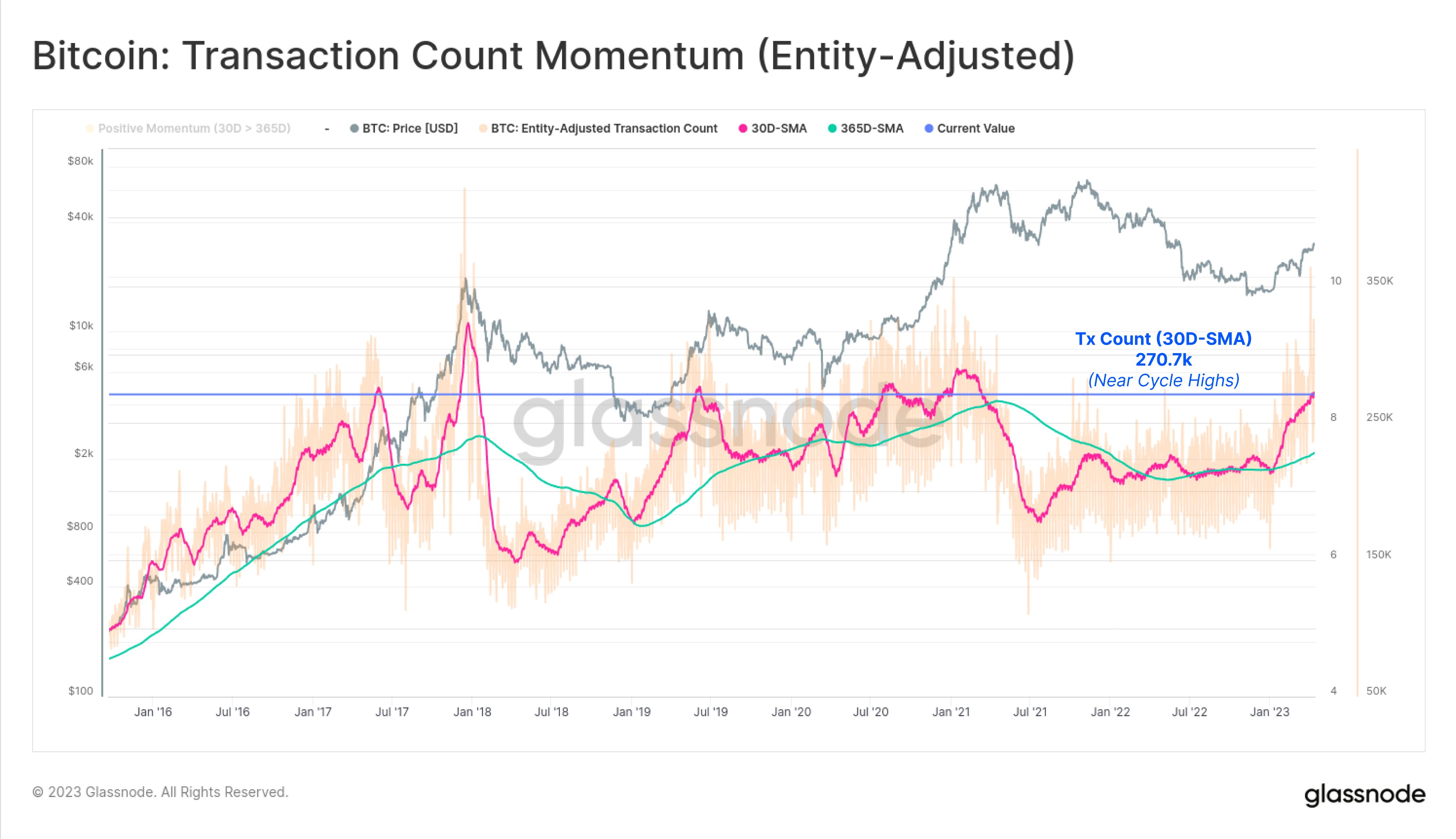

Why Bitcoin might see further accumulation this weekAccording to on-chain data analysis platform Glassnode, BTC/USD is below the realized price after 23 consecutive days above it. The sell-off seen this past week underpins the weakness across the markets, with risk-on appetite also off in equities.

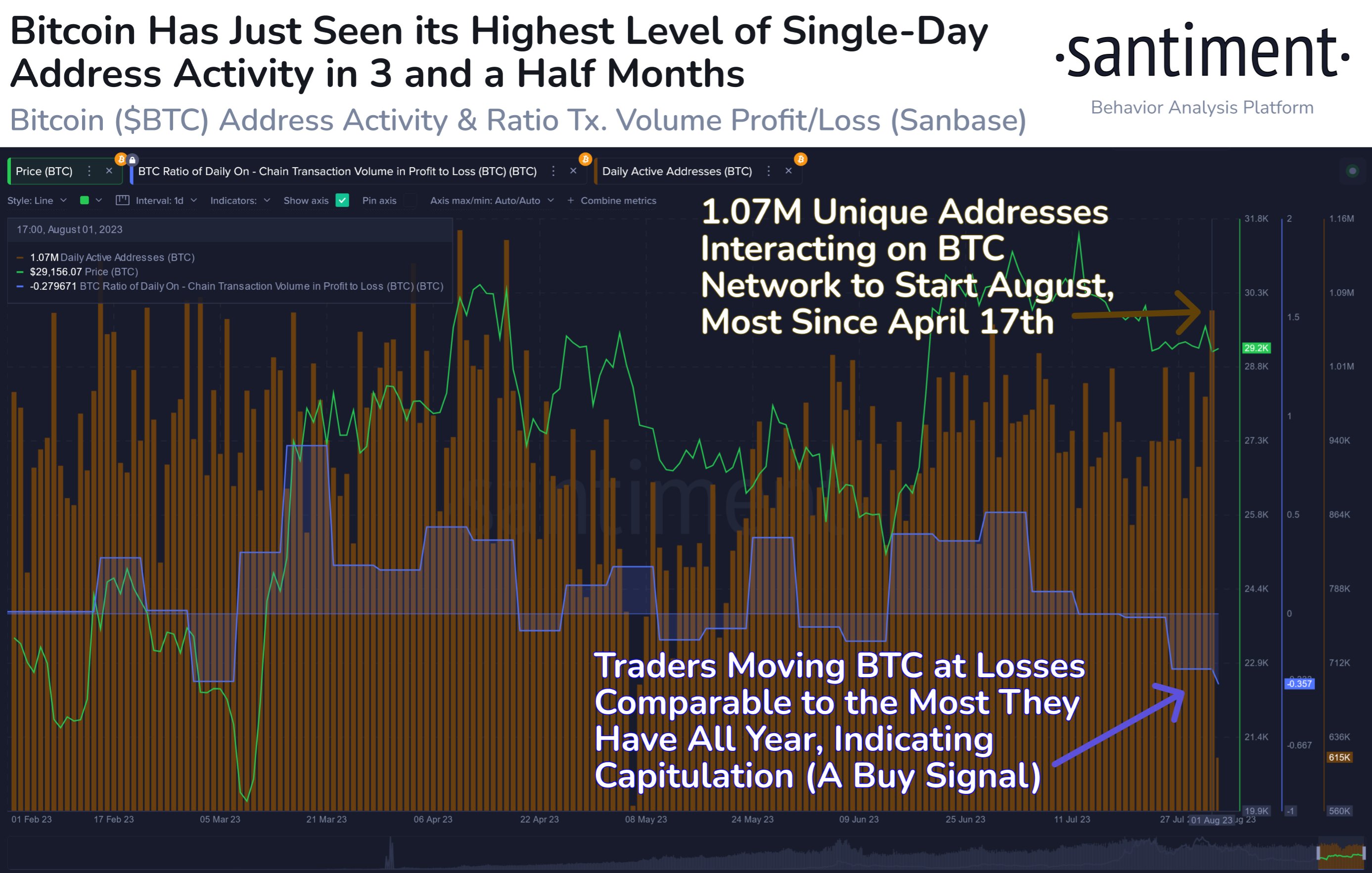

Also noticeable has been the lack of new money coming into the sector, with the recent upside not attracting a new wave of retail investors. These factors point to ranged movement for Bitcoin.

“The recent price uptrend also failed to attract a significant wave of new active users, which is particularly noticeable amongst retail investors and speculators. The monthly momentum of exchange flows is also not suggesting a new wave of investors entering the market, implying a relatively lackluster influx of capital,” the firm noted in its latest weekly update.

If price remains below the cost basis, Glassnode says we could see more accumulation.

“During the 2018-2019 bear market, prices fluctuated below the Realized Price for 140 days, making the prevailing bear market duration of 36 days relatively brief, and thus indicating more accumulation time may be required,” analysts at the firm wrote in the newsletter.

The post On-chain data suggests further accumulation for Bitcoin appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|