2024-11-23 10:21 |

Bitcoin almost tested $100,000 thousand late Friday but faced some resistance and stabilized around the $97,000 mark, incising a solid week of gains for the entire crypto market.

Several altcoins within the top 100 saw impressive gains, with the overall altcoin market capitalization increasing by over 4% in the past seven days. Unlike last week, notable blockchain projects led the charts, replacing the meme coin dominance seen in recent months.

The so-called “digital gold” continued breaking records throughout the week, eventually reaching a new all-time high of $99,486 during Asian trading hours on Nov. 22.

Late-week developments provided much-needed momentum for the bulls, who had struggled to overcome the $91,000 resistance earlier in the week.

Why BTC is rising?On a broader scale, Bitcoin thrived amid the election buzz, with a pro-crypto government preparing to take charge under a Donald Trump-led White House.

Momentum is already building as the incoming administration takes shape, with several high-profile, anti-crypto figures announcing their exits this week.

Securities and Exchange Commission Chair Gary Gensler, known for his aggressive approach toward cryptocurrency oversight, particularly his focus on categorising digital assets as securities, announced his resignation, effective Jan. 20.

Similarly, Marty Gruenberg, Chair of the Federal Deposit Insurance Corporation (FDIC), believed to have played a role in “Operation Choke Point 2.0,” targeting crypto-friendly banks, will step down a day before on Jan. 19.

With regulatory pressures easing and a pro-crypto government on the horizon, Bitcoin’s momentum appeared to reflect growing confidence in a more supportive policy landscape ahead.

Another big boost came with the launch of BlackRock’s IBIT ETF options trading for BlackRock’s iShares Bitcoin Trust (IBIT) ETF. On its first day, IBIT options achieved nearly $1.9 billion in notional exposure that added to the already intense demand around the underlying ETF products.

As of Nov. 21, $2.89 billion had seeped into Bitcoin via Wall Street, which has generated a significant chunk of the demand for the highly coveted crypto asset in the past months.

Whale activity stayed strong, with large holder netflows jumping 180%, according to IntoTheBlock—another sign of big players doubling down on Bitcoin’s momentum.

The icing on the cake was the surge in retail demand, marked by rising exchange outflows, record trading volumes, and a spike in Google searches for “Bitcoin,” as traders eagerly eyed the $100,000 milestone.

How high will Bitcoin go?The most obvious target right now is $100,000, which BTC is likely to break by the time this report is published, as the flagship crypto was hovering over $98,500 when writing, while the Crypto Fear and Green Index moved up to 87, signaling extreme greed and a sense of FOMO in the market.

However, with the six-figure milestone acting as a psychological resistance, bulls may need to regroup after already failing to breach the $99,500 level once. Although crypto analyst Bluntz believes the resistance will “get eaten up easily.”

In terms of long-term targets, experts at Bernstein forecast that Bitcoin could hit $200,000 by 2025. Traders at QCP Capital believe $120k is a likely target in the coming months.

Meanwhile, crypto analyst Ali Martinez has recently noted that Bitcoin’s recent rally closely resembles its pre-2017 breakout, pointing to a potential run to $150,000 in the coming weeks if the pattern repeats.

When writing, BTC was sitting over 12% weekly gains.

Bitcoin dominance also surged to 59.4% this week, which means a true altcoin is yet to come, and most of the fresh funds were being directed toward the benchmark crypto. The Altcoin Season Index on CoinMarketCap confirms this, as it was sitting at 27, which indicated Bitcoin season.

Yet some prominent projects managed to post triple-digit gains over the past week. The top tokens were:

MantraMantra (OM) led the highest gains of the week. The cryptocurrency focused on real-world asset tokenization broke out of its multi-month consolidation phase on Nov. 16, gaining 119% over the last 7 days and exchanging hands at $3.68 at the time of writing.

Source: CoinMarketCap

Mantra has also been one of the top-performing crypto assets, with a nearly 17000% surge over the past year, bringing its market cap to over $3.3 billion when writing.

Mantra’s rally followed a teaser from its developers regarding a significant upcoming announcement. Market commentators speculate that the news might reveal a major partnership with a large company.

The altcoin also secured a listing on the centralized exchange WOO X, which is now available in the perpetual futures market. Additionally, an upcoming airdrop for the token is on the horizon, further fueling the rally.

StellarStellar (XLM) rose 105.8% over the past week, bringing its market cap up from $706 million to $8.76 billion at press time. XLM was trading at $0.293 with a daily trading volume of over $2.8 billion.

Source: CoinMarketCap

XLM’s recent ally in price comes amid multiple partnerships with major firms and the anticipated changes in the U.S. administration following Donald Trump’s presidential win.

Notably, XLM’s rise came alongside the Ripple price rally as some analysts speculate that the U.S. Securities and Exchange Commission may drop its 6-year litigation against Ripple, especially now that its chief Gary Gensler, has vacated his seat.

Further, Stellar has recently partnered with Mastercard to use its Crypto Credential solution for secure blockchain interactions on the Stellar network. Another major partnership is with asset manager Franklin Templeton to launch a blockchain-based U.S. government money fund with over $435 million in assets.

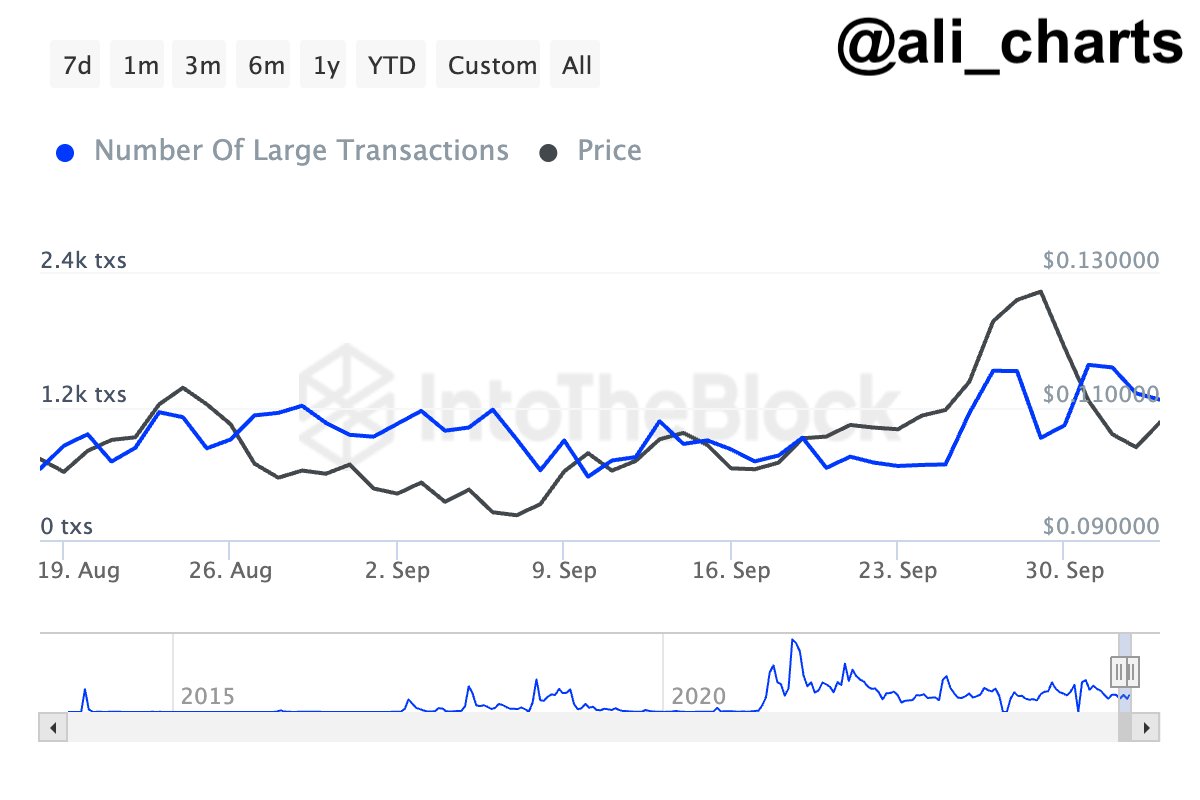

HederaOver the last 7 days, Hedera (HBAR) gained 101.2%, trading at $0.1359 when writing with its market cap standing at $5.2 billion. Its daily trading volume has soared alongside the price rally, increasing by 103.57% from $560 million on Nov. 16 to $1.14 billion at the time of writing.

Source: CoinMarketCap

The majority of the gains over the past week occurred on Nov. 18, when Canary Capital filed with the U.S. SEC for the first HBAR ETF, providing investors exposure to the crypto asset’s price.

Further, Archax, a U.K.-regulated crypto exchange and custodian, has added tokenized funds from State Street, Fidelity International, and LGIM. These funds will initially be available on Hedera Hashgraph, XRPL, and Arbitrum. The move has boosted interest in Hedera, driving up demand for HBAR as it strengthens its position in the tokenized assets market.

The post OM, XLM, HBAR up over 100% this week as BTC eyes post $100k targets appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Rally (RALLY) на Currencies.ru

|

|