2025-5-1 13:24 |

North Carolina is moving closer to becoming a leader in state-level digital asset investment.

On April 30, the state’s House of Representatives passed House Bill 92—also known as the Digital Assets Investment Act—with a vote of 71–44.

The bill now advances to the Senate for further deliberation.

If enacted, it would allow the state treasurer to allocate government funds into approved crypto assets under strict eligibility criteria.

The proposed legislation comes amid growing interest in regulated crypto investment tools across the United States.

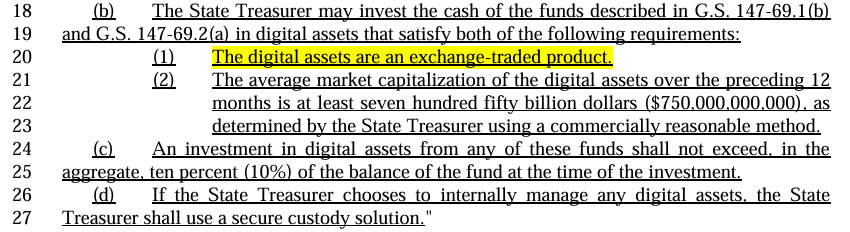

HB 92 outlines specific thresholds for asset inclusion, focusing on large-cap tokens available as exchange-traded products (ETPs).

It also includes new provisions to examine crypto investment options for state employee retirement plans.

As North Carolina steps up its digital finance ambitions, it joins a broader race among US states—most notably Arizona—to integrate cryptocurrencies into public sector finance with appropriate regulatory guardrails.

$750 billion market cap ruleFirst introduced in February by Republican House Speaker Destin Hall, HB 92 would allow the state to invest only in digital assets listed as ETPs and holding an average market capitalisation of at least $750 billion over one year.

The benchmark would be calculated by the state treasurer using commercially reasonable methods.

The bill places an emphasis on limiting risk by targeting highly capitalised assets, signalling a cautious but deliberate approach to crypto allocation.

Custody and oversightBefore investing state funds, the treasurer must obtain an independent third-party assessment to ensure the digital assets are stored in a secure custody solution.

This layer of protection is aimed at addressing growing concerns about crypto custody, loss recovery, and regulatory compliance.

In addition to secure storage, the bill enforces that crypto assets must meet defined regulatory standards and undergo risk assessments before qualifying for investment.

Pension fund feasibilityAn amendment to the bill allows the treasurer to assess the possibility of letting participants in state retirement and deferred compensation plans opt for crypto investment via ETPs.

While it stops short of implementing this directly, the provision opens up potential future access depending on market maturity and regulatory responses.

This move positions North Carolina as one of the few states to publicly explore the intersection of crypto and public pension planning.

Arizona’s crypto billsNorth Carolina’s legislative push parallels efforts underway in Arizona.

On April 28, Arizona’s House passed two bills—SB 1025 and SB 1373—that propose the creation of a Strategic Bitcoin Reserve.

Unlike North Carolina’s broader focus, Arizona’s measures centre exclusively on Bitcoin.

The fate of those two Arizona bills now rests with Governor Katie Hobbs.

If signed, they would mark a first in the US for such a reserve.

Meanwhile, North Carolina’s HB 92, if passed by the Senate, would authorise government investment in large-scale digital assets through regulated investment vehicles, marking another milestone in state-level crypto regulation.

The post North Carolina passes key crypto investment bill as Arizona rivalry intensifies appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Intelligent Investment Chain (IIC) на Currencies.ru

|

|