Signify - Свежие новости [ Фото в новостях ] | |

Sharplink refreshes brand as ETH staking reaches $1.7 billion

Sharplink, a leading advocate for Ethereum-focused digital asset treasuries, announced a series of major milestones on Thursday that signify its rapid ascent in the institutional finance space. The company revealed that institutional ownership has surged to 46%, a record level… дальше »

2026-2-20 10:47 | |

|

|

Polymarket introduces trading fees on US app and crypto markets

The Polymarket US app will charge takers 1 basis point, equivalent to 0.01%. This would signify the company's first revenue srtream since expanding дальше »

2026-1-8 02:59 | |

|

|

Panic, then pause: Bitcoin inflows collapse by half – What this means for $117K

Key Takeaways What do the addresses depositing BTC signify? The spike to 64k Active Addresses sending BTC to Binance on the 14th of October signified increased selling, but this number has begun to The post Panic, then pause: Bitcoin inflows collapse by half – What this means for $117K appeared first on AMBCrypto. дальше »

2025-10-20 16:00 | |

|

|

ALGO Surges Past $0.2257 as TD Sequential Indicates Double Buy Signals, Hinting at Algorand’s Upcoming Market Rally

Algorand’s TD Sequential buy indicators signify that the recent upturn could be opening up to a greater bullish rally supported by stablecoin liquidity. дальше »

2025-10-7 19:10 | |

|

|

This Dogecoin Indicator Could Signal a 7000% Rally in DOGE Price

Analyst Mikybull Crypto pointed out a bullish indicator for Dogecoin (DOGE) in a tweet. He highlighted the occurrence of a golden cross on Dogecoin’s weekly chart. Moreover, this indicator could signify a massive price rally similar to one observed in a previous cycle. дальше »

2024-11-12 14:30 | |

|

|

Stellar (XLM) Price Set to Explode? Key Breakout Signals Huge Gains!

Stellar’s (XLM) price is presently forming a descending channel on the daily time frame, and if the commodity successfully breaks through its trendline, it might signify the start of a bullish rally, according to crypto analyst Universe of Crypto. дальше »

2024-10-17 22:00 | |

|

|

Legion Secures $2 Million for its Merit-Based ICO Platform

Legion aims to establish itself as a pioneer in MiCA compliance for CASPs, enabling non-accredited investors to participate in early fundraising and token offerings. Today, Legion rises to signify a fresh era of fundraising based on merit within the blockchain. дальше »

2024-8-28 20:21 | |

|

|

Ripple vs. SEC: What The Proposed Schedule Submitted On Thursday Means

The US Securities and Exchange Commission (SEC) and Ripple, on November 9, filed their joint briefing schedule for remedies discovery and briefing, which could signify that both parties are close to settling. дальше »

2023-11-10 16:20 | |

|

|

Unveiling The Data: Is Bitcoin Gaining Ground As The New Gold?

The divergence between Bitcoin’s price and the sentiment surrounding it might signify an oncoming bearish trend in the future. Negative feelings and comments about Bitcoin seem to be outweighing the positive ones, potentially leading to a shift in its trajectory. дальше »

2023-10-30 09:32 | |

|

|

Ethereum Rebound Trail: Will ETH Hit $2,000 Again?

Ethereum (ETH) has witnessed a notable resurgence, reclaiming ground after hitting a crucial support level at $1,500. As traders analyze the daily time frame, it becomes evident that this resurgence may signify the formation of a bullish reversal pattern, known as a double bottom. дальше »

2023-10-23 10:36 | |

|

|

FC Barcelona Secures €120M Investment for Web3 Entity

FC Barcelona's strategic financial moves: Web3 investment & SPAC valuation signify digital transformation in sports industry. The post FC Barcelona Secures €120M Investment for Web3 Entity appeared first on NFT News Today. дальше »

2023-8-14 07:31 | |

|

|

From millions to pennies: the astonishing decline of iconic NFTs

Several iconic NFTs, once heralded as groundbreaking investments, have taken significant hits in their values. Let’s delve into the detailed stories of these NFTs, exploring what they are, why they declined in value, and what these cases signify for the… дальше »

2023-8-7 18:17 | |

|

|

Over 69% of BTC Supply Dormant for a Year – Holders Don’t Want To Sell Their Bitcoin

The term ‘HODLing’ has emerged as a popular strategy among long-term Bitcoin holders. This term, originating from a misspelling of ‘hold’, has come to signify the act of holding onto a cryptocurrency, particularly Bitcoin, for a long period without selling it. дальше »

2023-7-27 18:30 | |

|

|

Chainlink Holds Strong With 19% Rally – More Gains In The Pipeline?

Chainlink (CHAIN) has recently experienced a surge in its short-term price action, delivering considerable gains to its holders. The excitement surrounding this upward momentum has been palpable, but astute observers have noticed some intriguing indications that suggest this hike might not necessarily signify the peak for LINK. дальше »

2023-7-21 16:26 | |

|

|

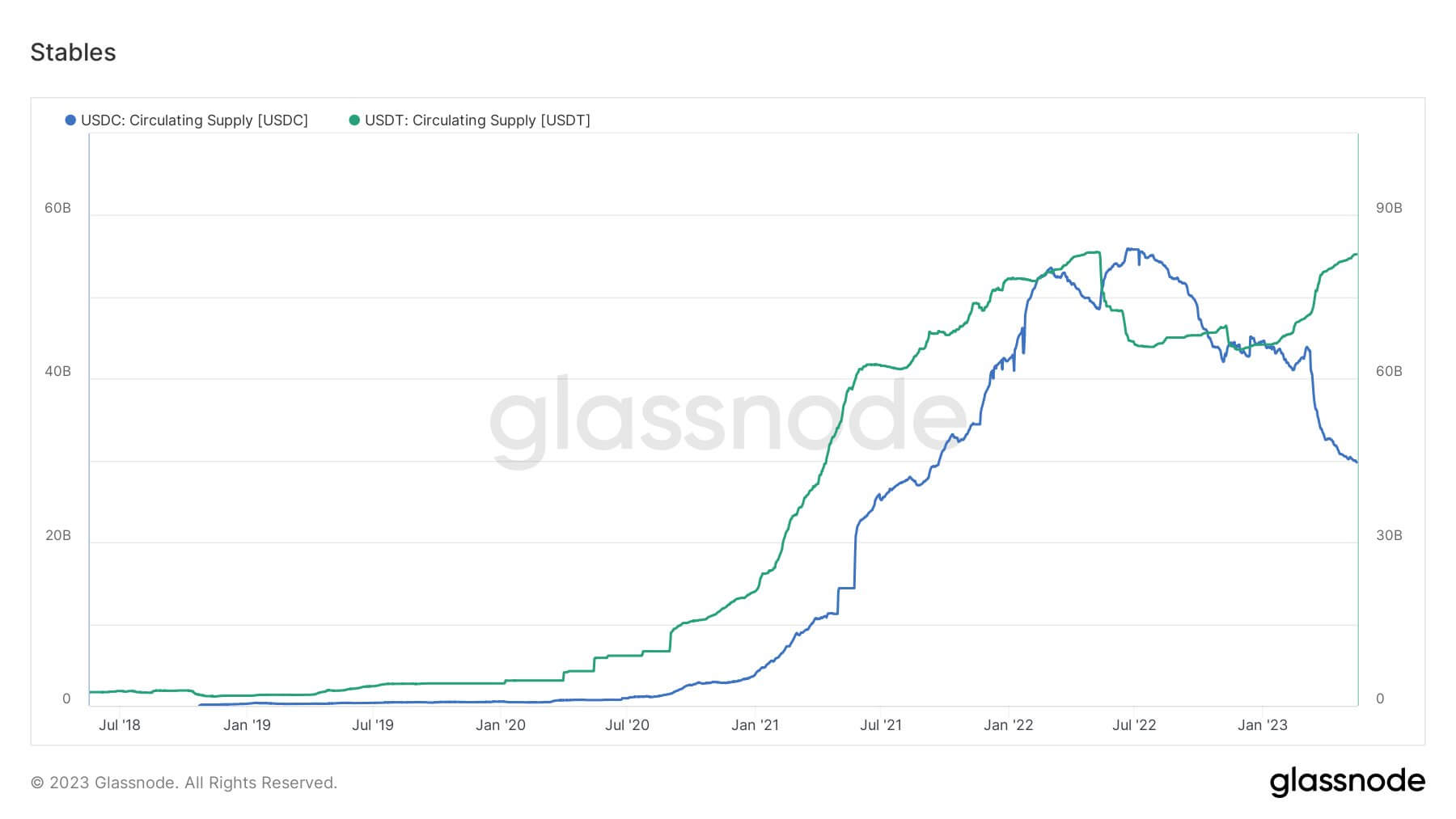

Does the divergence between USDT and USDC signify a winner in the stablecoin wars?

Quick Take USDT and USDC started roughly simultaneously, back in 2018, and grew in tandem with one another as the crypto market also grew, all the way through to 2022. In May 2022, USDC took a tumble to roughly $50 billion in circulating supply – total amount of all coins ever created/issued – while USDT […] The post Does the divergence between USDT and USDC signify a winner in the stablecoin wars? appeared first on CryptoSlate. дальше »

2023-5-18 19:47 | |

|

|

USDC market cap below $30 billion, struggles signify crypto turmoil

Key Takeaways USDC’s market cap has dipped from $54 billion to $30 billion in the last eight months The stablecoin has lost market share since March, falling from 32% to 23% Regulatory concerns and the fallout from the SVB collapse have plagued the stablecoin, whose struggles signify the capital flight out of the crypto industry […] The post USDC market cap below $30 billion, struggles signify crypto turmoil appeared first on CoinJournal. дальше »

2023-5-10 17:54 | |

|

|

Bitcoin at $30,000: Examining the curious market conditions before BTC's rise

A recent surge in large transactions and active addresses contributed helped BTC’s rise to $30,000. The hike could signify a halving cycle change as implied volatility increased. For the fThe post Bitcoin at $30,000: Examining the curious market conditions before BTC's rise appeared first on AMBCrypto. дальше »

2023-4-11 12:30 | |

|

|

Rising Bitcoin Hash Rate Sets The Stage For Energy Companies

Bitcoin Mining hash rates are important security metrics as they signify the network’s overall resistance to malicious attacks. Hash rates also measure a blockchain network’s ability to process transactions. дальше »

2022-11-3 12:28 | |

|

|

Myria announces free-to-claim Alliance Sigil NFT for all new and existing community members

The Myriaverse asks members to join an Alliance — Federation, Vector Prime or Equinox — to signify their stance against “the Rift”, and complete missions to be rewarded with an Alliance Sigil NFT Each Alliance Sigil NFT will also grant holders additional access and utility, which will be revealed at a later date. дальше »

2022-6-8 10:01 | |

|

|

Venture Capital Founder Believes Regulations Are Generally Good For Crypto

Future Perfect Ventures CEO believes that regulations signify that crypto has gained government recognition. Developed economies are still working to create a comprehensive regulatory environment for the crypto space. дальше »

2022-4-20 19:38 | |

|

|

Sudden whale activity involving large sums may signify this for XRP

While it is nearly impossible to decipher the intentions of a crypto whale, some monthly cycles and world events can hint at the real picture. As September began, a relatively sedate weekend stream ofThe post Sudden whale activity involving large sums may signify this for XRP appeared first on AMBCrypto. дальше »

2021-9-5 17:27 | |

|

|

Altseason is Upon Us: Recent Market Surges Overshadow Bitcoin’s (BTC) Market Dominance

As bitcoin’s potential bull run seems to have taken a slight detour, Altcoins are now the talk of the crypto town. Analysts suggest the Alts’ recent price signals signify a major run in the coming months. дальше »

2021-8-19 01:00 | |

|

|

270,000 Bitcoins Move Off Exchanges in the Past 30 Days

Although prices have begun to consolidate a bit, more and more BTC are leaving exchanges for cold storage. This metric, though ambiguous, could signify that investors are less interested in taking positions and prefer to move their BTC off exchanges so it can remain safer in cold wallet storage. дальше »

2021-1-21 14:52 | |

|

|

Bullish For Bitcoin: BTC Supply Slowly Shifts From Whales Toward Smaller Entities

New data shows that the amount of Bitcoin held by smaller entities has grown significantly. Meanwhile, during the same time, whale-sized BTC wallets declined by a similar margin. Clearly, there’s been a sizable shift in supply, but what exactly does this crypto wealth transfer signify? And is this bullish or bearish for the first-ever cryptocurrency? Supply Restrictions Give Cryptocurrencies Added Value That Isn’t Fully Understood Out of all of Bitcoin’s unique attributes that give it […] дальше »

2020-8-6 18:00 | |

|

|

Here's what Bitcoin's 3 consecutive bearish weekly candles signify

Bitcoin has not seen a bull run for almost 3 years now. With the last bull run ending on December 17, 2017, most people are yet to witness a bull run. This is an extended bear market and a pre-bull ruThe post Here's what Bitcoin's 3 consecutive bearish weekly candles signify appeared first on AMBCrypto. дальше »

2020-7-6 19:00 | |

|

|

Bitcoin and Ethereum being centrally-held highlights a trust problem

The term decentralized currency was meant to signify a virtual currency that would be based on the logic of mathematics and economics, mined from the blockchain and stored in one's digital wallet, assThe post Bitcoin and Ethereum being centrally-held highlights a trust problem appeared first on AMBCrypto. дальше »

2020-1-10 21:00 | |

|

|

ZILLIQA Price Prediction: Long-term (ZIL) Value Forecast – June 15

ZIL/USD has now resorted to a range moving mode. The $0. 02 lower range mark is considered as the critical price line that could signify an end of nurturing bullish sentiment. ZIL/USD Long-term Trend – Ranging Distribution territories: $0. дальше »

2019-6-15 07:50 | |

|

|

NEO Long-term Price Analysis – February 24

There has been a series of relative ups in the NEO/USD market worth. A breakdown against $8 mark could signify a serious warning against the current swing uptrend. NEO/USD Long-term Trend – Bullish Distribution territories: $12, $14, $16 Accumulation territories: $7, $6, $5 As at the start of trading sessions about a week back, there […] дальше »

2019-2-24 12:34 | |

|

|

Ethereum Price Analysis - SEC takes action on ICOs, dApps, and DEXs

U.S. regulators, like the SEC, are just beginning to sink their teeth into the violations of the past two years and signify many more enforcement actions in the coming months. дальше »

2018-11-21 14:01 | |

|

|

Vitalik Buterin Predicts Scaling Upgrade to Improve Ethereum Network Speed by 1,000 Times

Ethereum co-founder Vitalik Buterin announced that the blockchain platform’s next upgrade would improve its transaction capacity by a factor of one thousand. Speaking at the Devcon4 keynote in Prague, Czech Republic, Buterin reminded the audience that this long-awaited “Ethereum 2. дальше »

2018-11-3 02:00 | |

|

|

BKCM Crypto Hedge Fund CEO Lists Top 3 Reasons Why Bitcoin Markets will Boom

Bitcoin continues to go up, as it grew to USD$8,316 from its USD$7,339. Does this 13 percent signify anything? According to the CEO of BKCM Fund and CNBC’s very own crypto analyst, its growth might be contributed by three key factors, which include the possibility of a bitcoin ETF, the entry from several institutions and […] дальше »

2018-7-25 00:22 | |

|

|

Bitcoin cloning Trading

The terms of software license agreements may vary depending upon the specific software product and version that you licensed from Osiz Technologies Private Limited. Osiz Technologies packages are known as “Software Product” here and Osiz Technologies holds copyright to the “Software Product”. дальше »

2018-7-23 15:48 | |

|

|

A Quick Gasprice Market Analysis

Here is a file that contains data, extracted from geth, about transaction fees in every block between 4710000 and 4730000. For each block, it contains an object of the form: { "block":4710000, "coinbase":"0x829bd824b016326a401d083b33d092293333a830", "deciles":[40,40. дальше »

2018-7-21 23:03 | |

|

|

Bitcoin Falls While Hashrate Soars

According to a report by CoinJournal, the hashrate of the bitcoin network has soared in recent months, climbing by more than 100% in just 4 months. In June of 2018, the hashrate was more than 40 EH/s, as compared with the 2017 peak of about 13 EH/s. What does the increase in hashrate signify, and дальше »

2018-7-11 06:46 | |

|

|