2018-7-25 00:22 |

Bitcoin continues to go up, as it grew to USD$8,316 from its USD$7,339. Does this 13 percent signify anything?

According to the CEO of BKCM Fund and CNBC’s very own crypto analyst, its growth might be contributed by three key factors, which include the possibility of a bitcoin ETF, the entry from several institutions and blockchain’s ability to develop into the next Web 3.0.

Brian Kelly broke down the reasons why bitcoin is on the rise during his appearance on CNBC’s “Fast Money” piece. As per his views, bitcoin will experience another bullish market. The following is an in-depth analysis on what Kelly holds to be a possible prediction for the crypto market, with many of Kelly’s quotations reported by Ethereum World News.

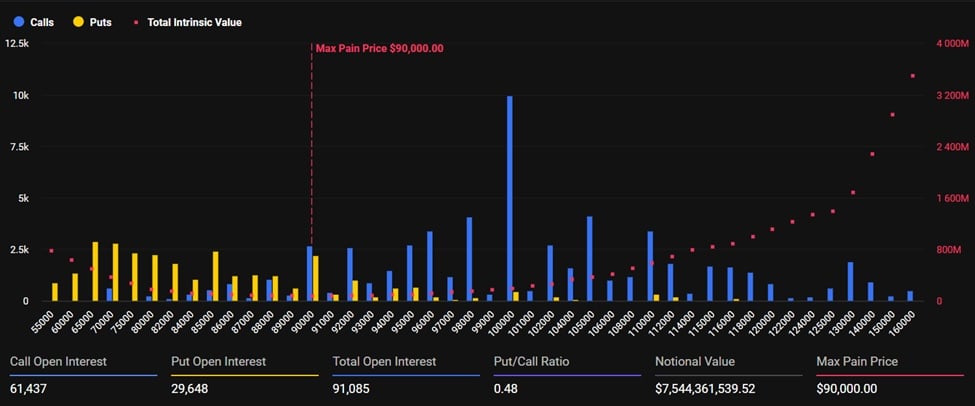

Awaiting The Possibility Of A Bitcoin ETFIt appears that a bitcoin ETF is what is giving hopes to the crypto sphere. The hope stems from the news that a cryptocurrency exchange proposed an ETF to the U.S Securities Exchanges and Commission (SEC). This happened on June 26, 2018, and since then everyone has been showing support.

Although many are still waiting for the results, Kelly does not see it happening any time now, adding that “an ETF in 2018 are relatively low”. However, he does not expand on his argument, but simply ends the comment by stating that its conjecture might be driving its price up.

Institutions Reconsidering The Crypto MarketKelly has openly stated that many institutions who were not fond of the crypto market and prices back in December are reconsidering its likes. He shared that many of them are “starting to get serious”. According to the crypto analyst, institutions have realized that the crypto market is here to stay and have decided it’s time to understand the complete package, that is, “what it is” and “where does this asset class fit into our portfolio”.

An example of this that Kelly discussed was that of Coinbase’s success in getting a $20 billion hedge fund for its Coinbase Custody Service. Evidently, this shows that institutional investors are gradually making their way into the crypto sphere. Similarly, not too long ago, Grayscale Investments released a report revealing its overall growth. What struck to this day, is the fact that institutional investors make up 56 per cent of the overall revenue.

Blockchain Dubbed As Web 3.0Blockchain technology is the highlight of the crypto market, as it has been dubbed as either the “fourth industrial revolution” and in many cases, the next layer of Internet, “Web 3.0”. He also the stressed the fact that consumers are switching their mindsets from “database to a databank”. The fact that data can be compensated for, according to Kelly, will mark blockchain technology on a whole new level – eventually enhancing the chances of user adoption.

Kelly concludes his arguments by stating that the once yearn for selling bitcoin as quickly as possible has died off, with more consumers reconsidering its like and actually investing in it.

In particular, he gave examples that occurred five months ago like that “Mt.Gox trustee selling” and “tax selling”, however he believes that its “over and so now you’ve had this positive news flow […] sometimes it just takes the market a little bit to catch up, so here we are and I don’t think it’s done (yet).”

As the saying goes, time is of the essence, hence holders should continue to do so, as bitcoin, according to Kelly, is slowly breaking out of its bearish trends. What are your takes on this matter? Do you think Kelly is right to say that ETFs will be turned down?

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|