365-day - Свежие новости [ Фото в новостях ] | |

Why This Bitcoin Bear Market Is Among The Worst Ever: CryptoQuant Researcher

The price of Bitcoin is nearly 45% away from its all-time high of $126,080, reflecting a worsening market climate over the past few months. One of the indicators that confirmed the emergence of the bear market was the breach of the 365-day moving average to the downside late last year. Using this metric, a prominent […] дальше »

2026-2-9 14:00 | |

|

|

Bear Market Warning: Bitcoin Faces Major Test That Defined the 2022 Crash

Bitcoin is once again approaching a level that carries real historical weight. According to the CryptoQuant chart, price is moving toward the 365-day moving average, a long-term trend line that played a decisive role during the 2022 bear market. дальше »

2026-1-18 03:00 | |

|

|

Shutdown Hopes, Trump Dividend Talk Lift Bitcoin to $106K

Bitcoin recovered from a sharp plunge, finding support at the 365-day MA, driven by hopes of a quick government shutdown resolution and President Trump's promise of a $2,000 dividend. The post Shutdown Hopes, Trump Dividend Talk Lift Bitcoin to $106K appeared first on BeInCrypto. дальше »

2025-11-10 06:29 | |

|

|

Bitcoin bulls in control? - Not if THESE signals are right

Bitcoin’s MVRV Ratio rebounded off its 365-day SMA, signaling trend continuation if the support holds. Price structure remains bullish, but on-chain weakness and rising sentiment risk trend rThe post Bitcoin bulls in control? - Not if THESE signals are right appeared first on AMBCrypto. дальше »

2025-7-6 06:00 | |

|

|

Don’t Call Bitcoin Bottom Just Yet, CryptoQuant Head Says: Here’s Why

The Head of Research at CryptoQuant has revealed why it may be too early to call a bottom for Bitcoin, based on the trend in on-chain data. Bitcoin MVRV Z-Score Has Plunged Under Its 365-Day MA In a new post on X, CryptoQuant Head of Research Julio Moreno has talked about why Bitcoin may not have reached a bottom yet. дальше »

2025-2-28 05:00 | |

|

|

Bitcoin MPI Crossover Could Suggest Bull Run Still On

On-chain data shows the Bitcoin Miners’ Position Index (MPI) has recently formed a crossover that has historically been bullish for the asset’s price. Bitcoin MPI Has Seen Its 90-Day MA Cross Above The 365-Day As explained by an analyst in a CryptoQuant Quicktake post, the Bitcoin MPI momentum has recently given a bullish signal for Bitcoin. дальше »

2025-1-29 05:00 | |

|

|

Bitcoin Is About To See A Historically-Profitable Crossover In This Metric

On-chain data shows the Bitcoin Puell Multiple is about to undergo a crossover that has historically been very bullish for BTC’s price. Bitcoin Puell Multiple Could Cross Its 365-Day MA In Near Future As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin Puell Multiple has been approaching its 365-day moving average (MA) recently. дальше »

2024-11-20 13:30 | |

|

|

Puell Multiple drops as miner revenues hit 10-month low

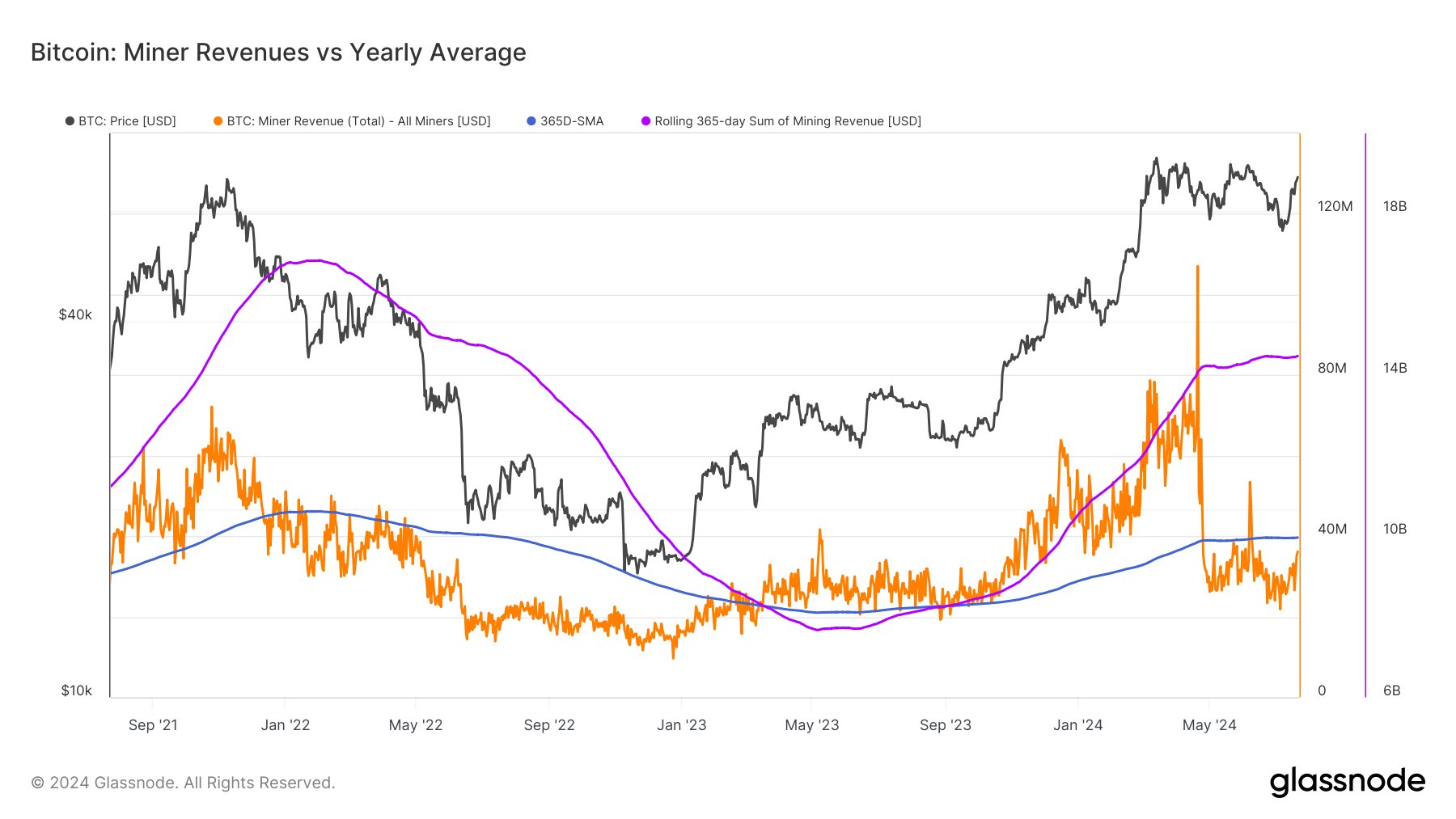

Miner revenues serve as a barometer for the overall state of the Bitcoin ecosystem, reflecting the delicate balance between mining costs, Bitcoin price, and network difficulty. Since Apr. 24, miner revenue has consistently been below its 365-day simple moving average (SMA), with only two brief exceptions in early June. дальше »

2024-8-13 19:15 | |

|

|

Bitcoin’s Puell Multiple struggles to recover post-April halving decline

Onchain Highlights DEFINITION:The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value. The Puell Multiple metric, which measures the ratio of the daily issuance value of Bitcoin to its 365-day moving average, dropped to 0. дальше »

2024-8-13 20:39 | |

|

|

Bitcoin Miner Capitulation Almost Over: What It Means For Price

On-chain data shows the Bitcoin mining revenue has neared its yearly average, a sign that capitulation could be coming to a close for miners. Bitcoin Miner Revenue Is Now Close To Its 365-Day SMA In a new post on X, analyst James Van Straten has discussed about how the situation of the BTC miners is […] дальше »

2024-7-24 00:00 | |

|

|

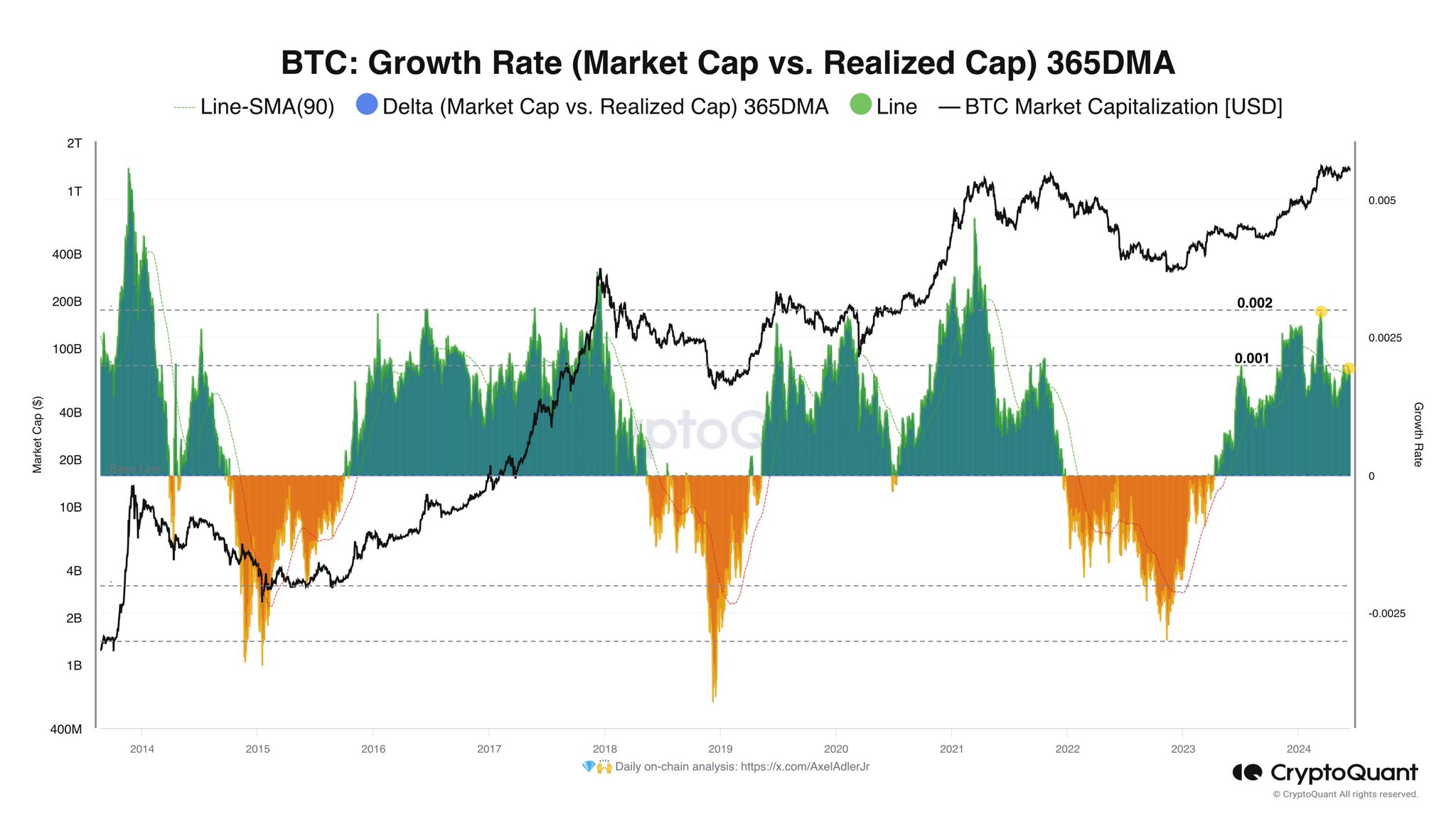

Is Bitcoin Overheated Right Now? This Metric Suggests No

Data of an on-chain indicator could suggest Bitcoin is currently not at a stage where its price would be at a significant risk of facing correction. Bitcoin 365-Day MA Growth Rate Is Sitting Below Historical Overheated Zone In a post on X, CryptoQuant author Axel Adler Jr has discussed about the recent trend in the “Growth Rate” metric for Bitcoin. дальше »

2024-6-13 20:00 | |

|

|

Bitcoin: Signs of bull run emerge, but all's not well with BTC

BTC’s daily Puell Multiple attempted to cross above its 365-day moving average. Historically, this has preceded a jump in BTC’s value. Bitcoin’s [BTC] daily Puell Multiple is poised The post Bitcoin: Signs of bull run emerge, but all's not well with BTC appeared first on AMBCrypto. дальше »

2024-1-23 11:30 | |

|

|

Bitcoin mining revenue just edges past year-long average

Quick Take Bitcoin miner revenue currently stands at approximately $25. 5 million, marginally surpassing the 365-day Simple Moving Average (SMA) of $22. 5 million. This financial situation draws noteworthy similarities to the pattern seen in 2019 during the previous bear market when the revenue eventually dipped below the 365 SMA, prompting speculations about potential parallels in trends. дальше »

2023-8-29 13:00 | |

|

|

Maker holders set to log over 50% profits, here's how

MKR's MVRV ratio over a 365-day window period has exceeded 50%. While MKR accumulation has climbed, some traders have started selling. Following a 14% jump in value in the last year, the MarThe post Maker holders set to log over 50% profits, here's how appeared first on AMBCrypto. дальше »

2023-7-31 19:30 | |

|

|

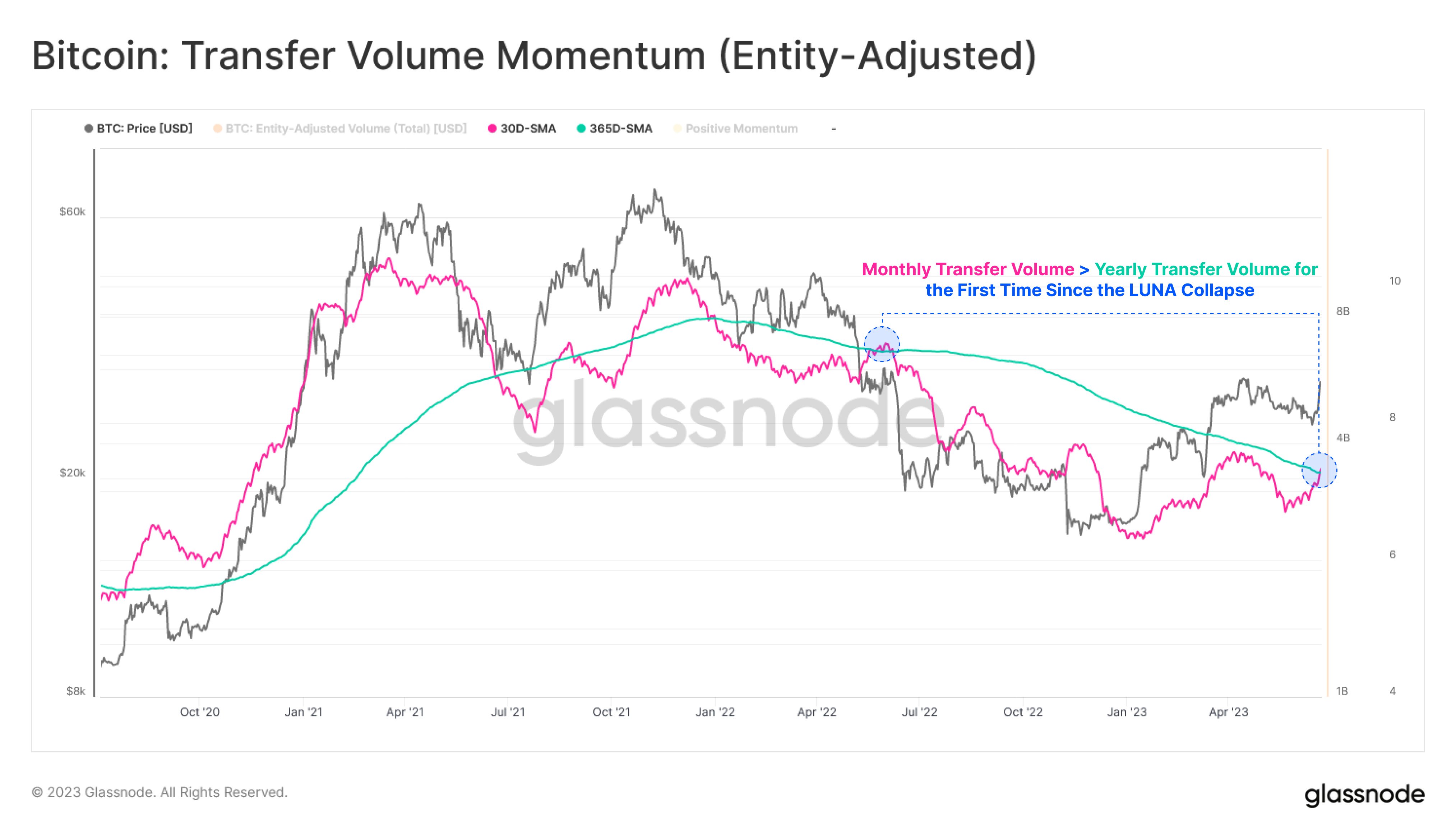

Bitcoin Monthly Volume Surpasses Yearly Average, Why This Is Bullish

Data shows the Bitcoin monthly average trading volume has now surpassed the yearly average one. Here’s why this may be bullish for the asset. Bitcoin 30-Day SMA Volume Has Crossed Above The 365-Day SMA According to data from the on-chain analytics firm Glassnode, this is the first time since the LUNA collapse that this pattern […] дальше »

2023-6-24 04:00 | |

|

|

Litecoin’s MVRV Has Surged, Why This Is Bearish

On-chain data shows the Litecoin MVRV has been at relatively high levels recently, something that could be bearish for the cryptocurrency. Both 30-Day & 365-Day Litecoin MVRV Ratios Are High Currently According to data from the on-chain analytics firm Santiment, LTC traders are well above water at the moment. дальше »

2023-5-23 14:58 | |

|

|

Bitcoin: Sharks, Crabs lag as BTC Shrimps create staggering shift

Addresses holding between 0 to 1 BTC increased holdings, thus, hitting an ATH. The coin might be undervalued considering the 365-day trend of one metric. Bitcoin [BTC] Shrimps, a term used tThe post Bitcoin: Sharks, Crabs lag as BTC Shrimps create staggering shift appeared first on AMBCrypto. дальше »

2023-5-20 04:30 | |

|

|

Assessing Bitcoin's [BTC] losses as it fails to recover from the fake news-induced FUD

The divergence between daily miner revenue and 365-day SMA has broadened since the start of 2023. The data on U. S. government's BTC holdings didn't show any decline since the beginning of May. дальше »

2023-5-13 22:30 | |

|

|

Bitcoin [BTC]: Silver lining for miners as fees exceed 2021 levels, more inside

The divergence between daily miner revenue and 365-day SMA has broadened since the start of 2023. There were instances of transaction fees exceeding the block rewards given to miners. While The post Bitcoin [BTC]: Silver lining for miners as fees exceed 2021 levels, more inside appeared first on AMBCrypto. дальше »

2023-5-10 22:30 | |

|

|

Bitcoin Miners Appear Not To Sell Or Care About Price, Is This Bullish?

Data from CryptoQuant suggests that Bitcoin miners might, after all, not care about price and all the fear, uncertainty, and doubt (FUD) in recent days. Bitcoin Miners Are Not Selling According to CryptoQuant’s Miners’ Position Index (MPI), a ratio between the total miner BTC outflows and the 365-day moving average of the same reading, Bitcoin miners have not been sending their coins to external addresses, typically exchanges. дальше »

2023-3-9 21:27 | |

|

|

Bitcoin Puell Multiple Starts To Leave Bear Market Zone, Bull Rally Here?

On-chain data shows the annual rate of change in the Bitcoin Puell Multiple has exited the bear market zone, a sign that a bull rally may be here. Bitcoin Puell Multiple 365-Day Rate Of Change Has Shot Up As pointed out by an analyst in a CryptoQuant post, this could be one of the first indications of the return of the bull market. дальше »

2023-1-24 00:00 | |

|

|