2021-11-12 02:03 |

Bitcoin has had a stellar run so far in November and has continued to build on the grounds covered in October. In the last ten days, the leading cryptocurrency has sustained prices between a low of $60,218 and a high of $68,789 which is notably also a new all-time high. It is up around 12% so far in November.

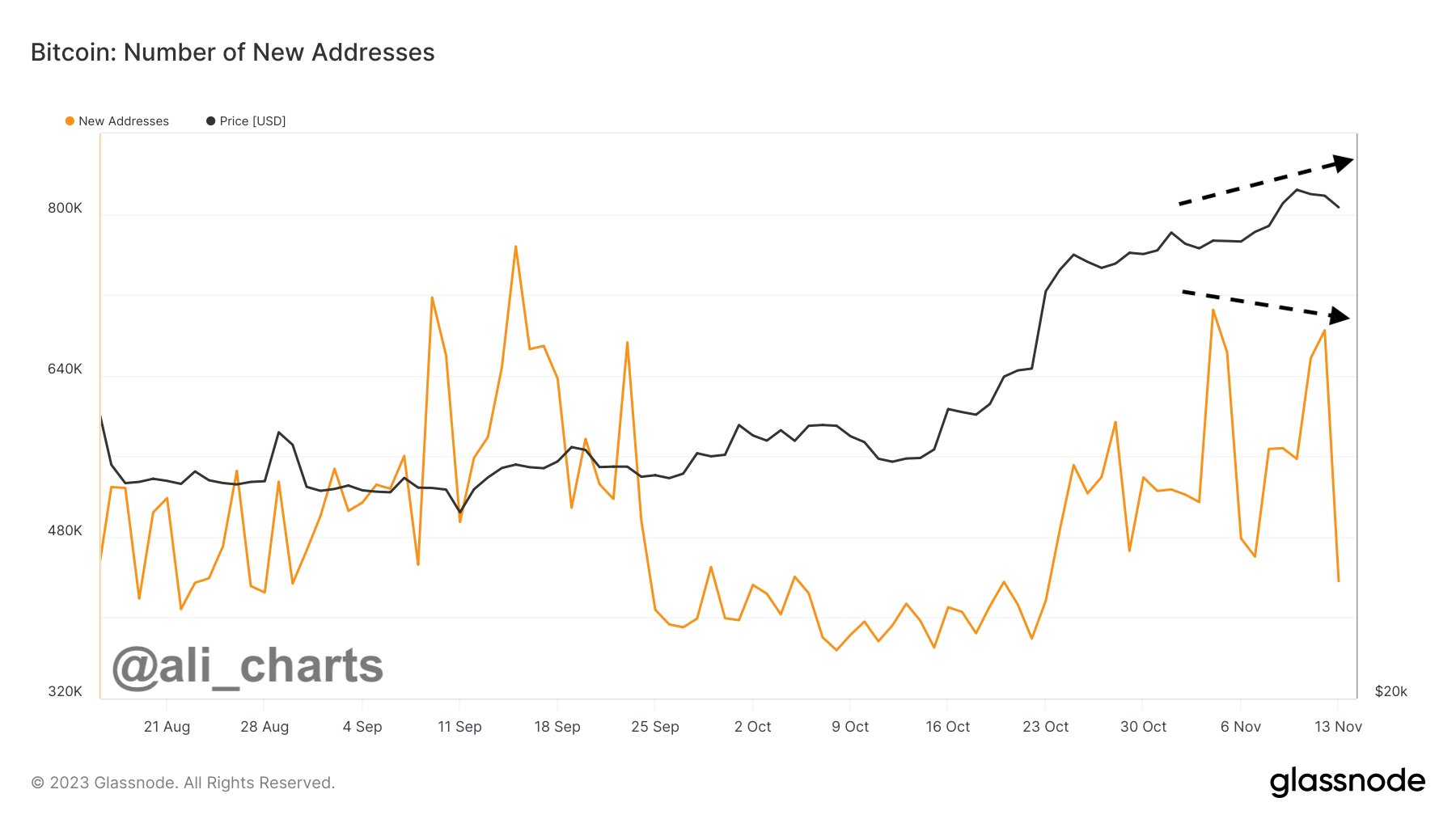

Despite the already impressive performance of the asset, data indicates that there is still more to be expected. According to leading on-chain metric monitoring firm Glassnode’s recent weekly On-Chain Report, on-chain activity on the Bitcoin network remains “only marginally” higher than the level observed during bear markets.

“…on-chain activity is recovering, albeit very slowly, and certainly far below historical examples of Hype and Euphoria as in 2017 and Q1 2021. Transaction counts remain well below the peaks seen in the first half of 2021, currently around 225k transactions/day. This is coincident with levels seen throughout the 2019-20 bear market,” the report stated.

What this implies for the market according to the report is that investor conviction is currently very high for Bitcoin. The metric is noted to be a “remarkable divergence” from other bull markets. This is because the metrics indicate that the market is potentially still in the “quite accumulation phase, punctuated by low activity, large exchange outflows, and very modest strategic spending by experienced holders.”

Furthermore, the report made a very bullish case for Bitcoin with the behavior of Long-Term Holders (LTH). According to on-chain data, this metric is also showing a divergence from the usual. While in other market cycles, LTH’s usually spend most of their coins near an all-time high, this time their spending behavior has significantly slowed down to “neutral levels” and has even been tending towards continued accumulation behavior. Equally bullish is the fact that more coins and holders are maturing into LTH status in this market.

The case gets even stronger as Bitcoin continues to experience a net outflow from exchanges. Glassnode points out that the aggregate exchange balance of Bitcoin has fallen to a multi-year low of 12.9% of the circulating supply.

In this week alone, withdrawals have reached levels of around 5000 BTC withdrawals daily from exchanges. This leads the report to assess that market demand for Bitcoin is currently in the ‘smart money accumulation’ phase. This phase is marked by low on-chain activity, constructive supply dynamics, and constructive profit-taking.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|