2024-8-1 13:30 |

On-chain data shows the Bitcoin network is finally witnessing a major influx of new users after hitting multi-year lows in adoption earlier in the year.

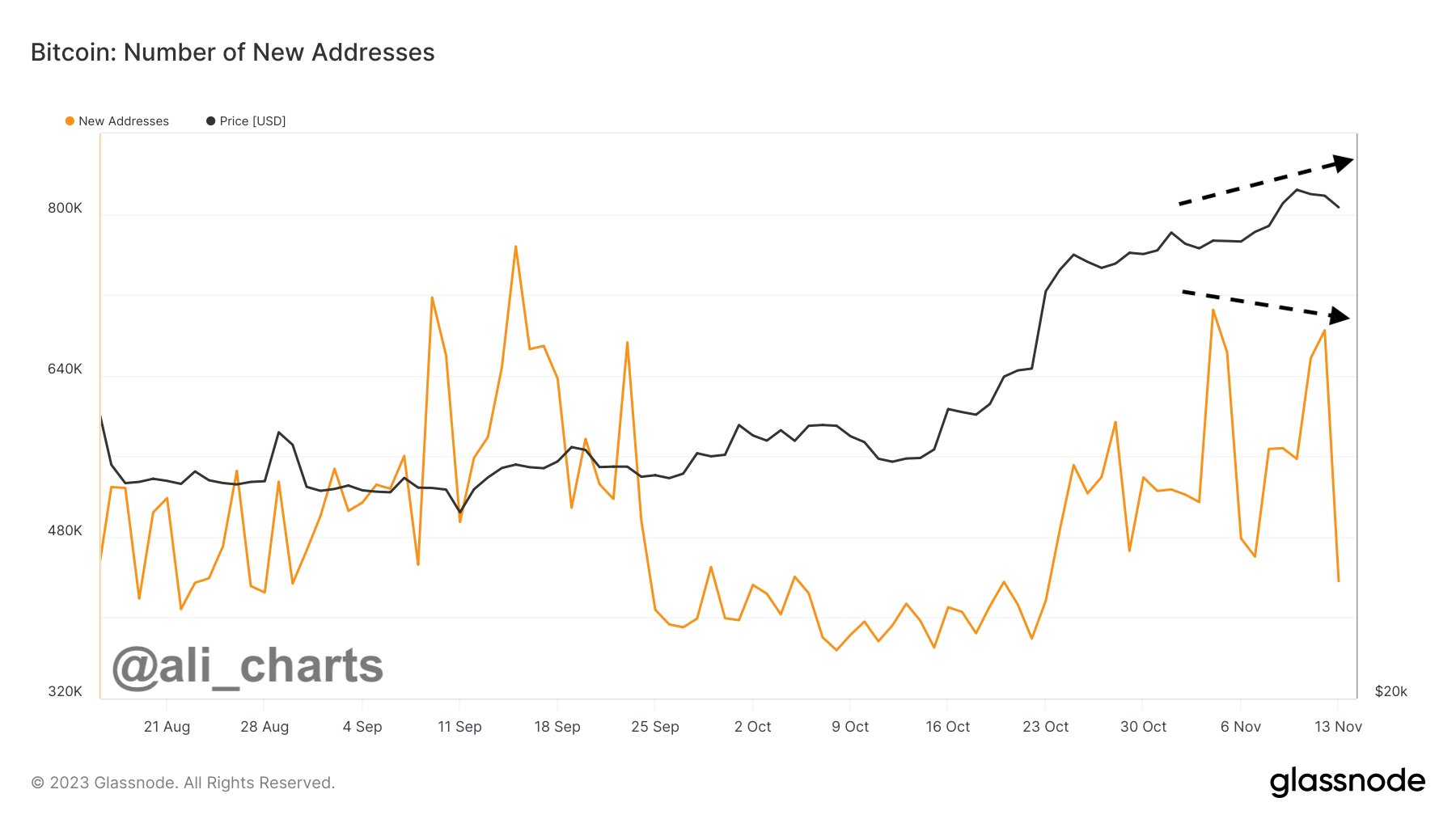

Bitcoin New Addresses Has Reversed Trend Since June BottomAccording to data from the market intelligence platform IntoTheBlock, Bitcoin has been seeing growth in daily new addresses recently. A “new address” is naturally one that has made a transaction on the network for the very first time.

When new addresses pop up on the blockchain, it can have a couple of underlying reasons. The first of these is an influx of new users, as new investors coming in open up new addresses to participate in trading activities. The other reason can be existing users making multiple wallets for a purpose like privacy.

In general, both of these factors are at play to some degree whenever the metric registers a rise, so some net adoption could be assumed to be happening. Adoption is usually bullish for any cryptocurrency’s price in the long-term.

Now, here is a chart that shows the trend in the new addresses for Bitcoin over the past decade:

As displayed in the above graph, the Bitcoin new addresses had been riding a downtrend this year, but the metric finally reached a bottom back in the beginning of June, although it was only after hitting multi-year lows.

One of the reasons behind the drawdown may have been the launch of the spot exchange-traded funds (ETFs), which are investment vehicles that provide for an alternative means of gaining exposure to the cryptocurrency’s price movements.

The spot ETFs function on traditional exchanges, so new investors may prefer to invest through them, instead of venturing into the unfamiliar territory that is digital asset wallets and exchanges.

Since the bottom in June, though, the daily new address count for the Bitcoin blockchain has shown a reversal. The metric is still nowhere near returning to the same levels as prior to this year’s drawdown, but it has nonetheless managed to surge 35%.

If this new upwards trajectory is the beginning of a larger trend, then the cryptocurrency’s price could naturally benefit from the renewed influx of fresh investors.

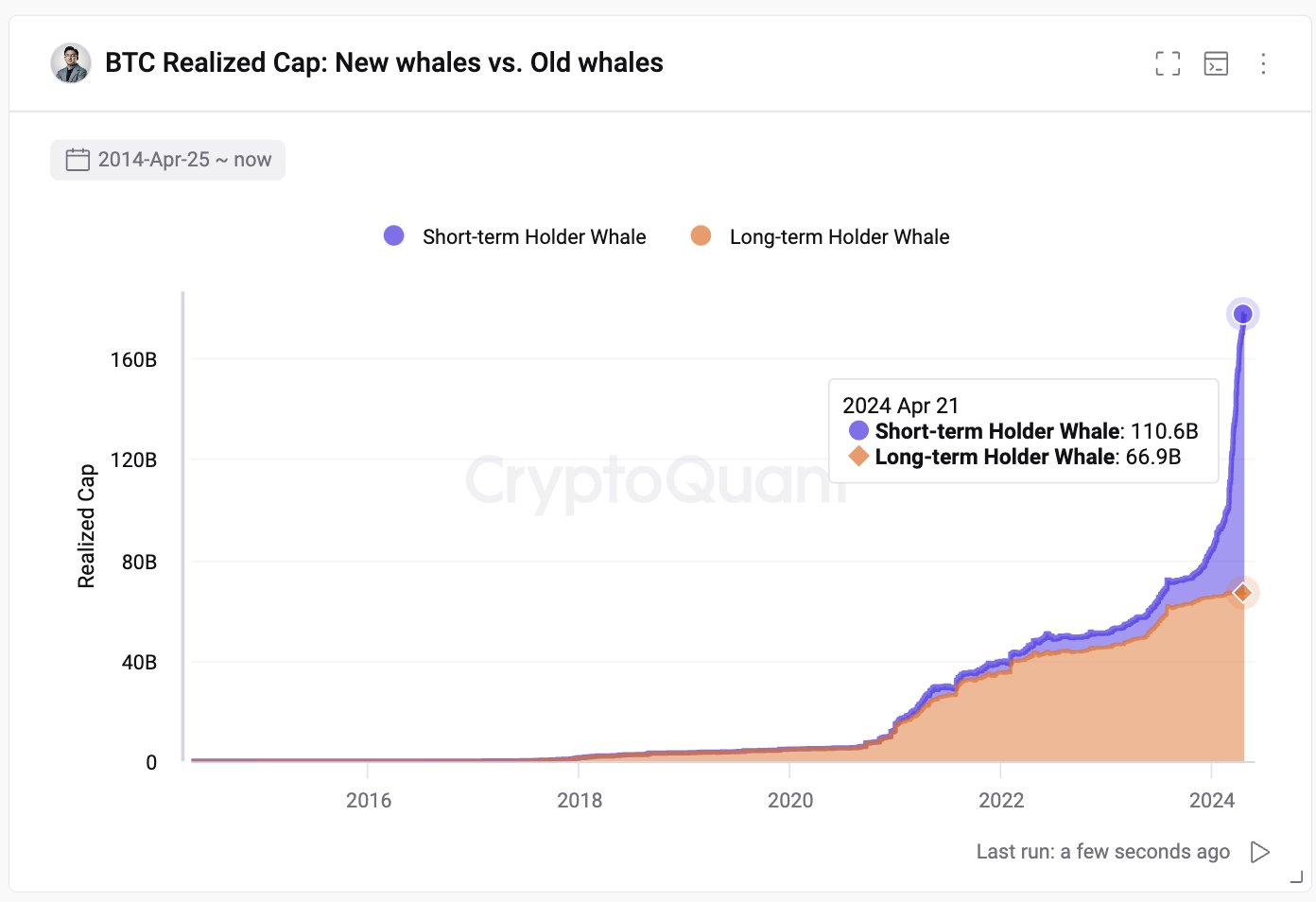

In some other news, the Bitcoin long-term holders have been increasing their supply recently, as revealed by the latest weekly report from Glassnode.

The short-term holders (STHs) and long-term holders (LTHs) make up for the two main divisions of the Bitcoin market done on the basis of holding time, with 155 days being the cutoff between the two.

The LTHs are considered the HODLers of the market, who don’t easily sell their coins. Despite their resilience, though, the rally to the all-time high price earlier in the year was still too good a profit-taking opportunity for even these diamond hands to miss out on, so they participated in significant selling.

Nonetheless, the latest increase in the LTH supply shows HODLing behavior is back on the Bitcoin network, as STHs are maturing into the cohort.

BTC PriceBitcoin has been moving sideways since its plunge a couple of days back as its price is still trading around $66,600.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|