2025-12-18 22:00 |

Ethereum’s (ETH) recent pullback is starting to reflect more than short-term price volatility. As ETH trades below the $3,000 mark, a combination of heavy liquidations, declining network activity, and sustained institutional outflows is reinforcing concerns about weakening demand.

While prices have so far held above key support levels, multiple indicators suggest that selling pressure remains firmly in place, leaving the market in a cautious holding pattern.

Over the past week, Ethereum has fallen roughly 12%, underperforming several major assets during a broader market correction. The drop pushed ETH briefly toward the $2,850–$2,900 zone, triggering over $200 million in liquidation, one of the largest liquidation events in recent months.

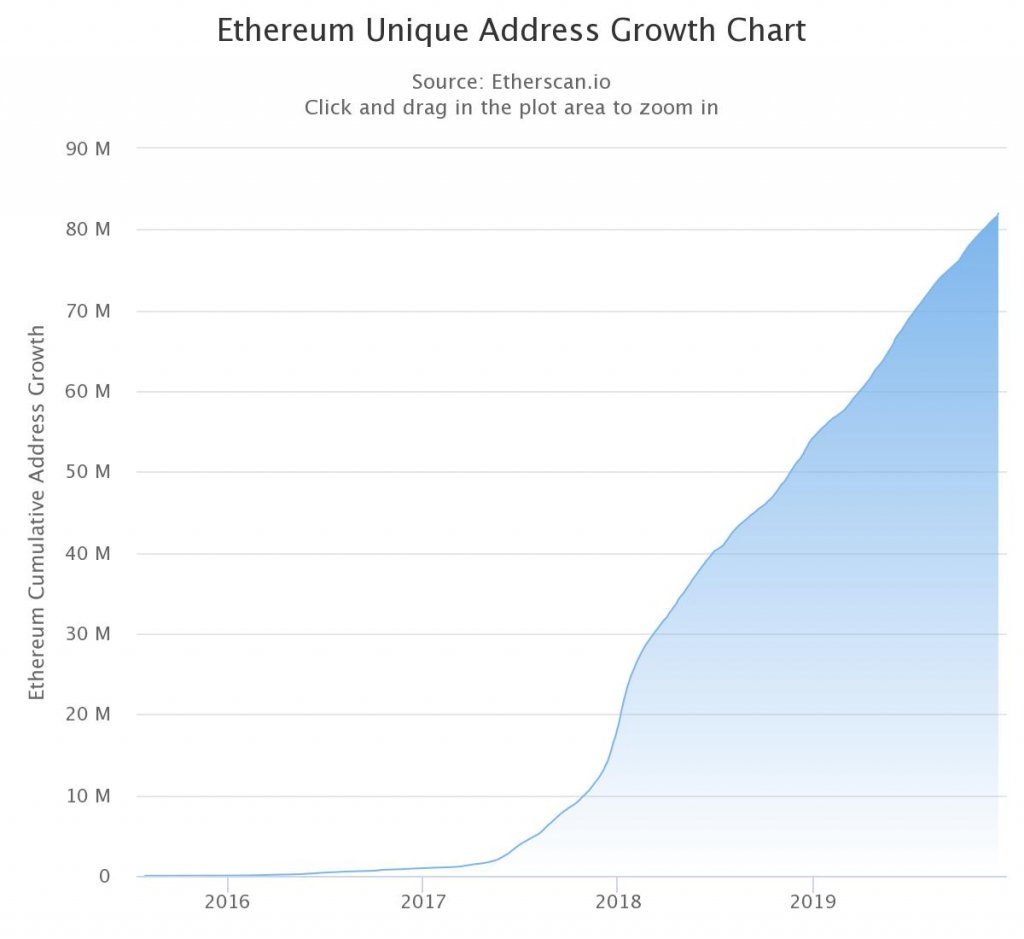

Network Activity and Ethereum ETF Flows Signal Waning ParticipationBeyond price action, Ethereum’s on-chain metrics are showing signs of cooling participation.

Weekly active addresses fell from around 440,000 earlier in the quarter to roughly 324,000 in December, marking the lowest level since May. Transaction counts have also dropped to mid-year lows, pointing to reduced engagement from both retail and institutional users.

At the same time, U.S. spot Ethereum ETFs continue to see persistent outflows. Data from SoSoValue shows more than $224 million exiting ETH ETFs over several consecutive sessions, led primarily by BlackRock’s ETHA fund.

Since mid-December, the total net assets across U.S. spot ETH ETFs have declined by more than $3 billion, suggesting that institutions are trimming their exposure rather than adding to positions. The Coinbase Premium Index turning negative further supports the view that U.S.-based selling pressure has returned.

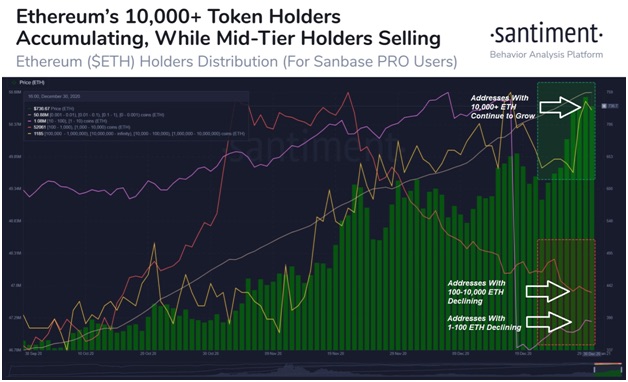

Whale Selling and Technical Structure Keep Risks Skewed LowerLarge holders have added to near-term pressure. On-chain data shows more than 28,500 ETH sold by a handful of whale wallets within a short period, including transactions exceeding $80 million in total value.

Despite this distribution, ETH has so far avoided a sharp breakdown, with buyers repeatedly defending levels near $2,880.

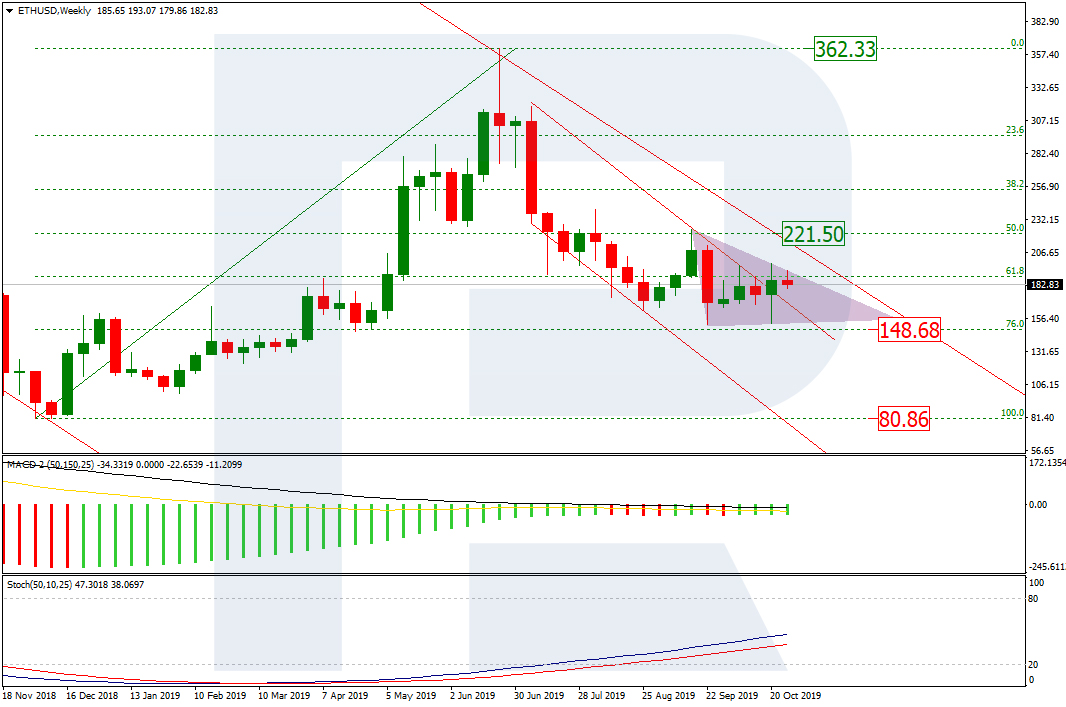

From a technical standpoint, Ethereum remains in a medium-term downtrend. Price continues to trade below key moving averages, while momentum indicators such as RSI remain below neutral levels.

Related Reading: Bitcoin ‘Death Cross’ Panic Returns: History Says It’s A Late Signal

Resistance is clustered between $3,050 and $3,120, and failure to reclaim that zone leaves ETH vulnerable to another test of $2,800. If that support gives way, analysts point to the $2,400–$2,600 range as the next area of interest.

Cover image from ChatGPT, ETHUSD chart from Tradingview

origin »Bitcoin price in Telegram @btc_price_every_hour

Social Activity Token (SAT) на Currencies.ru

|

|